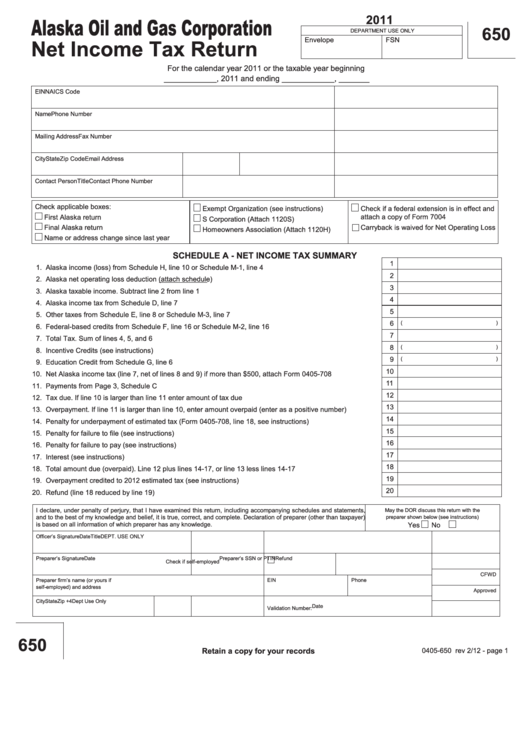

Form 650 - Alaska Oil And Gas Corporation Net Income Tax Return - 2011

ADVERTISEMENT

2011

Alaska Oil and Gas Corporation

650

DEPARTMENT USE ONLY

Net Income Tax Return

Envelope

FSN

For the calendar year 2011 or the taxable year beginning

____________, 2011 and ending ____________, _______

EIN

NAICS Code

Name

Phone Number

Mailing Address

Fax Number

City

State

Zip Code

Email Address

Contact Person

Title

Contact Phone Number

Check applicable boxes:

Exempt Organization (see instructions)

Check if a federal extension is in effect and

First Alaska return

attach a copy of Form 7004

S Corporation (Attach 1120S)

Carryback is waived for Net Operating Loss

Final Alaska return

Homeowners Association (Attach 1120H)

Name or address change since last year

SCHEDULE A - NET INCOME TAX SUMMARY

1

1. Alaska income (loss) from Schedule H, line 10 or Schedule M-1, line 4 ..............................................................

2

2. Alaska net operating loss deduction (attach schedule) ........................................................................................

3

3. Alaska taxable income. Subtract line 2 from line 1 ...............................................................................................

4

4. Alaska income tax from Schedule D, line 7 ..........................................................................................................

5

5. Other taxes from Schedule E, line 8 or Schedule M-3, line 7 ...............................................................................

6

(

)

6. Federal-based credits from Schedule F, line 16 or Schedule M-2, line 16 ...........................................................

7

7. Total Tax. Sum of lines 4, 5, and 6 .......................................................................................................................

8

(

)

8. Incentive Credits (see instructions) ......................................................................................................................

9

(

)

9. Education Credit from Schedule G, line 6 ............................................................................................................

10

10. Net Alaska income tax (line 7, net of lines 8 and 9) if more than $500, attach Form 0405-708 ...........................

11

11. Payments from Page 3, Schedule C .....................................................................................................................

12

12. Tax due. If line 10 is larger than line 11 enter amount of tax due .........................................................................

13

13. Overpayment. If line 11 is larger than line 10, enter amount overpaid (enter as a positive number) ...................

14

14. Penalty for underpayment of estimated tax (Form 0405-708, line 18, see instructions) ......................................

15

15. Penalty for failure to file (see instructions)............................................................................................................

16

16. Penalty for failure to pay (see instructions) ..........................................................................................................

17

17. Interest (see instructions) .....................................................................................................................................

18

18. Total amount due (overpaid). Line 12 plus lines 14-17, or line 13 less lines 14-17 ..............................................

19

19. Overpayment credited to 2012 estimated tax (see instructions) ..........................................................................

20

20. Refund (line 18 reduced by line 19)......................................................................................................................

I declare, under penalty of perjury, that I have examined this return, including accompanying schedules and statements,

May the DOR discuss this return with the

and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer)

preparer shown below (see instructions)

is based on all information of which preparer has any knowledge.

Yes

No

Officer’s Signature

Date

Title

DEPT. USE ONLY

Preparer’s Signature

Date

Preparer’s SSN or PTIN

Refund

Check if self-employed

CFWD

Preparer firm’s name (or yours if

EIN

Phone

self-employed) and address

Approved

City

State

Zip +4

Dept Use Only

Date

Validation Number:

650

Retain a copy for your records

0405-650 rev 2/12 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11