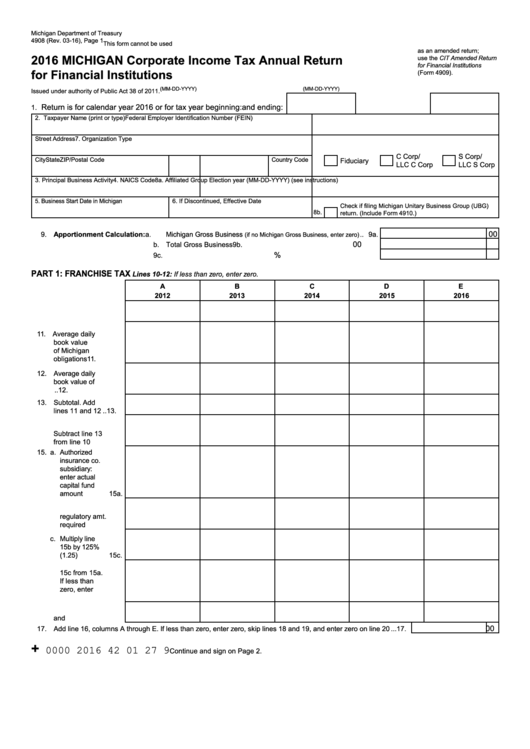

Form 4908 - Michigan Corporate Income Tax Annual Return For Financial Institutions - 2016

ADVERTISEMENT

Michigan Department of Treasury

4908 (Rev. 03-16), Page 1

This form cannot be used

as an amended return;

2016 MICHIGAN Corporate Income Tax Annual Return

use the CIT Amended Return

for Financial Institutions

for Financial Institutions

(Form 4909).

(MM-DD-YYYY)

(MM-DD-YYYY)

Issued under authority of Public Act 38 of 2011.

Return is for calendar year 2016 or for tax year beginning:

and ending:

1.

2. Taxpayer Name (print or type)

Federal Employer Identification Number (FEIN)

Street Address

7. Organization Type

C Corp/

S Corp/

City

State

ZIP/Postal Code

Country Code

Fiduciary

LLC C Corp

LLC S Corp

3. Principal Business Activity

4. NAICS Code

8a. Affiliated Group Election year (MM-DD-YYYY) (see instructions)

5. Business Start Date in Michigan

6. If Discontinued, Effective Date

Check if filing Michigan Unitary Business Group (UBG)

8b.

return. (Include Form 4910.)

00

9. Apportionment Calculation:

a. Michigan Gross Business

..

9a.

(if no Michigan Gross Business, enter zero)

00

b. Total Gross Business ...................................................................

9b.

%

c. Apportionment Percentage. Divide line 9a by line 9b .................

9c.

PART 1: FRANCHISE TAX

Lines 10-12: If less than zero, enter zero.

A

B

C

D

E

2012

2013

2014

2015

2016

10. Equity Capital .... 10.

11. Average daily

book value

of Michigan

obligations .........

11.

12. Average daily

book value of

U.S. obligations .. 12.

13. Subtotal. Add

lines 11 and 12 .. 13.

14. Net Capital.

Subtract line 13

from line 10 ........ 14.

15. a. Authorized

insurance co.

subsidiary:

enter actual

capital fund

amount ............ 15a.

b. Minimum

regulatory amt.

required .......... 15b.

c. Multiply line

15b by 125%

(1.25) ............... 15c.

d. Subtract line

15c from 15a.

If less than

zero, enter

zero................. 15d.

16. Add lines 14

and 15d.............. 16.

00

17. Add line 16, columns A through E. If less than zero, enter zero, skip lines 18 and 19, and enter zero on line 20 ...

17.

+

0000 2016 42 01 27 9

Continue and sign on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7