Form Tc201 - Income And Expense Schedule For Rent Producing Property - 2000

ADVERTISEMENT

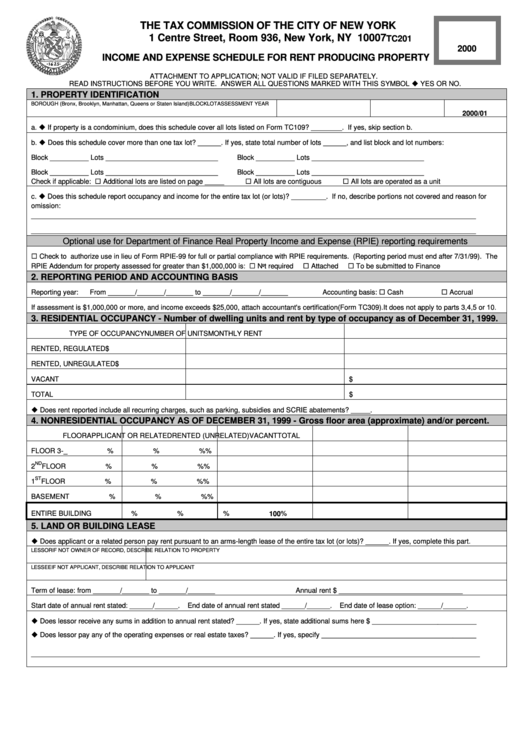

THE TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

TC201

2000

INCOME AND EXPENSE SCHEDULE FOR RENT PRODUCING PROPERTY

ATTACHMENT TO APPLICATION; NOT VALID IF FILED SEPARATELY.

READ INSTRUCTIONS BEFORE YOU WRITE. ANSWER ALL QUESTIONS MARKED WITH THIS SYMBOL ! YES OR NO.

1. PROPERTY IDENTIFICATION

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2000/01

a. ! If property is a condominium, does this schedule cover all lots listed on Form TC109? ________. If yes, skip section b.

b. ! Does this schedule cover more than one tax lot? ______. If yes, state total number of lots ______, and list block and lot numbers:

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Check if applicable: " Additional lots are listed on page _____

" All lots are contiguous

" All lots are operated as a unit

c. ! Does this schedule report occupancy and income for the entire tax lot (or lots)? _________. If no, describe portions not covered and reason for

omission:

___________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________

Optional use for Department of Finance Real Property Income and Expense (RPIE) reporting requirements

" Check to authorize use in lieu of Form RPIE-99 for full or partial compliance with RPIE requirements. (Reporting period must end after 7/31/99). The

RPIE Addendum for property assessed for greater than $1,000,000 is: " Not required

" Attached

" To be submitted to Finance

2. REPORTING PERIOD AND ACCOUNTING BASIS

Accounting basis: " Cash

" Accrual

Reporting year:

From _______/_______/_______ to _______/_______/_______

If assessment is $1,000,000 or more, and income exceeds $25,000, attach accountant's certification(Form TC309).It does not apply to parts 3,4,5 or 10.

3. RESIDENTIAL OCCUPANCY - Number of dwelling units and rent by type of occupancy as of December 31, 1999.

TYPE OF OCCUPANCY

NUMBER OF UNITS

MONTHLY RENT

RENTED, REGULATED

$

RENTED, UNREGULATED

$

VACANT

$

TOTAL

$

! Does rent reported include all recurring charges, such as parking, subsidies and SCRIE abatements? _____.

4. NONRESIDENTIAL OCCUPANCY AS OF DECEMBER 31, 1999 - Gross floor area (approximate) and/or percent.

FLOOR

APPLICANT OR RELATED

RENTED (UNRELATED)

VACANT

TOTAL

FLOOR 3-_

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

ND

2

FLOOR

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

ST

1

FLOOR

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

BASEMENT

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

ENTIRE BUILDING

Sq.ft.

%

Sq.ft.

%

Sq.ft.

%

Sq.ft.

100 %

5. LAND OR BUILDING LEASE

! Does applicant or a related person pay rent pursuant to an arms-length lease of the entire tax lot (or lots)? ______. If yes, complete this part.

LESSOR

IF NOT OWNER OF RECORD, DESCRIBE RELATION TO PROPERTY

LESSEE

IF NOT APPLICANT, DESCRIBE RELATION TO APPLICANT

Term of lease: from _______/_______ to _______/_______

Annual rent $ ________________________________

Start date of annual rent stated: ______/______.

End date of annual rent stated ______/______.

End date of lease option: ______/______.

! Does lessor receive any sums in addition to annual rent stated? ______. If yes, state additional sums here $ ___________________________

! Does lessor pay any of the operating expenses or real estate taxes? ______. If yes, specify ________________________________________

____________________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2