Instructions For Preparing Form 27

ADVERTISEMENT

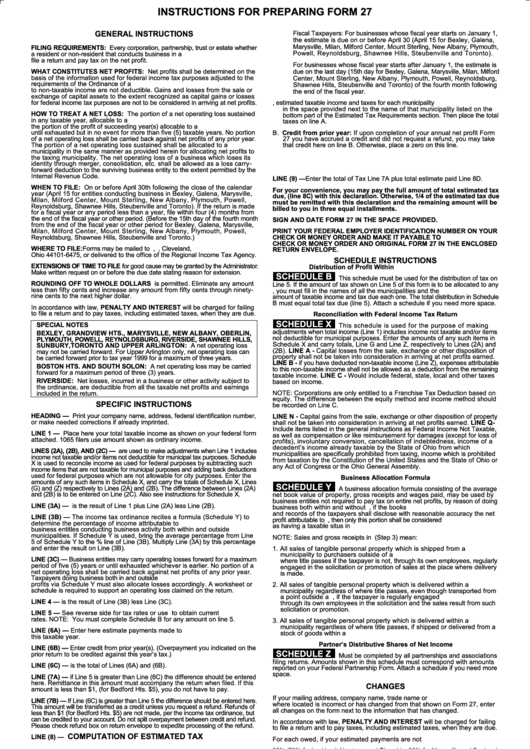

INSTRUCTIONS FOR PREPARING FORM 27

GENERAL INSTRUCTIONS

FILING REQUIREMENTS:

WHAT CONSTITUTES NET PROFITS:

HOW TO TREAT A NET LOSS:

Credit from prior year:

LINE (9) —

WHEN TO FILE:

For your convenience, you may pay the full amount of total estimated tax

due, (line 8C) with this declaration. Otherwise, 1/4 of the estimated tax due

must be remitted with this declaration and the remaining amount will be

billed to you in three equal installments.

SIGN AND DATE FORM 27 IN THE SPACE PROVIDED.

PRINT YOUR FEDERAL EMPLOYER IDENTIFICATION NUMBER ON YOUR

CHECK OR MONEY ORDER AND MAKE IT PAYABLE TO R.I.T.A. ENCLOSE

CHECK OR MONEY ORDER AND ORIGINAL FORM 27 IN THE ENCLOSED

WHERE TO FILE:

RETURN ENVELOPE.

SCHEDULE INSTRUCTIONS

EXTENSIONS OF TIME TO FILE

Distribution of Profit Within R.I.T.A. Municipalities

SCHEDULE B

ROUNDING OFF TO WHOLE DOLLARS

PENALTY AND INTEREST

Reconciliation with Federal Income Tax Return

SCHEDULE X

SPECIAL NOTES

BEXLEY, GRANDVIEW HTS., MARYSVILLE, NEW ALBANY, OBERLIN,

PLYMOUTH, POWELL, REYNOLDSBURG, RIVERSIDE, SHAWNEE HILLS,

SUNBURY, TORONTO AND UPPER ARLINGTON:

LINE A -

LINE B -

BOSTON HTS. AND SOUTH SOLON:

LINE C -

RIVERSIDE:

SPECIFIC INSTRUCTIONS

HEADING —

LINE N -

LINE Q-

LINE 1 —

LINES (2A), (2B), AND (2C) —

Business Allocation Formula

SCHEDULE Y

LINE (3A) —

LINE (3B) —

LINE (3C) —

LINE 4 —

LINE 5 —

LINE (6A) —

Partner’s Distributive Shares of Net Income

LINE (6B) —

SCHEDULE Z

LINE (6C) —

LINE (7A) —

CHANGES

LINE (7B) —

PENALTY AND INTEREST

COMPUTATION OF ESTIMATED TAX

LINE (8) —

R.I.T.A. MUNICIPALITY

PLEASE NOTE: IF THE ESTIMATE IS LEFT BLANK, AN ESTIMATE

WILL BE CREATED FOR YOU BASED ON PRIOR YEAR LIABILITY

AND DISTRIBUTION. IF NO ESTIMATE IS REQUIRED PLACE A ZERO

ON LINE 8A.

DECLARATION OF ESTIMATED MUNICIPAL TAX ON NET PROFITS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2