Schedule B1 Incentives - Credit For Purchase Of Products Manufactured In Puerto Rico And Puerto Rican Agricultural Products

ADVERTISEMENT

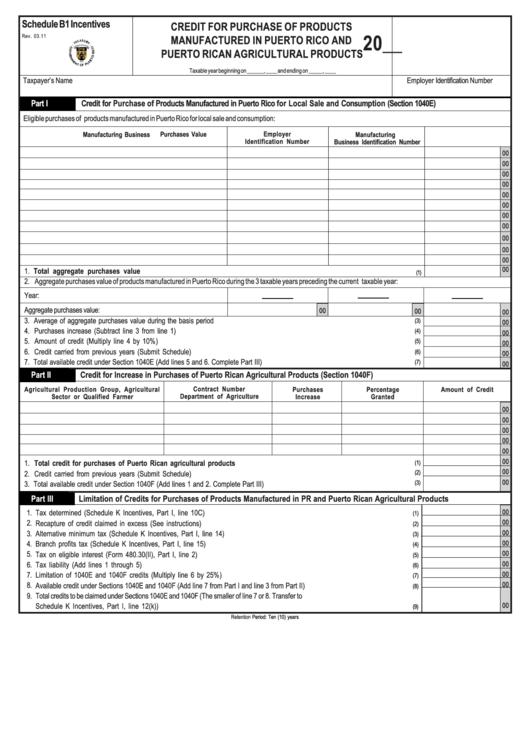

Schedule B1 Incentives

CREDIT FOR PURCHASE OF PRODUCTS

20__

Rev. 03.11

MANUFACTURED IN PUERTO RICO AND

PUERTO RICAN AGRICULTURAL PRODUCTS

Taxable year beginning on ______, ____ and ending on _____, ____

Taxpayer’s Name

Employer Identification Number

Part I

Credit for Purchase of Products Manufactured in Puerto Rico for Local Sale and Consumption (Section 1040E)

Eligible purchases of products manufactured in Puerto Rico for local sale and consumption:

Employer

Manufacturing Business

Manufacturing

Purchases Value

Identification Number

Business Identification Number

00

00

00

00

00

00

00

00

00

00

00

00

1. Total aggregate purchases value ..............................................................................................................................................

(1)

2. Aggregate purchases value of products manufactured in Puerto Rico during the 3 taxable years preceding the current taxable year:

Year:

Aggregate purchases value:

00

00

00

3. Average of aggregate purchases value during the basis period ............................................................................................................

(3)

00

4. Purchases increase (Subtract line 3 from line 1) ...............................................................................................................................

(4)

00

5. Amount of credit (Multiply line 4 by 10%) .......................................................................................................................................

(5)

00

6. Credit carried from previous years (Submit Schedule) ......................................................................................................................

(6)

00

7. Total available credit under Section 1040E (Add lines 5 and 6. Complete Part III) ..................................................................................

(7)

00

Part II

Credit for Increase in Purchases of Puerto Rican Agricultural Products (Section 1040F)

Agricultural Production Group, Agricultural

Contract Number

Purchases

Percentage

Amount of Credit

Sector or Qualified Farmer

Department of Agriculture

Increase

Granted

00

00

00

00

00

00

1. Total credit for purchases of Puerto Rican agricultural products ..............................................................................................

(1)

00

2. Credit carried from previous years (Submit Schedule) ......................................................................................................................

(2)

00

3. Total available credit under Section 1040F (Add lines 1 and 2. Complete Part III) .................................................................................

(3)

Part III

Limitation of Credits for Purchases of Products Manufactured in PR and Puerto Rican Agricultural Products

1.

Tax determined (Schedule K Incentives, Part I, line 10C) ...............................................................................................................

00

(1)

2.

Recapture of credit claimed in excess (See instructions) .................................................................................................................

00

(2)

3.

Alternative minimum tax (Schedule K Incentives, Part I, line 14) .....................................................................................................

00

(3)

00

4.

Branch profits tax (Schedule K Incentives, Part I, line 15) ...............................................................................................................

(4)

5.

00

Tax on eligible interest (Form 480.30(II), Part I, line 2) ....................................................................................................................

(5)

6.

00

Tax liability (Add lines 1 through 5) ...............................................................................................................................................

(6)

7.

Limitation of 1040E and 1040F credits (Multiply line 6 by 25%) .......................................................................................................

00

(7)

8.

Available credit under Sections 1040E and 1040F (Add line 7 from Part I and line 3 from Part II) ..........................................................

00

(8)

9.

Total credits to be claimed under Sections 1040E and 1040F (The smaller of line 7 or 8. Transfer to

00

Schedule K Incentives, Part I, line 12(k)) .....................................................................................................................................

(9)

Retention

Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1