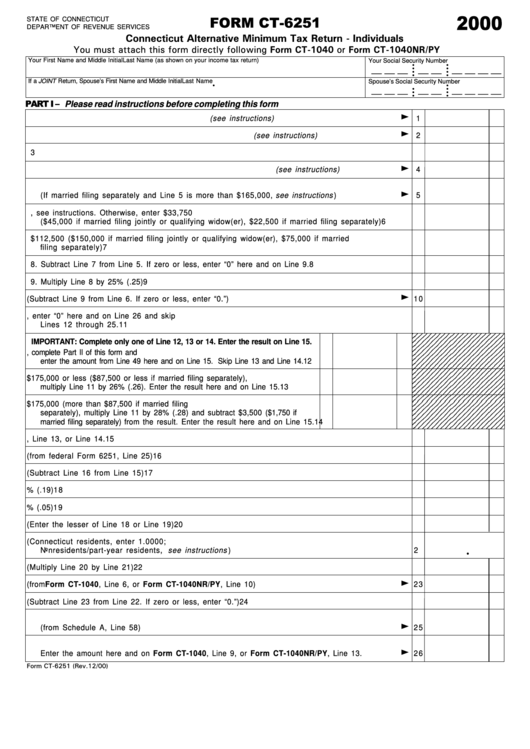

Form Ct-6251 - Connecticut Alternative Minimum Tax Return - Individuals - 2000

ADVERTISEMENT

2000

FORM CT-6251

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

Connecticut Alternative Minimum Tax Return - Individuals

You must attach this form directly following Form CT-1040 or Form CT-1040NR/PY

Your First Name and Middle Initial

Last Name (as shown on your income tax return)

Your Social Security Number

•

•

__ __ __ __ __ __ __ __ __

•

•

•

•

•

•

If a JOINT Return, Spouse’s First Name and Middle Initial

Last Name

Spouse’s Social Security Number

•

•

__ __ __ __ __ __ __ __ __

•

•

•

•

•

•

PART I – Please read instructions before completing this form

<

1. Federal alternative minimum taxable income (see instructions)

1

<

2. Additions to federal alternative minimum taxable income (see instructions)

2

3. Add Line 1 and Line 2

3

<

4. Subtractions from federal alternative minimum taxable income (see instructions)

4

5. Adjusted federal alternative minimum taxable income. Subtract Line 4 from Line 3

<

(If married filing separately and Line 5 is more than $165,000, see instructions )

5

6. If this form is for a child under age 14, see instructions. Otherwise, enter $33,750

($45,000 if married filing jointly or qualifying widow(er), $22,500 if married filing separately)

6

7. Enter $112,500 ($150,000 if married filing jointly or qualifying widow(er), $75,000 if married

filing separately)

7

8. Subtract Line 7 from Line 5. If zero or less, enter “0” here and on Line 9.

8

9. Multiply Line 8 by 25% (.25)

9

<

10. Exemption (Subtract Line 9 from Line 6. If zero or less, enter “0.”)

1 0

11. Subtract Line 10 from Line 5. If zero or less, enter “0” here and on Line 26 and skip

Lines 12 through 25.

11

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

IMPORTANT: Complete only one of Line 12, 13 or 14. Enter the result on Line 15.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

12. If you completed Part IV of federal Form 6251, complete Part II of this form and

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

enter the amount from Line 49 here and on Line 15. Skip Line 13 and Line 14.

1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

13. If Line 11 is $175,000 or less ($87,500 or less if married filing separately),

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

multiply Line 11 by 26% (.26). Enter the result here and on Line 15.

1 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

14. If Line 11 is more than $175,000 (more than $87,500 if married filing

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

separately), multiply Line 11 by 28% (.28) and subtract $3,500 ($1,750 if

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

married filing separately) from the result. Enter the result here and on Line 15.

1 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

15. Enter the amount from Line 12, Line 13, or Line 14.

1 5

16. Alternative minimum tax foreign tax credit (from federal Form 6251, Line 25)

1 6

17. Adjusted federal tentative minimum tax (Subtract Line 16 from Line 15)

1 7

18. Multiply Line 17 by 19% (.19)

1 8

19. Multiply Line 5 by 5% (.05)

1 9

20. Connecticut minimum tax (Enter the lesser of Line 18 or Line 19)

2 0

21. Apportionment factor (Connecticut residents, enter 1.0000;

Nonresidents/part-year residents, see instructions )

2 1

•

22. Apportioned Connecticut minimum tax (Multiply Line 20 by Line 21)

2 2

<

23. Connecticut income tax (from Form CT-1040, Line 6, or Form CT-1040NR/PY, Line 10)

2 3

24. Net Connecticut minimum tax (Subtract Line 23 from Line 22. If zero or less, enter “0.”)

2 4

25. Credit for minimum tax paid to qualifying jurisdictions. Residents and part-year residents only

<

(from Schedule A, Line 58)

2 5

26. Subtract Line 25 from Line 24

<

Enter the amount here and on Form CT-1040, Line 9, or Form CT-1040NR/PY, Line 13.

2 6

Form CT-6251 (Rev.12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2