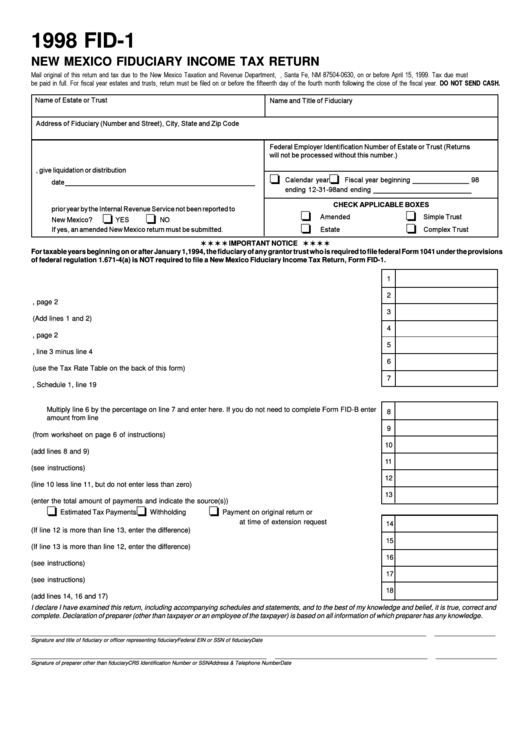

1998 FID-1

NEW MEXICO FIDUCIARY INCOME TAX RETURN

IMPORTANT NOTICE

For taxable years beginning on or after January 1,1994, the fiduciary of any grantor trust who is required to file federal Form 1041 under the provisions

of federal regulation 1.671-4(a) is NOT required to file a New Mexico Fiduciary Income Tax Return, Form FID-1.

1

1.

Federal taxable income of fiduciary .................................................................................................................

2

2.

Additions from line 3, page 2 ............................................................................................................................

3

3.

Subtotal (Add lines 1 and 2) .............................................................................................................................

4

4.

Deductions from line 6, page 2 .........................................................................................................................

5

5.

New Mexico taxable income, line 3 minus line 4 ..............................................................................................

6

6.

Tax on amount on line 5 (use the Tax Rate Table on the back of this form) ....................................................

7

7.

New Mexico percentage from FID-B, Schedule 1, line 19 ...............................................................................

8.

New Mexico Income Tax

Multiply line 6 by the percentage on line 7 and enter here. If you do not need to complete Form FID-B enter

8

amount from line 6 .............................................................................................................................................

9

9.

Tax on lump sum distribution (from worksheet on page 6 of instructions) .....................................................

10

10. Total New Mexico Tax (add lines 8 and 9) .......................................................................................................

11

11. Total non-refundable credits (see instructions) ...............................................................................................

12

12. NET TAX (line 10 less line 11, but do not enter less than zero) ............................................................. ..........

13

13. Payments (enter the total amount of payments and indicate the source(s)) ..................................................

Estimated Tax Payments

Withholding

Payment on original return or

at time of extension request

14

14. Tax Due (If line 12 is more than line 13, enter the difference) .........................................................................

15

15. Refund Due (If line 13 is more than line 12, enter the difference) ...................................................................

16

16. Penalty (see instructions) .................................................................................................................................

17

17. Interest (see instructions) .................................................................................................................................

18

18. Total Amount Due (add lines 14, 16 and 17) .....................................................................................................

I declare I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and

complete. Declaration of preparer (other than taxpayer or an employee of the taxpayer) is based on all information of which preparer has any knowledge.

______________________________________________________

__________________________________________________

________________

Signature and title of fiduciary or officer representing fiduciary

Federal EIN or SSN of fiduciary

Date

__________________________________

____________________________

________________________________________

________________

Signature of preparer other than fiduciary

CRS Identification Number or SSN

Address & Telephone Number

Date

1

1 2

2 3

3 4

4