Form Dte 106b - Homestead Exemption And 22% Reduction Complaint

ADVERTISEMENT

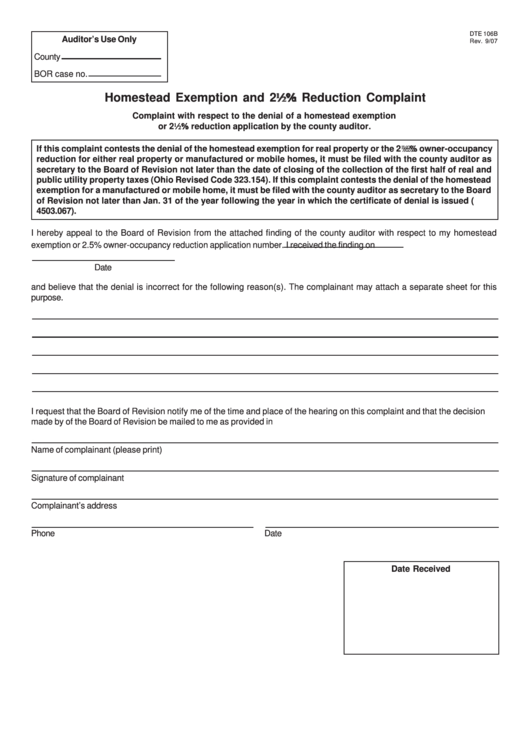

DTE 106B

Auditor’s Use Only

Rev. 9/07

County

BOR case no.

Homestead Exemption and 22 2 2 2 2 % Reduction Complaint

Complaint with respect to the denial of a homestead exemption

or 22 2 2 2 2 % reduction application by the county auditor.

If this complaint contests the denial of the homestead exemption for real property or the 22 2 2 2 2 % owner-occupancy

reduction for either real property or manufactured or mobile homes, it must be filed with the county auditor as

secretary to the Board of Revision not later than the date of closing of the collection of the first half of real and

public utility property taxes (Ohio Revised Code 323.154). If this complaint contests the denial of the homestead

exemption for a manufactured or mobile home, it must be filed with the county auditor as secretary to the Board

of Revision not later than Jan. 31 of the year following the year in which the certificate of denial is issued (R.C.

4503.067).

I hereby appeal to the Board of Revision from the attached finding of the county auditor with respect to my homestead

exemption or 2.5% owner-occupancy reduction application number

. I received the finding on

Date

and believe that the denial is incorrect for the following reason(s). The complainant may attach a separate sheet for this

purpose.

I request that the Board of Revision notify me of the time and place of the hearing on this complaint and that the decision

made by of the Board of Revision be mailed to me as provided in R.C. 5715.20.

Name of complainant (please print)

Signature of complainant

Complainant’s address

Phone

Date

Date Received

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1