Self-Certification For Common Reporting Standard (Crs)

ADVERTISEMENT

1

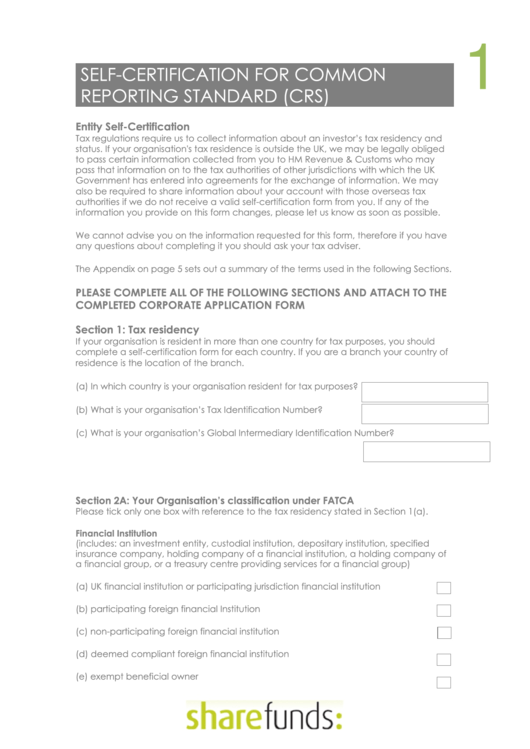

SELF-CERTIFICATION FOR COMMON

REPORTING STANDARD (CRS)

Entity Self-Certification

Tax regulations require us to collect information about an investor’s tax residency and

status. If your organisation's tax residence is outside the UK, we may be legally obliged

to pass certain information collected from you to HM Revenue & Customs who may

pass that information on to the tax authorities of other jurisdictions with which the UK

Government has entered into agreements for the exchange of information. We may

also be required to share information about your account with those overseas tax

authorities if we do not receive a valid self-certification form from you. If any of the

information you provide on this form changes, please let us know as soon as possible.

We cannot advise you on the information requested for this form, therefore if you have

any questions about completing it you should ask your tax adviser.

The Appendix on page 5 sets out a summary of the terms used in the following Sections.

PLEASE COMPLETE ALL OF THE FOLLOWING SECTIONS AND ATTACH TO THE

COMPLETED CORPORATE APPLICATION FORM

Section 1: Tax residency

If your organisation is resident in more than one country for tax purposes, you should

complete a self-certification form for each country. If you are a branch your country of

residence is the location of the branch.

(a) In which country is your organisation resident for tax purposes?

(b) What is your organisation’s Tax Identification Number?

(c) What is your organisation’s Global Intermediary Identification Number?

Section 2A: Your Organisation’s classification under FATCA

Please tick only one box with reference to the tax residency stated in Section 1(a).

Financial Institution

(includes: an investment entity, custodial institution, depositary institution, specified

insurance company, holding company of a financial institution, a holding company of

a financial group, or a treasury centre providing services for a financial group)

(a) UK financial institution or participating jurisdiction financial institution

(b) participating foreign financial Institution

(c) non-participating foreign financial institution

(d) deemed compliant foreign financial institution

(e) exempt beneficial owner

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10