Form Rpd-41290 - High-Wage Jobs Tax Credit Claim Form Instructions

ADVERTISEMENT

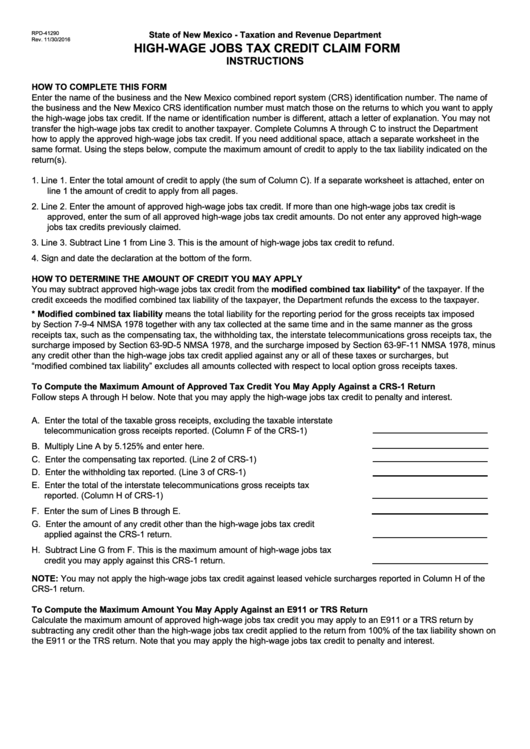

State of New Mexico - Taxation and Revenue Department

RPD-41290

Rev. 11/30/2016

HIGH-WAGE JOBS TAX CREDIT CLAIM FORM

INSTRUCTIONS

HOW TO COMPLETE THIS FORM

Enter the name of the business and the New Mexico combined report system (CRS) identification number. The name of

the business and the New Mexico CRS identification number must match those on the returns to which you want to apply

the high-wage jobs tax credit. If the name or identification number is different, attach a letter of explanation. You may not

transfer the high-wage jobs tax credit to another taxpayer. Complete Columns A through C to instruct the Department

how to apply the approved high-wage jobs tax credit. If you need additional space, attach a separate worksheet in the

same format. Using the steps below, compute the maximum amount of credit to apply to the tax liability indicated on the

return(s).

1. Line 1. Enter the total amount of credit to apply (the sum of Column C). If a separate worksheet is attached, enter on

line 1 the amount of credit to apply from all pages.

2. Line 2. Enter the amount of approved high-wage jobs tax credit. If more than one high-wage jobs tax credit is

approved, enter the sum of all approved high-wage jobs tax credit amounts. Do not enter any approved high-wage

jobs tax credits previously claimed.

3. Line 3. Subtract Line 1 from Line 3. This is the amount of high-wage jobs tax credit to refund.

4. Sign and date the declaration at the bottom of the form.

HOW TO DETERMINE THE AMOUNT OF CREDIT YOU MAY APPLY

You may subtract approved high-wage jobs tax credit from the modified combined tax liability* of the taxpayer. If the

credit exceeds the modified combined tax liability of the taxpayer, the Department refunds the excess to the taxpayer.

* Modified combined tax liability means the total liability for the reporting period for the gross receipts tax imposed

by Section 7-9-4 NMSA 1978 together with any tax collected at the same time and in the same manner as the gross

receipts tax, such as the compensating tax, the withholding tax, the interstate telecommunications gross receipts tax, the

surcharge imposed by Section 63-9D-5 NMSA 1978, and the surcharge imposed by Section 63-9F-11 NMSA 1978, minus

any credit other than the high-wage jobs tax credit applied against any or all of these taxes or surcharges, but

“modified combined tax liability” excludes all amounts collected with respect to local option gross receipts taxes.

To Compute the Maximum Amount of Approved Tax Credit You May Apply Against a CRS-1 Return

Follow steps A through H below. Note that you may apply the high-wage jobs tax credit to penalty and interest.

A. Enter the total of the taxable gross receipts, excluding the taxable interstate

telecommunication gross receipts reported. (Column F of the CRS-1)

B. Multiply Line A by 5.125% and enter here.

C. Enter the compensating tax reported. (Line 2 of CRS-1)

D. Enter the withholding tax reported. (Line 3 of CRS-1)

E. Enter the total of the interstate telecommunications gross receipts tax

reported. (Column H of CRS-1)

F. Enter the sum of Lines B through E.

G. Enter the amount of any credit other than the high-wage jobs tax credit

applied against the CRS-1 return.

H. Subtract Line G from F. This is the maximum amount of high-wage jobs tax

credit you may apply against this CRS-1 return.

NOTE: You may not apply the high-wage jobs tax credit against leased vehicle surcharges reported in Column H of the

CRS-1 return.

To Compute the Maximum Amount You May Apply Against an E911 or TRS Return

Calculate the maximum amount of approved high-wage jobs tax credit you may apply to an E911 or a TRS return by

subtracting any credit other than the high-wage jobs tax credit applied to the return from 100% of the tax liability shown on

the E911 or the TRS return. Note that you may apply the high-wage jobs tax credit to penalty and interest.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1