Municipal Income Tax Return And Claim For Refund Instructions For Form Ir-22 (Individual Return) - 2001

ADVERTISEMENT

2001 Municipal Income Tax Return and Claim for Refund

Instructions for Form IR-22 (Individual Return)

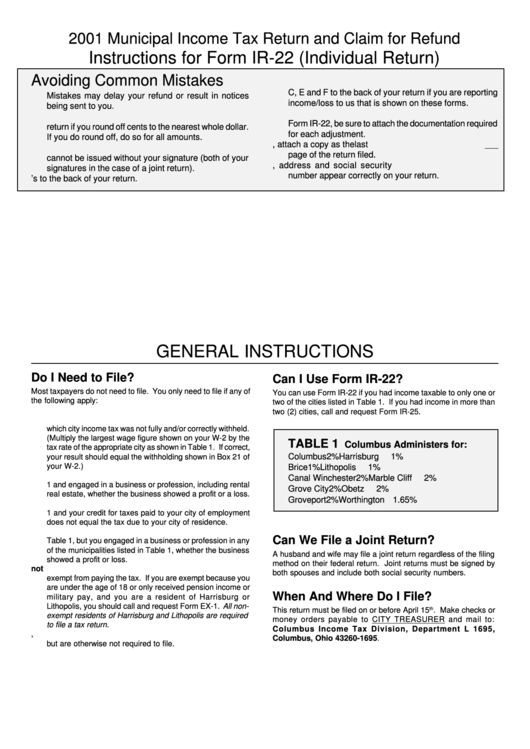

Avoiding Common Mistakes

4. Remember to attach copies of your Federal Schedules

C, E and F to the back of your return if you are reporting

Mistakes may delay your refund or result in notices

income/loss to us that is shown on these forms.

being sent to you.

5. If you are adjusting your taxable wages on Page 2 of

1. Check your math. You may find it easier to do your

Form IR-22, be sure to attach the documentation required

return if you round off cents to the nearest whole dollar.

for each adjustment.

If you do round off, do so for all amounts.

6. If an extension has been filed, attach a copy as the last

2. Remember to sign and date your return. Your refund

page of the return filed.

cannot be issued without your signature (both of your

7. Make sure your name, address and social security

signatures in the case of a joint return).

number appear correctly on your return.

3. Attach your W-2’s to the back of your return.

GENERAL INSTRUCTIONS

Do I Need to File?

Can I Use Form IR-22?

Most taxpayers do not need to file. You only need to file if any of

You can use Form IR-22 if you had income taxable to only one or

the following apply:

two of the cities listed in Table 1. If you had income in more than

two (2) cities, call and request Form IR-25.

1.

You earned income in a municipality listed in Table 1 from

which city income tax was not fully and/or correctly withheld.

(Multiply the largest wage figure shown on your W-2 by the

TABLE 1

Columbus Administers for:

tax rate of the appropriate city as shown in Table 1. If correct,

Columbus

2%

Harrisburg

1%

your result should equal the withholding shown in Box 21 of

your W-2.)

Brice

1%

Lithopolis

1%

2.

You are a resident of one of the municipalities listed in Table

Canal Winchester

2%

Marble Cliff

2%

1 and engaged in a business or profession, including rental

Grove City

2%

Obetz

2%

real estate, whether the business showed a profit or a loss.

Groveport

2%

Worthington 1.65%

3.

You are a resident of one of the municipalities listed in Table

1 and your credit for taxes paid to your city of employment

does not equal the tax due to your city of residence.

4.

You were not a resident of one of the municipalities listed in

Can We File a Joint Return?

Table 1, but you engaged in a business or profession in any

of the municipalities listed in Table 1, whether the business

A husband and wife may file a joint return regardless of the filing

showed a profit or loss.

method on their federal return. Joint returns must be signed by

5.

You are a resident of Harrisburg or Lithopolis and are not

both spouses and include both social security numbers.

exempt from paying the tax. If you are exempt because you

are under the age of 18 or only received pension income or

When And Where Do I File?

military pay, and you are a resident of Harrisburg or

Lithopolis, you should call and request Form EX-1. All non-

This return must be filed on or before April 15

th

. Make checks or

exempt residents of Harrisburg and Lithopolis are required

money orders payable to CITY TREASURER and mail to:

to file a tax return.

Columbus Income Tax Division, Department L 1695,

6.

You received a pre-printed tax form from our office for 2001,

Columbus, Ohio 43260-1695.

but are otherwise not required to file.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4