Clear Form

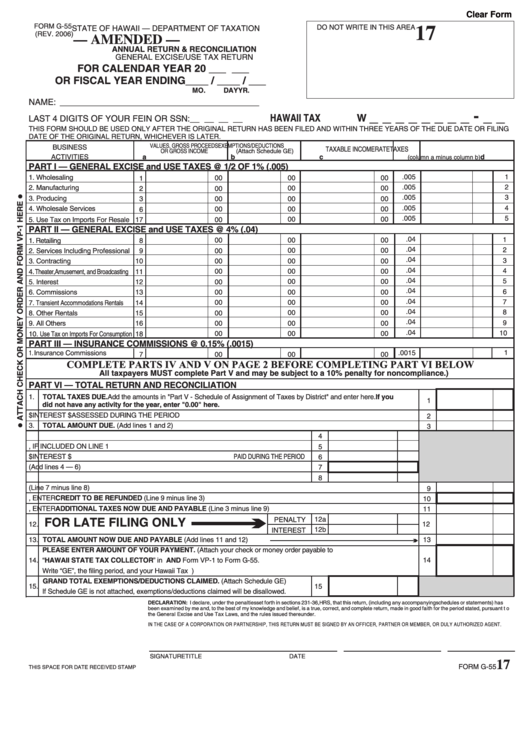

FORM G-55

DO NOT WRITE IN THIS AREA

STATE OF HAWAII — DEPARTMENT OF TAXATION

17

(REV. 2006)

— AMENDED —

ANNUAL RETURN & RECONCILIATION

GENERAL EXCISE/USE TAX RETURN

FOR CALENDAR YEAR 20 ___ ___

OR FISCAL YEAR ENDING ____ / ____ / ___

MO.

DAY

YR.

NAME: __________________________________________

_ _ _ _ _ _ _ _ - _ _

HAWAII TAX I.D. NO. W

LAST 4 DIGITS OF YOUR FEIN OR SSN: __ __ __ __

THIS FORM SHOULD BE USED ONLY AFTER THE ORIGINAL RETURN HAS BEEN FILED AND WITHIN THREE YEARS OF THE DUE DATE OR FILING

DATE OF THE ORIGINAL RETURN, WHICHEVER IS LATER.

VALUES, GROSS PROCEEDS

EXEMPTIONS/DEDUCTIONS

BUSINESS

TAXABLE INCOME

RATE

TAXES

OR GROSS INCOME

(Attach Schedule GE)

ACTIVITIES

a

b

c

d

(column a minus column b)

PART I — GENERAL EXCISE and USE TAXES @ 1/2 OF 1% (.005)

.005

1

1. Wholesaling

00

00

00

1

.005

2

2. Manufacturing

00

00

00

2

.005

3

3. Producing

00

00

00

3

.005

4

4. Wholesale Services

00

00

00

6

.005

5

00

00

00

5. Use Tax on Imports For Resale

17

PART II — GENERAL EXCISE and USE TAXES @ 4% (.04)

.04

1

00

00

00

1. Retailing

8

.04

2

00

00

00

2. Services Including Professional

9

.04

3

00

00

00

3. Contracting

10

.04

4

00

00

00

4. Theater, Amusement, and Broadcasting

11

.04

5

00

00

00

5. Interest

12

.04

6

00

00

00

6. Commissions

13

.04

7

00

00

00

7. Transient Accommodations Rentals

14

.04

8

00

00

00

8. Other Rentals

15

.04

9

00

00

00

9. All Others

16

.04

10

00

00

00

10. Use Tax on Imports For Consumption

18

PART III — INSURANCE COMMISSIONS @ 0.15% (.0015)

1

1. Insurance Commissions

.0015

00

00

00

7

COMPLETE PARTS IV AND V ON PAGE 2 BEFORE COMPLETING PART VI BELOW

All taxpayers MUST complete Part V and may be subject to a 10% penalty for noncompliance.)

PART VI — TOTAL RETURN AND RECONCILIATION

1.

TOTAL TAXES DUE. Add the amounts in "Part V - Schedule of Assignment of Taxes by District" and enter here. If you

1

did not have any activity for the year, enter "0.00" here.

2.

PENALTIES $

INTEREST $

ASSESSED DURING THE PERIOD

2

3.

TOTAL AMOUNT DUE. (Add lines 1 and 2)

3

4.

TOTAL TAXES PAID WITH YOUR PERIODIC RETURNS FOR THE YEAR

4

5.

ADDITIONAL ASSESSMENTS PAID FOR THE PERIOD, IF INCLUDED ON LINE 1

5

6.

PENALTIES $

INTEREST $

PAID DURING THE PERIOD

6

7.

TOTAL PAYMENTS MADE (Add lines 4 — 6)

7

8.

CREDIT CLAIMED ON ORIGINAL ANNUAL RETURN

8

9.

NET PAYMENTS MADE DURING THE YEAR (Line 7 minus line 8)

9

10. IF LINE 9 IS LARGER THAN LINE 3, ENTER CREDIT TO BE REFUNDED (Line 9 minus line 3)

10

11. IF LINE 3 IS LARGER THAN LINE 9, ENTER ADDITIONAL TAXES NOW DUE AND PAYABLE (Line 3 minus line 9)

11

12a

FOR LATE FILING ONLY

PENALTY

12.

12

12b

INTEREST

13. TOTAL AMOUNT NOW DUE AND PAYABLE (Add lines 11 and 12)

13

PLEASE ENTER AMOUNT OF YOUR PAYMENT. (Attach your check or money order payable to

14.

“HAWAII STATE TAX COLLECTOR” in U.S. dollars drawn on any U.S. bank AND Form VP-1 to Form G-55.

14

Write “GE”, the filing period, and your Hawaii Tax I.D. No. on your check or money order.)

GRAND TOTAL EXEMPTIONS/DEDUCTIONS CLAIMED. (Attach Schedule GE)

15.

15

If Schedule GE is not attached, exemptions/deductions claimed will be disallowed.

DECLARATION: I declare, under the penalties set forth in sections 231-36, HRS, that this return, (including any accompanying schedules or statements) has

been examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith for the period stated, pursuant to

the General Excise and Use Tax Laws, and the rules issued thereunder.

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

SIGNATURE

TITLE

DATE

17

FORM G-55

THIS SPACE FOR DATE RECEIVED STAMP

1

1 2

2