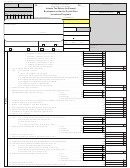

Form 480.30(Ii) - Income Tax Return For Exempt Businesses Under The Puerto Rico Incentives Programs Page 4

ADVERTISEMENT

Form 480.30(II) Rev. 03.11

Incentives - Page 4

Part VIII

Questionnaire

14.

Did the corporation at the end of the taxable year own, directly or indirectly,

Yes

No

Yes

No

1.

If a foreign corporation, indicate if the trade or business in Puerto Rico was

50% or more of the voting stocks of a corporation who is engaged in trade

held as a branch .............................................................................

(1)

or business in Puerto Rico? .............................................................

(14)

2.

If a branch, indicate the percent that represents the income from sources

If “Yes”, attach a schedule showing: (a) name and employer identification

within Puerto Rico from the total income of the corporation:_______%

number, (b) percentage owned, and (c) taxable income (or loss) before net

3.

Did the exempt business file an option under Section 936 of the Federal

operating loss and special deductions of the corporation for the taxable year

Internal Revenue Code? ..................................................................

(3)

(even when such taxable year does not coincide with the one of the

4.

Did the exempt business keep any part of its records on a computerized

corporation or partnership for which this return is filed).

system during this year? .................................................................

(4)

15.

Is the corporation a subsidiary in an affiliated group or a parent subsidiary of

5.

The exempt business books are in care of:

(15)

a controlled group?...............................................................................

Name ______________________________________________________

If “Yes”, enter the employer identification number and the name of the parent

Address ____________________________________________________

corporation: ______________________________________________

____________________________________________________________

_____________________________________________________________

6.

Check accounting method used:

16.

Did any individual, partnership, corporation, estate or trust at the end of the

Cash

Accrual

taxable year own, directly or indirectly, 50% or more of the corporation's

Other (specify): _____________________________________

voting stocks? If “Yes”, attach a schedule showing the name and employer

(16)

7.

Did the exempt business file the following documents?

identification number (Do not include any information entered in question

(a)

Informative Return (Forms 480.5, 480.6A, 480.6B) ........................

(7a)

15). Enter the percentage owned:

%

(b)

Withholding Statement (Form 499R-2/W-2PR) ...............................

(7b)

17.

Enter the amount of exempt interest: ________________________________

8.

If the gross income exceeds $3,000,000 and is a foreign

18.

Does the exempt business have other exempt activities not covered under

corporation, did you submit financial statements audited by a CPA licensed

the Industrial Incentives Acts? (Attach schedule)

(18)

in Puerto Rico?...............................................................................

(8)

Under which Act? _____________________________________________

9.

Number of employees during the year: ___________________________

19.

(19)

Have you made a timely election under:

(a)

Production:__________ (b) Non-production:____________________

Section 3(f) Act No. 8 of 1987

Section 5(b) Act No. 52 of 1983

10.

Did the exempt business claim a deduction for expenses

Section 6(f) Act No. 135 of 1997

Section 3(a)(i)(D) Act No. 78 of 1993

connected with:

Section 10(b) Act No. 73 of 2008

Article 2.15(b) Act No. 83 of 2010

(a)

Vessels? ..............................................................................

(10a)

20.

Enter the total amount of charitable contributions to

(b)

Living expenses? ..................................................................

(10b)

municipalities claimed during the taxable year: ______________________

(c)

Employees attending conventions or meetings outside Puerto Rico or

21.

(21)

Indicate if your books reflect premiums paid by unauthorized insurers ....

the United States? ..................................................................

(10c)

22.

Indicate the method used to allocate expenses:

11.

Have you been audited by the Federal Internal Revenue Service? .......

(11)

Profit - Split

Cost Sharing

Others _____________

Which years?_________________________________________________

23.

If a single method is used, Profit Split or Cost Sharing, indicate the following:

12.

Did the exempt business distribute dividends other than stock dividends or

Profit - Split Intangible Income

Cost Sharing Payment

distributions in liquidation in excess of the current and accumulated earnings

24.

Indicate the method used to claim the credit on the Federal Corporation

during this year?.............................................................................

(12)

Income Tax Return:

Economic Activity Limitation

13.

Is the exempt business a partner in a special partnership?....................

(13)

Percentage Credit Limitation

Name ______________________________________________________

25.

Employer number assigned by the Department of Labor and

Employer identification number __________________________________

Human Resources ______________________________________________

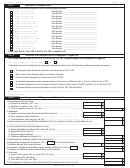

OATH

We, the undersigned, president (or vice president or other principal officer) and treasurer (or assistant treasurer) or agent of the exempt business for which this income tax return is made, each for himself,

declare under penalty of perjury, that this return (including the schedules and statements attached) has been examined by us and is, to the best of our knowledge and belief, a true, correct, and complete return,

made in good faith, pursuant to the Puerto Rico Internal Revenue Code of 1994, as amended, and the Regulations issued thereunder.

_______________________________________________

_______________________________________________

President's or vice president's signature

Treasurer's or assistant treasurer's signature

___________________________________________________

Agent

Affidavit no. _____________________________

Sworn and subscribed before me by ________________________________________________ , of legal age, _____________________________________________ [civil status],

NOTARY

_____________________________ [occupation], and resident of _______________________ , ______ , and by ___________________________________________________,

SEAL

of legal age, _____________________ [civil status], ________________________________ [occupation], and resident of _____________________________, ______________,

personally known to me or identified by means of _______________________________________________, at ____________________________, ________________________,

this ___th day of ______________________, ______.

_____________________________________________________________

_________________________________________________

Title of the person administering oath

Signature of the person administering oath

SPECIALIST'S USE ONLY

I declare under penalty of perjury that this return (including the schedules and statements attached) has been examined by me, and to the best of my knowledge and belief is a true, correct and complete return. The declaration of the

person who prepares this return is with respect to the information received, and this information may be verified.

Specialist's name (Print)

Date

Self-employed Specialist

Registration number

20

Firm's name

Employer identification number

Specialist signature

Addresss

Zip code

NOTE TO TAXPAYER

Indicate if you made payments for the preparation of your return:

Yes

No. If you answered "Yes", require the Specialist’s signature and registration number.

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4