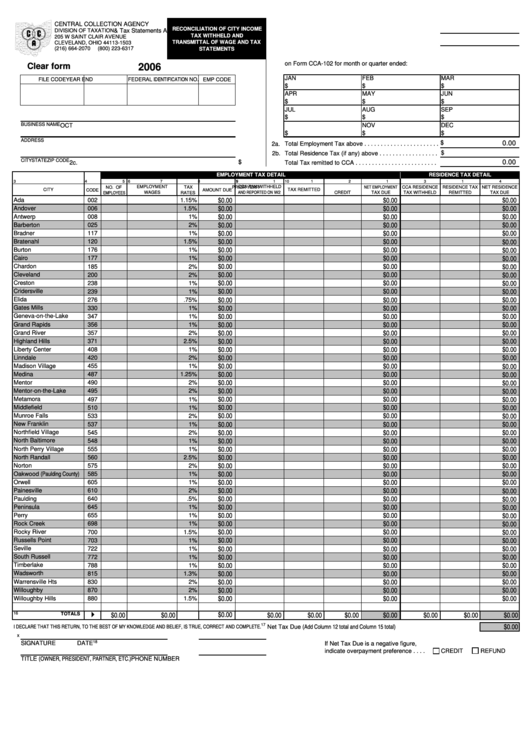

CENTRAL COLLECTION AGENCY

RECONCILIATION OF CITY INCOME

DIVISION OF TAXATION

1.

Number of W-2 Wage & Tax Statements Attached . . . . . .

TAX WITHHELD AND

205 W SAINT CLAIR AVENUE

TRANSMITTAL OF WAGE AND TAX

CLEVELAND, OHIO 44113-1503

1a. Number of 1099 Statements Attached . . . . . . . . . . . . . . . .

(216) 664-2070

(800) 223-6317

STATEMENTS

2.

City Income Tax withheld and remitted

on Form CCA-102 for month or quarter ended:

Clear form

2006

FEDERAL IDENTIFICATION NO.

JAN

FEB

MAR

FILE CODE

YEAR END

EMP CODE

$

$

$

APR

MAY

JUN

$

$

$

JUL

AUG

SEP

$

$

$

BUSINESS NAME

OCT

NOV

DEC

$

$

$

ADDRESS

$

0.00

2a.

Total Employment Tax above . . . . . . . . . . . . . . . . . . . . . . .

$

2b.

Total Residence Tax (if any) above . . . . . . . . . . . . . . . . . .

CITY

STATE

ZIP CODE

0.00

$

2c.

Total Tax remitted to CCA . . . . . . . . . . . . . . . . . . . . . . . . .

EMPLOYMENT TAX DETAIL

RESIDENCE TAX DETAIL

3

4

5

6

7

8

9

10

11

12

13

14

15

EMPLOYMENT

CCA TAX WITHHELD

NET EMPLOYMENT

NO. OF

TAX

PRIOR YEAR

CCA RESIDENCE

RESIDENCE TAX

NET RESIDENCE

CITY

TAX REMITTED

CODE

AMOUNT DUE

EMPLOYEES

AND REPORTED ON W2

WAGES

RATES

CREDIT

TAX DUE

TAX WITHHELD

REMITTED

TAX DUE

$0.00

$0.00

$0.00

Ada

002

1.15%

$0.00

$0.00

$0.00

Andover

006

1.5%

$0.00

$0.00

$0.00

Antwerp

008

1%

$0.00

$0.00

$0.00

Barberton

025

2%

$0.00

$0.00

$0.00

Bradner

117

1%

$0.00

$0.00

$0.00

Bratenahl

120

1.5%

$0.00

$0.00

$0.00

Burton

176

1%

$0.00

$0.00

$0.00

Cairo

177

1%

$0.00

$0.00

$0.00

Chardon

185

2%

$0.00

$0.00

$0.00

Cleveland

200

2%

$0.00

$0.00

$0.00

Creston

238

1%

$0.00

$0.00

$0.00

Cridersville

239

1%

$0.00

$0.00

$0.00

Elida

276

.75%

$0.00

$0.00

$0.00

Gates Mills

330

1%

$0.00

$0.00

$0.00

Geneva-on-the-Lake

347

1%

$0.00

$0.00

$0.00

Grand Rapids

356

1%

$0.00

$0.00

$0.00

Grand River

357

2%

$0.00

$0.00

$0.00

Highland Hills

371

2.5%

$0.00

$0.00

$0.00

Liberty Center

408

1%

$0.00

$0.00

$0.00

Linndale

420

2%

$0.00

$0.00

$0.00

Madison Village

455

1%

$0.00

$0.00

$0.00

Medina

487

1.25%

$0.00

$0.00

$0.00

Mentor

490

2%

$0.00

$0.00

$0.00

Mentor-on-the-Lake

495

2%

$0.00

$0.00

$0.00

Metamora

497

1%

$0.00

$0.00

$0.00

Middlefield

510

1%

$0.00

$0.00

$0.00

Munroe Falls

533

2%

$0.00

$0.00

$0.00

New Franklin

537

1%

$0.00

$0.00

$0.00

Northfield Village

545

2%

$0.00

$0.00

$0.00

North Baltimore

548

1%

$0.00

$0.00

$0.00

North Perry Village

555

1%

$0.00

$0.00

$0.00

North Randall

560

2.5%

$0.00

$0.00

$0.00

Norton

575

2%

$0.00

$0.00

$0.00

Oakwood (Paulding County)

585

1%

$0.00

$0.00

$0.00

Orwell

605

1%

$0.00

$0.00

$0.00

Painesville

610

2%

$0.00

$0.00

$0.00

Paulding

640

.5%

$0.00

$0.00

$0.00

Peninsula

645

1%

$0.00

$0.00

$0.00

Perry

655

1%

$0.00

$0.00

$0.00

Rock Creek

698

1%

$0.00

$0.00

$0.00

Rocky River

700

1.5%

$0.00

$0.00

$0.00

Russells Point

703

1%

$0.00

$0.00

$0.00

Seville

722

1%

$0.00

$0.00

$0.00

South Russell

772

1%

$0.00

$0.00

$0.00

Timberlake

788

1%

$0.00

$0.00

$0.00

Wadsworth

815

1.3%

$0.00

$0.00

$0.00

Warrensville Hts

830

2%

$0.00

$0.00

$0.00

Willoughby

870

2%

$0.00

$0.00

$0.00

Willoughby Hills

880

1.5%

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

16

TOTALS

$0.00

I DECLARE THAT THIS RETURN, TO THE BEST OF MY KNOWLEDGE AND BELIEF, IS TRUE, CORRECT AND COMPLETE.

17

Net Tax Due (Add Column 12 total and Column 15 total)

x

18

SIGNATURE

DATE

If Net Tax Due is a negative figure,

indicate overpayment preference . . . .

CREDIT

REFUND

TITLE (OWNER, PRESIDENT, PARTNER, ETC.)

PHONE NUMBER

1

1