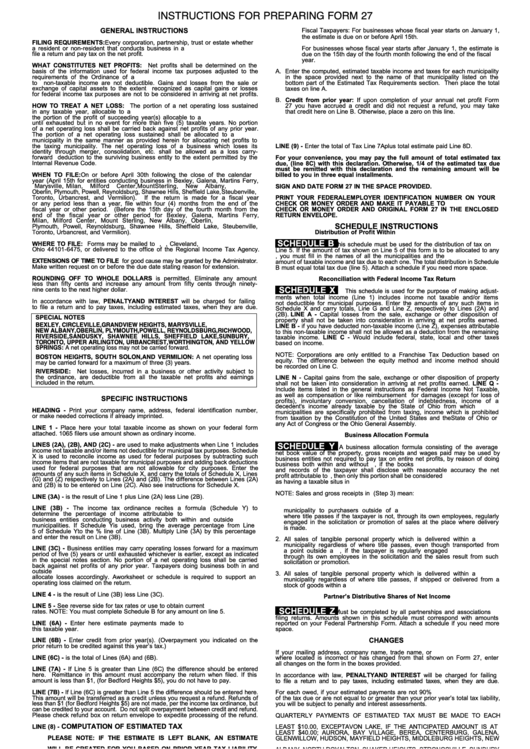

Instructions For Preparing Form 27

ADVERTISEMENT

INSTRUCTIONS FOR PREPARING FORM 27

GENERAL INSTRUCTIONS

Fiscal Taxpayers: For businesses whose fiscal year starts on January 1,

the estimate is due on or before April 15th.

FILING REQUIREMENTS: Every corporation, partnership, trust or estate whether

a resident or non-resident that conducts business in a R.I.T.A. municipality must

For businesses whose fiscal year starts after January 1, the estimate is

file a return and pay tax on the net profit.

due on the 15th day of the fourth month following the end of the fiscal

year.

WHAT CONSTITUTES NET PROFITS: Net profits shall be determined on the

basis of the information used for federal income tax purposes adjusted to the

A. Enter the computed, estimated taxable income and taxes for each municipality

requirements of the Ordinance of a R.I.T.A. municipality. Expenses attributable

in the space provided next to the name of that municipality listed on the

to non-taxable income are not deductible. Gains and losses from the sale or

bottom part of the Estimated Tax Requirements section. Then place the total

exchange of capital assets to the extent recognized as capital gains or losses

taxes on line A.

for federal income tax purposes are not to be considered in arriving at net profits.

B. Credit from prior year: If upon completion of your annual net profit Form

HOW TO TREAT A NET LOSS: The portion of a net operating loss sustained

27 you have accrued a credit and did not request a refund, you may take

in any taxable year, allocable to a R.I.T.A. municipality may be applied against

that credit here on Line B. Otherwise, place a zero on this line.

the portion of the profit of succeeding year(s) allocable to a R.I.T.A. municipality

until exhausted but in no event for more than five (5) taxable years. No portion

C. Subtract line B from line A and place the difference on line C.

of a net operating loss shall be carried back against net profits of any prior year.

The portion of a net operating loss sustained shall be allocated to a R.I.T.A.

D. Enter the amount of estimated tax to be paid with this return on line D.

municipality in the same manner as provided herein for allocating net profits to

the taxing municipality. The net operating loss of a business which loses its

LINE (9) - Enter the total of Tax Line 7A plus total estimate paid Line 8D.

identity through merger, consolidation, etc. shall be allowed as a loss carry-

forward deduction to the surviving business entity to the extent permitted by the

For your convenience, you may pay the full amount of total estimated tax

Internal Revenue Code.

due, (line 8C) with this declaration. Otherwise, 1/4 of the estimated tax due

must be remitted with this declaration and the remaining amount will be

WHEN TO FILE:

On or before April 30th following the close of the calendar

billed to you in three equal installments.

year (April 15th for entities conducting business in Bexley, Galena, Martins Ferry,

Marysville, Milan,

Milford

Center,

Mount

Sterling,

New

Albany,

SIGN AND DATE FORM 27 IN THE SPACE PROVIDED.

Oberlin, Plymouth, Powell, Reynoldsburg, Shawnee Hills, Sheffield Lake, Steubenville,

Toronto, Urbancrest, and Vermilion).

If the return is made for a fiscal year

PRINT YOUR FEDERAL EMPLOYER IDENTIFICATION NUMBER ON YOUR

or any period less than a year, file within four (4) months from the end of the

CHECK OR MONEY ORDER AND MAKE IT PAYABLE TO R.I.T.A. ENCLOSE

fiscal year or other period. (Before the 15th day of the fourth month from the

CHECK OR MONEY ORDER AND ORIGINAL FORM 27 IN THE ENCLOSED

end of the fiscal year or other period for Bexley, Galena, Martins Ferry,

RETURN ENVELOPE.

Milan, Milford Center, Mount Sterling, New Albany, Oberlin,

SCHEDULE INSTRUCTIONS

Plymouth, Powell, Reynoldsburg, Shawnee Hills, Sheffield Lake, Steubenville,

Toronto, Urbancrest, and Vermilion).

Distribution of Profit Within R.I.T.A. Municipalities

SCHEDULE B

WHERE TO FILE: Forms may be mailed to R.I.T.A., P.O. Box 89475, Cleveland,

This schedule must be used for the distribution of tax on

Ohio 44101-6475, or delivered to the office of the Regional Income Tax Agency.

Line 5. If the amount of tax shown on Line 5 of this form is to be allocated to any

R.I.T.A. municipality, you must fill in the names of all the municipalities and the

EXTENSIONS OF TIME TO FILE for good cause may be granted by the Administrator.

amount of taxable income and tax due to each one. The total distribution in Schedule

Make written request on or before the due date stating reason for extension.

B must equal total tax due (line 5). Attach a schedule if you need more space.

ROUNDING OFF TO WHOLE DOLLARS is permitted. Eliminate any amount

Reconciliation with Federal Income Tax Return

less than fifty cents and increase any amount from fifty cents through ninety-

SCHEDULE X

nine cents to the next higher dollar.

This schedule is used for the purpose of making adjust-

ments when total income (Line 1) includes income not taxable and/or items

In accordance with law, PENALTY AND INTEREST will be charged for failing

not deductible for municipal purposes. Enter the amounts of any such items in

to file a return and to pay taxes, including estimated taxes, when they are due.

Schedule X and carry totals, Line G and Line Z, respectively to Lines (2A) and

(2B). LINE A - Capital losses from the sale, exchange or other disposition of

SPECIAL NOTES

property shall not be taken into consideration in arriving at net profits earned.

BEXLEY, CIRCLEVILLE, GRANDVIEW HEIGHTS, MARYSVILLE,

LINE B - if you have deducted non-taxable income (Line Z), expenses attributable

NEW ALBANY, OBERLIN, PLYMOUTH, POWELL, REYNOLDSBURG, RICHWOOD,

to this non-taxable income shall not be allowed as a deduction from the remaining

RIVERSIDE, SANDUSKY, SHAWNEE HILLS, SHEFFIELD LAKE, SUNBURY,

taxable income. LINE C - Would include federal, state, local and other taxes

TORONTO, UPPER ARLINGTON, URBANCREST, WORTHINGTON, AND YELLOW

based on income.

SPRINGS: A net operating loss may not be carried forward.

NOTE: Corporations are only entitled to a Franchise Tax Deduction based on

BOSTON HEIGHTS, SOUTH SOLON, AND VERMILION: A net operating loss

equity. The difference between the equity method and income method should

may be carried forward for a maximum of three (3) years.

be recorded on Line C.

RIVERSIDE: Net losses, incurred in a business or other activity subject to

the ordinance, are deductible from all the taxable net profits and earnings

LINE N - Capital gains from the sale, exchange or other disposition of property

included in the return.

shall not be taken into consideration in arriving at net profits earned. LINE Q -

Include items listed in the general instructions as Federal Income Not Taxable,

as well as compensation or like reimbursement for damages (except for loss of

SPECIFIC INSTRUCTIONS

profits), involuntary conversion, cancellation of indebtedness, income of a

decedent's income already taxable by the State of Ohio from which R.I.T.A.

HEADING - Print your company name, address, federal identification number,

municipalities are specifically prohibited from taxing, income which is prohibited

or make needed corrections if already imprinted.

from taxation by the Constitution of the United States and the State of Ohio or

any Act of Congress or the Ohio General Assembly.

LINE 1 - Place here your total taxable income as shown on your federal form

attached. 1065 filers use amount shown as ordinary income.

Business Allocation Formula

LINES (2A), (2B), AND (2C) - are used to make adjustments when Line 1 includes

SCHEDULE Y

A business allocation formula consisting of the average

income not taxable and/or items not deductible for municipal tax purposes. Schedule

net book value of the property, gross receipts and wages paid may be used by

X is used to reconcile income as used for federal purposes by subtracting such

business entities not required to pay tax on entire net profits, by reason of doing

income items that are not taxable for municipal purposes and adding back deductions

business both within and without R.I.T.A. municipalities. However, if the books

used for federal purposes that are not allowable for city purposes. Enter the

and records of the taxpayer shall disclose with reasonable accuracy the net

amounts of any such items in Schedule X, and carry the totals of Schedule X, Lines

profit attributable to R.I.T.A. municipalities, then only this portion shall be considered

(G) and (Z) respectively to Lines (2A) and (2B). The difference between Lines (2A)

as having a taxable situs in R.I.T.A. municipalities.

and (2B) is to be entered on Line (2C). Also see instructions for Schedule X.

NOTE: Sales and gross receipts in R.I.T.A. municipalities (Step 3) mean:

LINE (3A) - is the result of Line 1 plus Line (2A) less Line (2B).

1. All sales of tangible personal property which is shipped from a R.I.T.A.

LINE (3B) - The income tax ordinance recites a formula (Schedule Y) to

municipality to purchasers outside of a R.I.T.A. municipality regardless of

determine the percentage of income attributable to R.I.T.A. municipalities by

where title passes if the taxpayer is not, through its own employees, regularly

business entities conducting business activity both within and outside R.I.T.A.

engaged in the solicitation or promotion of sales at the place where delivery

municipalities. If Schedule Y is used, bring the average percentage from Line

is made.

5 of Schedule Y to the % line of Line (3B). Multiply Line (3A) by this percentage

and enter the result on Line (3B).

2. All sales of tangible personal property which is delivered within a R.I.T.A.

municipality regardless of where title passes, even though transported from

LINE (3C) - Business entities may carry operating losses forward for a maximum

a point outside a R.I.T.A. municipality, if the taxpayer is regularly engaged

period of five (5) years or until exhausted whichever is earlier, except as indicated

through its own employees in the solicitation and the sales result from such

in the special notes section. No portion of a net operating loss shall be carried

solicitation or promotion.

back against net profits of any prior year. Taxpayers doing business both in and

outside R.I.T.A. municipalities who allocate profits via Schedule Y must also

3. All sales of tangible personal property which is delivered within a R.I.T.A.

allocate losses accordingly. A worksheet or schedule is required to support an

municipality regardless of where title passes, if shipped or delivered from a

operating loss claimed on the return.

stock of goods within a R.I.T.A. municipality.

LINE 4 - is the result of Line (3B) less Line (3C).

Partner’s Distributive Shares of Net Income

LINE 5 - See reverse side for tax rates or use to obtain current

SCHEDULE Z

rates. NOTE: You must complete Schedule B for any amount on line 5.

Must be completed by all partnerships and associations

filing returns. Amounts shown in this schedule must correspond with amounts

LINE (6A) - Enter here estimate payments made to R.I.T.A. municipalities for

reported on your Federal Partnership Form. Attach a schedule if you need more

this taxable year.

space.

LINE (6B) - Enter credit from prior year(s). (Overpayment you indicated on the

CHANGES

prior return to be credited against this year’s tax.)

If your mailing address, company name, trade name, or R.I.T.A. MUNICIPALITY

LINE (6C) - is the total of Lines (6A) and (6B).

where located is incorrect or has changed from that shown on Form 27, enter

all changes on the form in the boxes provided.

LINE (7A) - If Line 5 is greater than Line (6C) the difference should be entered

here. Remittance in this amount must accompany the return when filed. If this

In accordance with law, PENALTY AND INTEREST will be charged for failing

amount is less than $1, (for Bedford Heights $5), you do not have to pay.

to file a return and to pay taxes, including estimated taxes, when they are due.

LINE (7B) - If Line (6C) is greater than Line 5 the difference should be entered here.

For each R.I.T.A. MUNICIPALITY owed, if your estimated payments are not 90%

This amount will be transferred as a credit unless you request a refund. Refunds of

of the tax due or are not equal to or greater than your prior year’s total tax liability,

less than $1 (for Bedford Heights $5) are not made, per the income tax ordinance, but

you will be subject to penalty and interest assessments.

can be credited to your account. Do not split overpayment between credit and refund.

Please check refund box on return envelope to expedite processing of the refund.

QUARTERLY PAYMENTS OF ESTIMATED TAX MUST BE MADE TO EACH

R.I.T.A. MUNICIPALITY IN WHICH THE ANTICIPATED AMOUNT OWED IS AT

COMPUTATION OF ESTIMATED TAX

LINE (8) -

LEAST $10.00, EXCEPT AVON LAKE, IF THE ANTICIPATED AMOUNT IS AT

LEAST $40.00; AURORA, BAY VILLAGE, BEREA, CENTERBURG, GALENA,

PLEASE NOTE: IF THE ESTIMATE IS LEFT BLANK, AN ESTIMATE

GLENWILLOW, HUDSON, MAYFIELD HEIGHTS, MIDDLEBURG HEIGHTS, NEW

WILL BE CREATED FOR YOU BASED ON PRIOR YEAR TAX LIABILITY

ALBANY, NORTH ROYALTON, SHAKER HEIGHTS, STRONGSVILLE, SUNBURY,

AND DISTRIBUTION. IF NO ESTIMATE IS REQUIRED PLACE A ZERO

UNIVERSITY HEIGHTS, WELLSTON, AND WILLOWICK IS AT LEAST $50.00;

ON LINE 8A.

BRECKSVILLE IS AT LEAST $75.00; CIRCLEVILLE, ELYRIA, ELYRIA TOWNSHIP

JEDD, FORT JENNINGS, GRANDVIEW HEIGHTS, LAKEWOOD, MAINEVILLE,

DECLARATION OF ESTIMATED MUNICIPAL TAX ON NET PROFITS

OTTAWA, REYNOLDSBURG, RICHMOND HEIGHTS, SAINT PARIS, SILVER

LAKE, SOUTH EUCLID, STEUBENVILLE, UPPER ARLINGTON, WESTLAKE AND

It is required by municipal ordinance, a Declaration of Estimated Income

WORTHINGTON IS AT LEAST $100.00. FOR ARLINGTON HEIGHTS, ASHVILLE,

Tax on Net Profits must be filed by the following:

BEACHWOOD, BEDFORD HEIGHTS, BEXLEY, CEDARVILLE, CLAYTON, FAIR-

PORT HARBOR, LOCKLAND, MARYSVILLE, MILAN, MILFORD CENTER,

(1) All corporations whose income is derived from sales made, work

MOUNT

STERLING,

NEW

BLOOMINGTON,

NEWTOWN,

done, services performed or rendered, and business or other activities

NORTH LEWISBURG, OBERLIN, PLAIN CITY, PLYMOUTH, POWELL, RICH-

conducted in any R.I.T.A. MUNICIPALITY, whether or not such income

WOOD, RIDGEWAY, SHAWNEE HILLS, SHEFFIELD LAKE, SOUTH SOLON,

results in a net profit.

TORONTO, VERMILION, WAKEMAN, WINTERSVILLE AND YELLOW SPRINGS

- QUARTERLY PAYMENTS MUST BE MADE REGARDLESS OF THE AMOUNT

(2) All resident or non-resident partnerships, limited partnerships, estates

OWED.

or trusts which expect a profit or loss derived from sales made, work

done, services performed or rendered and business or other activities

conducted in any R.I.T.A. MUNICIPALITY.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3