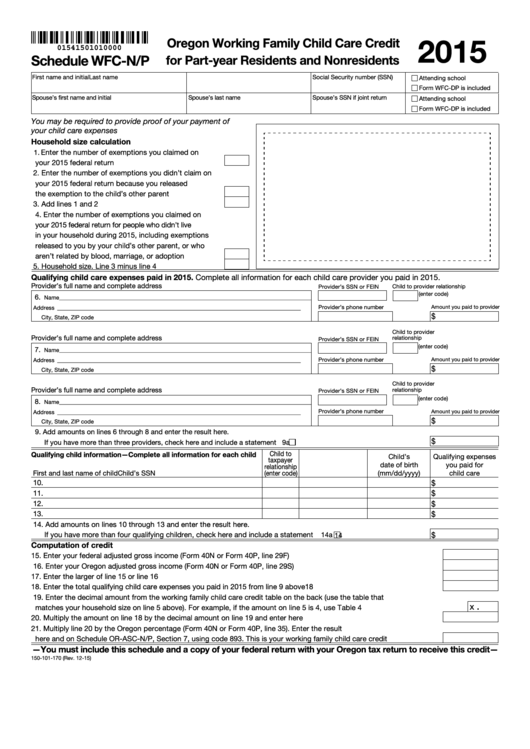

Clear Form

2015

Oregon Working Family Child Care Credit

01541501010000

Schedule WFC-N/P

for Part-year Residents and Nonresidents

First name and initial

Last name

Social Security number (SSN)

Attending school

Form WFC-DP is included

Spouse’s first name and initial

Spouse’s last name

Spouse’s SSN if joint return

Attending school

Form WFC-DP is included

You may be required to provide proof of your payment of

your child care expenses

Household size calculation

Enter the number of exemptions you claimed on

1.

your 2015 federal return ............................................. 1

2. Enter the number of exemptions you didn’t claim on

your 2015 federal return because you released

the exemption to the child’s other parent .................. 2

3. Add lines 1 and 2 ....................................................... 3

4. Enter the number of exemptions you claimed on

your 2015 federal return for people who didn’t live

in your household during 2015, including exemptions

released to you by your child’s other parent, or who

aren’t related by blood, marriage, or adoption ........... 4

5. Household size. Line 3 minus line 4 ........................... 5

Qualifying child care expenses paid in 2015. Complete all information for each child care provider you paid in 2015.

Provider’s full name and complete address

Provider’s SSN or FEIN

Child to provider relationship

(enter code)

6.

Name __________________________________________________________________________________________

Provider’s phone number

Amount you paid to provider

Address _______________________________________________________________________________________

$

.............. 6

City, State, ZIP code

Child to provider

Provider’s full name and complete address

relationship

Provider’s SSN or FEIN

(enter code)

7.

Name __________________________________________________________________________________________

Provider’s phone number

Amount you paid to provider

Address _______________________________________________________________________________________

$

.............. 7

City, State, ZIP code

Child to provider

Provider’s full name and complete address

relationship

Provider’s SSN or FEIN

(enter code)

8.

Name __________________________________________________________________________________________

Provider’s phone number

Amount you paid to provider

Address _______________________________________________________________________________________

$

...............8

City, State, ZIP code

9. Add amounts on lines 6 through 8 and enter the result here.

$

If you have more than three providers, check here and include a statement 9a

..................................................................9

Child to

Qualifying child information—Complete all information for each child

Child’s

Qualifying expenses

taxpayer

date of birth

you paid for

relationship

First and last name of child

(enter code)

Child’s SSN

(mm/dd/yyyy)

child care

$

10.

11.

$

12.

$

$

13.

14. Add amounts on lines 10 through 13 and enter the result here.

If you have more than four qualifying children, check here and include a statement

$

14a

........................................ 14

Computation of credit

15. Enter your federal adjusted gross income (Form 40N or Form 40P, line 29F) ..................................................................... 15

16. Enter your Oregon adjusted gross income (Form 40N or Form 40P, line 29S) ................................................................... 16

17. Enter the larger of line 15 or line 16 .................................................................................................................................... 17

18. Enter the total qualifying child care expenses you paid in 2015 from line 9 above ............................................................ 18

19. Enter the decimal amount from the working family child care credit table on the back (use the table that

.

x

matches your household size on line 5 above). For example, if the amount on line 5 is 4, use Table 4 ......................................... 19

20. Multiply the amount on line 18 by the decimal amount on line 19 and enter here ............................................................. 20

21. Multiply line 20 by the Oregon percentage (Form 40N or Form 40P, line 35). Enter the result

here and on Schedule OR-ASC-N/P, Section 7, using code 893. This is your working family child care credit ................ 21

—You must include this schedule and a copy of your federal return with your Oregon tax return to receive this credit—

150-101-170 (Rev. 12-15)

1

1