Schedule 10e - Schedule Of Uncollectible Tax From Eligible Purchasers - Indiana Department Of Revenue

ADVERTISEMENT

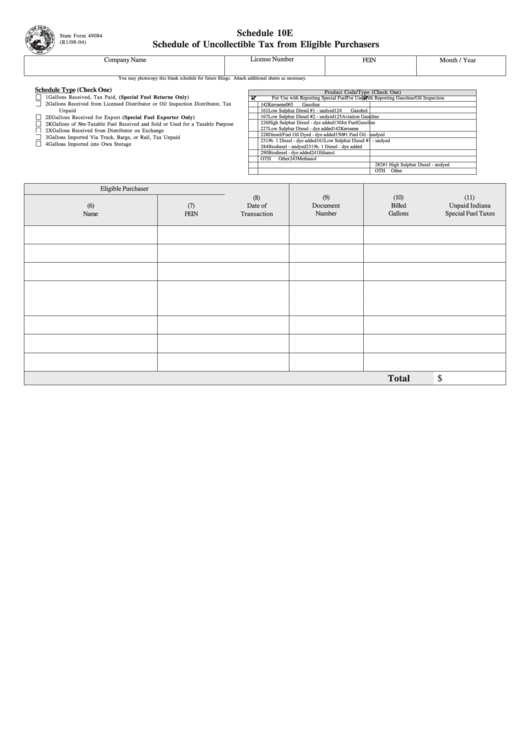

Schedule 10E

State Form 49084

(R1/08-04)

Schedule of Uncollectible Tax from Eligible Purchasers

License Number

Company Name

FEIN

Month / Year

You may photocopy this blank schedule for future filings. Attach additional sheets as necessary.

Schedule Type (Check One)

Product Code/Type (Check One)

1

Gallons Received, Tax Paid, (Special Fuel Returns Only)

For Use with Reporting Special Fuel

For Use with Reporting Gasoline/Oil Inspection

2

Gallons Received from Licensed Distributor or Oil Inspection Distributor, Tax

142

Kerosene

065

Gasoline

Unpaid

161

Low Sulphur Diesel #1 - undyed

124

Gasohol

167

Low Sulphur Diesel #2 - undyed

125

Aviation Gasoline

2 E

Gallons Received for Export (Special Fuel Exporter Only)

226

High Sulphur Diesel - dye added

130

Jet FuelGasoline

2K

Gallons of Non-Taxable Fuel Received and Sold or Used for a Taxable Purpose

227

Low Sulphur Diesel - dye added

142

Kerosene

2X

Gallons Received from Distributor on Exchange

228

Diesel/Fuel Oil Dyed - dye added

150

#1 Fuel Oil - undyed

3

Gallons Imported Via Truck, Barge, or Rail, Tax Unpaid

231

No. 1 Diesel - dye added

161

Low Sulphur Diesel #1 - undyed

4

Gallons Imported into Own Storage

284

Biodiesel - undyed

231

No. 1 Diesel - dye added

290

Biodiesel - dye added

241

Ethanol

OTH

Other

243

Methanol

282

#1 High Sulphur Diesel - undyed

OTH

Other

Eligible Purchaser

(9)

(10)

(11)

(8)

Document

(6)

(7)

Date of

Billed

Unpaid Indiana

Name

FEIN

Transaction

Number

Gallons

Special Fuel Taxes

Total

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2