Faqs About Reporting Delinquent Participant Contributions On The Form 5500 - U.s. Department Of Labor

ADVERTISEMENT

FAQs about Reporting Delinquent

Participant Contributions on the

Form 5500

What is the purpose of this FAQ guidance?

The purpose of these FAQs is to provide guidance to plan administrators and accountants on

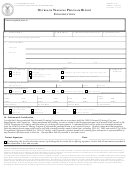

complying with the requirements of the 2003 Form 5500 Annual Return/Report of Employee

Benefit Plan for reporting delinquent participant contributions on Line 4a and Line 4d of the

Schedules H and I.

What were the Form 5500 reporting requirements for delinquent participant

contributions prior to plan year 2003?

Since 1995, the Employee Benefits Security Administration (EBSA) has pursued an aggressive

enforcement project intended to safeguard employee contributions to 401(k) plans and health

care and other welfare plans by investigating situations in which employers delay in forwarding

participant contributions to employee benefit plans.

As part of that effort, plan administrators who are required to file Form 5500 financial

information on a Schedule H (large plans) or Schedule I (small plans) must report on Line 4a

of the schedule whether an employer failed to transmit to the plan any participant

contributions within the time period set forth in the Department’s plan asset regulation at 29

CFR § 2510.3-102. Under the regulation, amounts paid by a plan participant or beneficiary or

withheld by an employer from a participant’s wages for contribution to a plan are plan assets

on the earliest date that they can reasonably be segregated from the employer's general assets,

but in no event later than (i) for pension plans, the 15th business day of the month following

the month in which the participant contributions are withheld or received by the employer

and (ii) for welfare plans, 90 days from the date on which such amounts are withheld or

received by the employer.

Also, when an employer is delinquent in forwarding participant contributions and holds them

commingled with its general assets, the employer will have engaged in a nonexempt prohibited

transaction under ERISA section 406. Line 4d on the Schedule H and Schedule I required plan

administrators to report delinquent participant contributions as nonexempt prohibited

transactions unless the requirements for the DOL Voluntary Fiduciary Correction Program

(VFCP) were met, and the conditions of PTE 2002-51 were satisfied. Plans filing Schedule H

that report nonexempt prohibited transactions on Line 4d also are required to file a Schedule

G to report detailed information regarding the nonexempt prohibited transactions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5