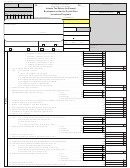

Form 480.30(Ii) - Income Tax Return For Exempt Businesses Under The Puerto Rico Incentives Programs Page 3

ADVERTISEMENT

Form 480.30(II) Rev. 03.11

Incentives - Page 3

Part V

Exempt Business - Comparative Balance Sheet

Beginning of the year

Ending of the year

Assets

Total

Total

1.

Cash on hand and banks ............................

00

00

(1)

(1)

2.

00

00

Accounts receivable ..................................

(2)

(2)

(

)

)

(

3.

00

00

00

00

Less: Reserve for bad debts .......................

(3)

(3)

4.

00

00

Notes receivable .......................................

(4)

(4)

5.

00

00

Inventories ...............................................

(5)

(5)

6.

00

00

Investments .............................................

(6)

(6)

7.

00

00

Depreciable assets ....................................

(7)

(7)

(

)

(

)

8.

00

00

00

00

Less: Reserve for depreciation ....................

(8)

(8)

9.

Land .......................................................

00

00

(9)

(9)

10.

00

00

Other assets ............................................

(10)

(10)

11.

00

00

Total Assets ...........................................

(11)

(11)

Liabilities and Net Worth

Liabilities

12.

00

00

Accounts payable .....................................

(12)

(12)

13.

00

00

Notes payable ..........................................

(13)

(13)

14.

00

00

Accrued expenses (not paid) ......................

(14)

(14)

15.

Other liabilities ..........................................

00

00

(15)

(15)

16.

00

00

Total Liabilities ......................................

(16)

(16)

Net Worth

17.

Capital stock

00

00

(a) Preferred stock ....................................

(17a)

(17a)

00

00

(b) Common stock ....................................

(17b)

(17b)

18.

00

00

Additional paid in capital .............................

(18)

(18)

19.

00

00

Retained earnings ......................................

(19)

(19)

20.

Reserve ..................................................

00

00

(20)

(20)

21.

00

00

Total Net Worth ......................................

(21)

(21)

22.

Total Liabilities and Net Worth ...............

(22)

(22)

00

00

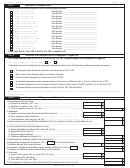

Part VI

Reconciliation of Net Income (or Loss) per Books with Net Taxable Income (or Loss) per Return

00

1.

Net income (or loss) per books ...................

7.

Income recorded on books this year not included on

(1)

00

2.

Income tax ..............................................

this return (Itemize, use schedule

(2)

3.

Excess of capital losses over capital

if necessary)

00

gains ......................................................

(a) Exempt interest ___________________________

(3)

4.

Taxable income not recorded on books this year

(b) ________________________________________

(Itemize, use schedule if necessary)

(c) ________________________________________

(a) ___________________________________

(d) ________________________________________

00

(b) ___________________________________

Total ................................................................

(7)

(c) ___________________________________

8.

Deductions on this tax return not charged against book

(d) ___________________________________

income this year (Itemize, use schedule

00

Total .......................................................

if necessary)

(4)

5.

Expenses recorded on books this year not

(a) Depreciation _____________________________

claimed on this return (Itemize, use schedule if

(b) ________________________________________

necessary)

(c) ________________________________________

(a) Meals and entertainment (portion not

(d) ________________________________________

00

claimed ) ________________________

Total ................................................................

(8)

00

(b) Depreciation ________________________

9.

Total (Add lines 7 and 8) ....................................

(9)

(c) ___________________________________

10.

Net taxable income (or loss) per return

00

(d) ___________________________________

(Subtract line 9 from line 6) .....................................

(10)

00

Total ........................................................

(5)

00

6.

Total (Add lines 1 through 5) .......................

(6)

Part VII

Analysis of Unappropriated Retained Earnings per Books

5.

Distributions:

(a)

Cash ...............................

(5a)

00

00

1.

Balance at beginning of year .......................

(1)

(b)

Property ...........................

(5b)

00

00

2.

Net income per books ...............................

(2)

(c)

Stocks ..............................

(5c)

00

3.

Other increases (Itemize, use schedule if

6.

Other decreases (Use schedule if

necessary) ____________________________

necessary) .....................................................

(6)

00

______________________________________

7.

Total (Add lines 5 and 6) ...................................

(7)

00

00

______________________________________

(3)

8.

Balance at end of year (Subtract line

00

4.

Total (Add lines 1, 2 and 3) .........................

(4)

7 from line 4)

....................................................

00

(8)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4