Form Ct-6251 - Connecticut Alternative Minimum Tax Return - Individuals - 2000 Page 2

ADVERTISEMENT

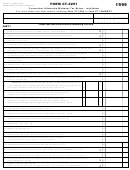

PART II

27. Enter the amount from Line 11

27

1 2 3 4

1 2 3 4

1 2 3 4

28. Enter the amount from federal Form 6251, Line 30 (see instructions)

28

1 2 3 4

1 2 3 4

1 2 3 4

29. Enter the amount from federal Form 6251, Line 31 (see instructions)

29

1 2 3 4

1 2 3 4

1 2 3 4

30. Add Lines 28 and 29

30

1 2 3 4

1 2 3 4

1 2 3 4

31. Enter the amount from federal Form 6251, Line 33 (see instructions)

31

1 2 3 4

32. Enter the smaller of Line 30 or Line 31

32

33. Subtract Line 32 from Line 27. If zero or less, enter “0.”

33

IMPORTANT: Complete Line 34 or Line 35 but not both.

34. If Line 33 is $175,000 or less ($87,500 or less if married filing separately), multiply Line 33 by 26% (.26)

34

35. If Line 33 is more than $175,000 (more than $87,500 if married filing separately), multiply Line 33 by

28% (.28) and subtract $3,500 ($1,750 if married filing separately) from the result

35

1 2 3 4

1 2 3 4

36. Enter the amount from federal Form 6251, Line 37 (see instructions)

36

1 2 3 4

1 2 3 4

1 2 3 4

37. Enter the smallest of Line 27, Line 28 or Line 36

37

1 2 3 4

38. Multiply Line 37 by 10% (.10)

38

1 2 3 4

1 2 3 4

1 2 3 4

39. Enter the smaller of Line 27 or Line 28

39

1 2 3 4

1 2 3 4

1 2 3 4

40. Enter the amount from Line 37

40

1 2 3 4

1 2 3 4

1 2 3 4

41. Subtract Line 40 from Line 39

41

1 2 3 4

42. Multiply Line 41 by 20% (.20). If Line 29 is zero or blank, skip Lines 43 through 46 and go to Line 47.

42

1 2 3 4

1 2 3 4

43. Enter the amount from Line 27

43

1 2 3 4

1 2 3 4

1 2 3 4

44. Add Lines 33, 37, and 41

44

1 2 3 4

1 2 3 4

1 2 3 4

45. Subtract Line 44 from Line 43

45

1 2 3 4

46. Multiply Line 45 by 25% (.25)

46

47. Add Lines 34, 35, 38, 42, and 46

47

48. If Line 27 is $175,000 or less ($87,500 or less if married filing separately), multiply Line 27 by 26% (.26).

Otherwise, multiply Line 27 by 28% (.28), and subtract $3,500 ($1,750 if married filing separately) from the result.

48

49. Enter the smaller of Line 47 or Line 48 here and on Line 12.

49

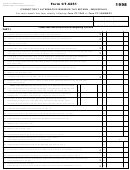

SCHEDULE A - CREDIT FOR ALTERNATIVE MINIMUM TAX PAID TO QUALIFYING JURISDICTIONS

IMPORTANT: You must attach a copy of your return filed with the qualifying jurisdiction(s) or your credit will be disallowed.

50. Modified adjusted federal alternative minimum taxable income (see instructions)

50

COLUMN A

COLUMN B

FOR EACH COLUMN, ENTER THE FOLLOWING:

Name

Code

Name

Code

51. Enter qualifying jurisdiction’s name and two-letter code.

(see chart below)

51

52. Non-Connecticut adjusted federal alternative minimum taxable

income included on Line 50 which is subject to qualifying

jurisdiction’s alternative minimum tax

52

53. Divide Line 52 by Line 50 (round to four decimal places)

53

•

•

54. Enter the Net Connecticut Minimum Tax (from Form CT-6251,

Line 24). Part-Year Residents, see instructions

54

55. Multiply Line 53 by Line 54

55

56. Alternative minimum tax paid to qualifying jurisdiction (see instructions)

56

57. Enter the lesser of Line 55 or Line 56

57

58. TOTAL CREDIT (Add Line 57, all columns)

Enter this amount here and on Line 25 on the front of this form.

58

If you claim credit for alternative minimum taxes paid to another state of the United States, a political subdivision within another

state, or the District of Columbia, enter the appropriate two-letter code.

STANDARD TWO-LETTER CODES

California

CA

Nebraska

NE

Colorado

CO

New York

NY

Iowa

I A

West Virginia

WV

Maine

ME

Wisconsin

WI

Minnesota

MN

All others

OO

Form CT-6251 Back (Rev.12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2