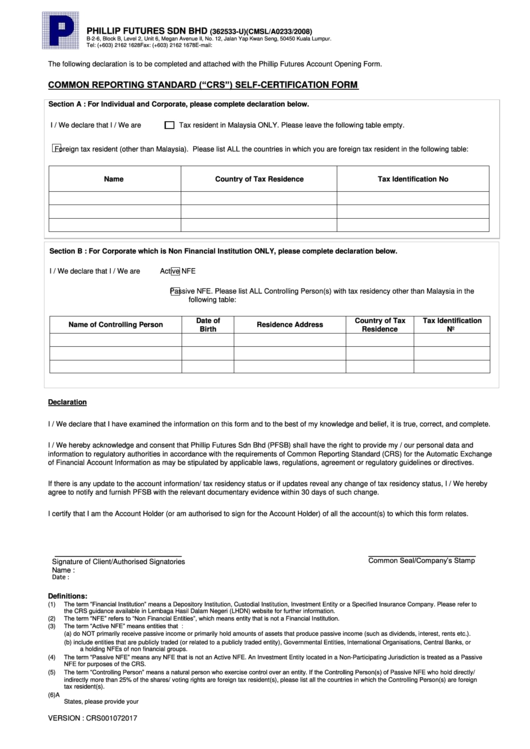

Common Reporting Standard ("Crs") Self-Certification Form

ADVERTISEMENT

PHILLIP FUTURES SDN BHD

(362533-U) (CMSL/A0233/2008)

B-2-6, Block B, Level 2, Unit 6, Megan Avenue II, No. 12, Jalan Yap Kwan Seng, 50450 Kuala Lumpur.

Tel: (+603) 2162 1628

Fax: (+603) 2162 1678

E-mail: .my

The following declaration is to be completed and attached with the Phillip Futures Account Opening Form.

COMMON REPORTING STANDARD (“CRS”) SELF-CERTIFICATION FORM

Section A : For Individual and Corporate, please complete declaration below.

I / We declare that I / We are

Tax resident in Malaysia ONLY. Please leave the following table empty.

Foreign tax resident (other than Malaysia). Please list ALL the countries in which you are foreign tax resident in the following table:

Name

Country of Tax Residence

Tax Identification No

Section B : For Corporate which is Non Financial Institution ONLY, please complete declaration below.

I / We declare that I / We are

Active NFE

Passive NFE. Please list ALL Controlling Person(s) with tax residency other than Malaysia in the

following table:

Date of

Country of Tax

Tax Identification

Name of Controlling Person

Residence Address

Birth

Residence

No

Declaration

I / We declare that I have examined the information on this form and to the best of my knowledge and belief, it is true, correct, and complete.

I / We hereby acknowledge and consent that Phillip Futures Sdn Bhd (PFSB) shall have the right to provide my / our personal data and

information to regulatory authorities in accordance with the requirements of Common Reporting Standard (CRS) for the Automatic Exchange

of Financial Account Information as may be stipulated by applicable laws, regulations, agreement or regulatory guidelines or directives.

If there is any update to the account information/ tax residency status or if updates reveal any change of tax residency status, I / We hereby

agree to notify and furnish PFSB with the relevant documentary evidence within 30 days of such change.

I certify that I am the Account Holder (or am authorised to sign for the Account Holder) of all the account(s) to which this form relates.

__________________________

______________________

Common Seal/Company’s Stamp

Signature of Client/Authorised Signatories

Name :

Date :

Definitions:

The term “Financial Institution” means a Depository Institution, Custodial Institution, Investment Entity or a Specified Insurance Company. Please refer to

(1)

the CRS guidance available in Lembaga Hasil Dalam Negeri (LHDN) website for further information.

The term “NFE” refers to “Non Financial Entities”, which means entity that is not a Financial Institution.

(2)

The term “Active NFE” means entities that :

(3)

(a)

do NOT primarily receive passive income or primarily hold amounts of assets that produce passive income (such as dividends, interest, rents etc.).

(b)

include entities that are publicly traded (or related to a publicly traded entity), Governmental Entities, International Organisations, Central Banks, or

a holding NFEs of non financial groups.

The term “Passive NFE” means any NFE that is not an Active NFE. An Investment Entity located in a Non-Participating Jurisdiction is treated as a Passive

(4)

NFE for purposes of the CRS.

The term “Controlling Person” means a natural person who exercise control over an entity. If the Controlling Person(s) of Passive NFE who hold directly/

(5)

indirectly more than 25% of the shares/ voting rights are foreign tax resident(s), please list all the countries in which the Controlling Person(s) are foreign

tax resident(s).

(6)

A U.S. citizen is considered a tax resident of the United States even if he / she is a tax resident of another jurisdiction. If you are a tax resident of the United

States, please provide your U.S. TIN using Form W-9.

VERSION : CRS001072017

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1