Mail This Form With Remittance Payable To:

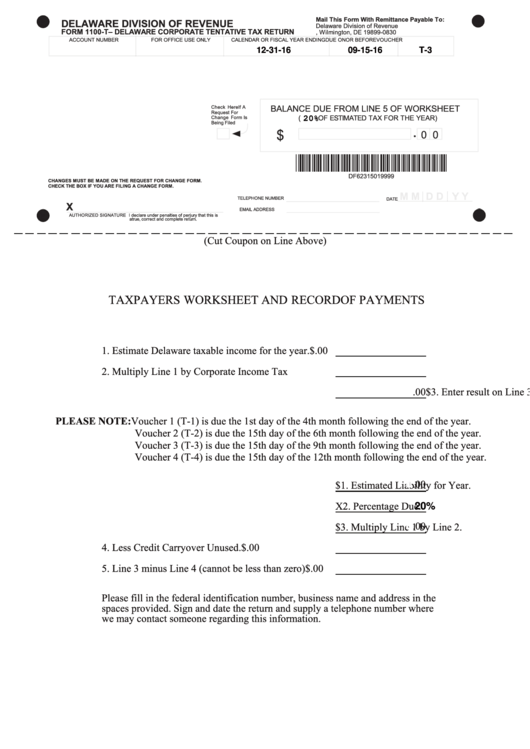

DELAWARE DIVISION OF REVENUE

Delaware Division of Revenue

FORM 1100-T – DELAWARE CORPORATE TENTATIVE TAX RETURN

P.O. Box 830, Wilmington, DE 19899-0830

ACCOUNT NUMBER

FOR OFFICE USE ONLY

CALENDAR OR FISCAL YEAR ENDING

DUE ON OR BEFORE

VOUCHER

Reset

0-000000000-000

12-31-16

09-15-16

T-3

Print Form

00380103000000000000012311609151600000000000000000000

BALANCE DUE FROM LINE 5 OF WORKSHEET

Check Here If A

Request For

(

OF ESTIMATED TAX FOR THE YEAR)

Change Form Is

20%

Being Filed

.

$

0 0

*DF62315019999*

DF62315019999

CHANGES MUST BE MADE ON THE REQUEST FOR CHANGE FORM.

CHECK THE BOX IF YOU ARE FILING A CHANGE FORM.

TELEPHONE NUMBER

DATE

X

EMAIL ADDRESS

AUTHORIZED SIGNATURE I declare under penalties of perjury that this is

a true, correct and complete return.

(Cut Coupon on Line Above)

Reset

TAXPAYERS WORKSHEET AND RECORD OF PAYMENTS

1. Estimate Delaware taxable income for the year.

$

.00

2. Multiply Line 1 by Corporate Income Tax Rate.

x

.087

3. Enter result on Line 3.

$

.00

0

PLEASE NOTE: Voucher 1 (T-1) is due the 1st day of the 4th month following the end of the year.

Voucher 2 (T-2) is due the 15th day of the 6th month following the end of the year.

Voucher 3 (T-3) is due the 15th day of the 9th month following the end of the year.

Voucher 4 (T-4) is due the 15th day of the 12th month following the end of the year.

.00

1. Estimated Liability for Year.

$

0

0

2. Percentage Due.

X

20%

.00

3. Multiply Line 1 by Line 2.

$

0

0

4. Less Credit Carryover Unused.

$

.00

5. Line 3 minus Line 4 (cannot be less than zero)

$

0

.00

0

Please fill in the federal identification number, business name and address in the

spaces provided. Sign and date the return and supply a telephone number where

we may contact someone regarding this information.

1

1