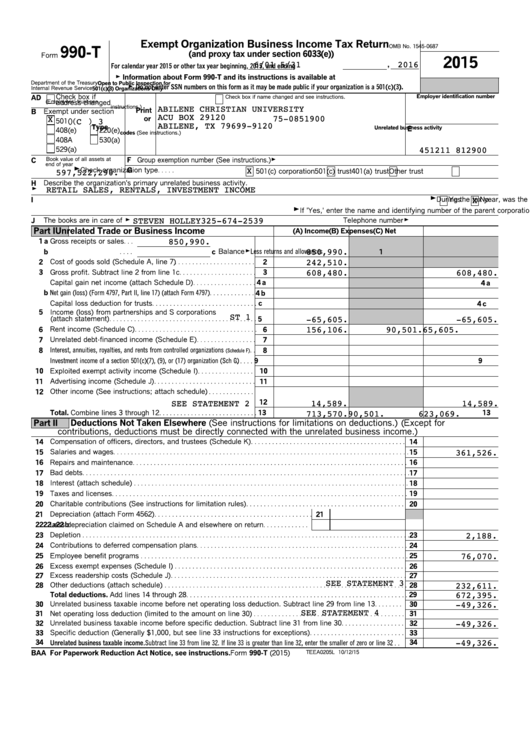

Form 990-T - Exempt Organization Business Income Tax Return - 2015

ADVERTISEMENT

Exempt Organization Business Income Tax Return

OMB No. 1545-0687

990-T

(and proxy tax under section 6033(e))

Form

2015

6/01

5/31

2016

,

For calendar year 2015 or other tax year beginning

, 2015, and ending

G Information about Form 990-T and its instructions is available at

Department of the Treasury

Open to Public Inspection for

G Do not enter SSN numbers on this form as it may be made public if your organization is a 501(c)(3).

Internal Revenue Service

501(c)(3) Organizations Only

Check box if

Check box if name changed and see instructions.

Employer identification number

A

D

address changed

(Employees' trust, see

ABILENE CHRISTIAN UNIVERSITY

instructions.)

Print

B

Exempt under section

ACU BOX 29120

X

75-0851900

or

C

3

501(

)(

)

ABILENE, TX 79699-9120

Type

Unrelated business activity

E

408(e)

220(e)

codes (See instructions.)

408A

530(a)

451211

812900

529(a)

Group exemption number (See instructions.)G

Book value of all assets at

F

C

end of year

G

X

G

Check organization type

597,522,290.

. . . . .

501(c) corporation

501(c) trust

401(a) trust

Other trust

H

Describe the organization's primary unrelated business activity.

RETAIL SALES, RENTALS, INVESTMENT INCOME

G

G

X

I

During the tax year, was the corporation a subsidiary in an affiliated group or a parent-subsidiary controlled group?

Yes

No

. . . .

G

If 'Yes,' enter the name and identifying number of the parent corporation

. . . .

STEVEN HOLLEY

325-674-2539

The books are in care of G

Telephone numberG

J

Part I

Unrelated Trade or Business Income

(A) Income

(B) Expenses

(C) Net

850,990.

Gross receipts or sales

1 a

. . .

850,990.

Less returns and allowances

BalanceG

b

c

1 c

. . . .

242,510.

2

Cost of goods sold (Schedule A, line 7)

2

. . . . . . . . . . . . . . . . . . . . . . .

608,480.

608,480.

Gross profit. Subtract line 2 from line 1c

3

3

. . . . . . . . . . . . . . . . . . . . . .

4 a

Capital gain net income (attach Schedule D)

4 a

. . . . . . . . . . . . . . . . . .

b Net gain (loss) (Form 4797, Part II, line 17) (attach Form 4797)

4 b

. . . . . . . . . . . . .

c

Capital loss deduction for trusts

4 c

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income (loss) from partnerships and S corporations

5

ST 1

-65,605.

-65,605.

(attach statement)

5

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

156,106.

90,501.

65,605.

6

Rent income (Schedule C)

6

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Unrelated debt-financed income (Schedule E)

7

7

. . . . . . . . . . . . . . . . .

Interest, annuities, royalties, and rents from controlled organizations

8

8

(Schedule F). .

9

Investment income of a section 501(c)(7), (9), or (17) organization (Sch G)

9

. . . . .

Exploited exempt activity income (Schedule I)

10

10

. . . . . . . . . . . . . . . .

Advertising income (Schedule J)

11

11

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Other income (See instructions; attach schedule)

. . . . . . . . . . . . . .

SEE STATEMENT 2

14,589.

14,589.

12

713,570.

90,501.

623,069.

13

Total. Combine lines 3 through 12

13

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deductions Not Taken Elsewhere (See instructions for limitations on deductions.) (Except for

Part II

contributions, deductions must be directly connected with the unrelated business income.)

Compensation of officers, directors, and trustees (Schedule K)

14

14

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

361,526.

Salaries and wages

15

15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

Repairs and maintenance

16

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Bad debts

17

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest (attach schedule)

18

18

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxes and licenses

19

19

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

Charitable contributions (See instructions for limitation rules)

20

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Depreciation (attach Form 4562)

21

21

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Less depreciation claimed on Schedule A and elsewhere on return

22

22 a

22 b

. . . . . . . . . . . . .

2,188.

23

Depletion

23

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Contributions to deferred compensation plans

24

24

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

76,070.

Employee benefit programs

25

25

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

Excess exempt expenses (Schedule I)

26

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

Excess readership costs (Schedule J)

27

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SEE STATEMENT 3

232,611.

28

Other deductions (attach schedule)

28

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

672,395.

29

Total deductions. Add lines 14 through 28

29

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-49,326.

30

Unrelated business taxable income before net operating loss deduction. Subtract line 29 from line 13

30

. . . . . . . .

SEE STATEMENT 4

31

Net operating loss deduction (limited to the amount on line 30)

31

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-49,326.

32

Unrelated business taxable income before specific deduction. Subtract line 31 from line 30

32

. . . . . . . . . . . . . . . . . .

33

Specific deduction (Generally $1,000, but see line 33 instructions for exceptions)

33

. . . . . . . . . . . . . . . . . . . . . . . . . . .

-49,326.

34

34

Unrelated business taxable income. Subtract line 33 from line 32. If line 33 is greater than line 32, enter the smaller of zero or line 32

. . .

BAA For Paperwork Reduction Act Notice, see instructions.

TEEA0205L 10/12/15

Form 990-T (2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13