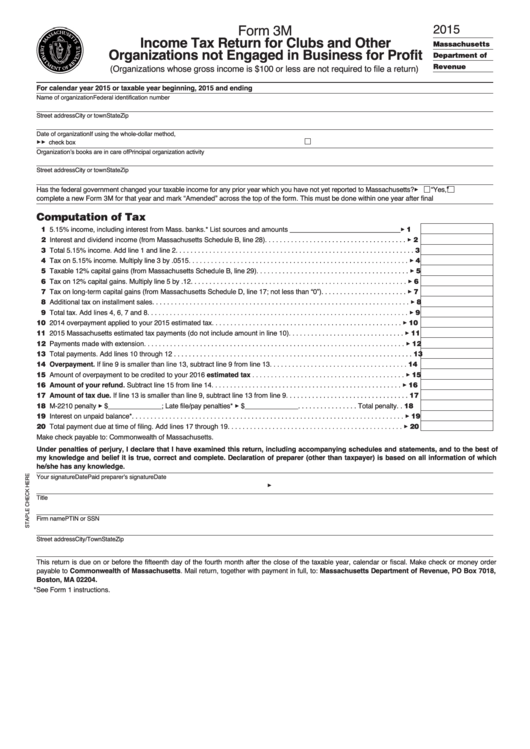

Form 3m Draft - Income Tax Return For Clubs And Other Organizations Not Engaged In Business For Profit - 2015

ADVERTISEMENT

2015

Form 3M

Income Tax Return for Clubs and Other

Massachusetts

Organizations not Engaged in Business for Profit

Department of

Revenue

(Organizations whose gross income is $100 or less are not required to file a return)

For calendar year 2015 or taxable year beginning

, 2015 and ending

Name of organization

Federal identification number

Street address

City or town

State

Zip

Date of organization

If using the whole-dollar method,

check box

3

3

Organization’s books are in care of

Principal organization activity

Street address

City or town

State

Zip

Has the federal government changed your taxable income for any prior year which you have not yet reported to Massachusetts? 3

Yes

No. If “Yes,”

complete a new Form 3M for that year and mark “Amended” across the top of the form. This must be done within one year after final U.S. determination.

Computation of Tax

11 5.15% income, including interest from Mass. banks.* List sources and amounts _____________________________

3 1

12 Interest and dividend income (from Massachusetts Schedule B, line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 2

13 Total 5.15% income. Add line 1 and line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Tax on 5.15% income. Multiply line 3 by .0515 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

25 Taxable 12% capital gains (from Massachusetts Schedule B, line 29). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

16 Tax on 12% capital gains. Multiply line 5 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

27 Tax on long-term capital gains (from Massachusetts Schedule D, line 17; not less than “0”) . . . . . . . . . . . . . . . . . . . . . . . 3 7

18 Additional tax on installment sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

19 Total tax. Add lines 4, 6, 7 and 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 9

10 2014 overpayment applied to your 2015 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 2015 Massachusetts estimated tax payments (do not include amount in line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Payments made with extension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Total payments. Add lines 10 through 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Overpayment. If line 9 is smaller than line 13, subtract line 9 from line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Amount of overpayment to be credited to your 2016 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Amount of your refund. Subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 16

17 Amount of tax due. If line 13 is smaller than line 9, subtract line 13 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 M-2210 penalty 3 $ ______________ ; Late file/pay penalties* 3 $ ______________ . . . . . . . . . . . . . . . . Total penalty . . 18

19 Interest on unpaid balance*. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

20 Total payment due at time of filing. Add lines 17 through 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

Make check payable to: Commonwealth of Massachusetts.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of

my knowledge and belief it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which

he/she has any knowledge.

Your signature

Date

Paid preparer’s signature

Date

3

Title

Firm name

PTIN or SSN

Street address

City/Town

State

Zip

This return is due on or before the fifteenth day of the fourth month after the close of the taxable year, calendar or fiscal. Make check or money order

payable to Commonwealth of Massachusetts. Mail return, together with payment in full, to: Massachusetts Department of Revenue, PO Box 7018,

Boston, MA 02204.

*See Form 1 instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4