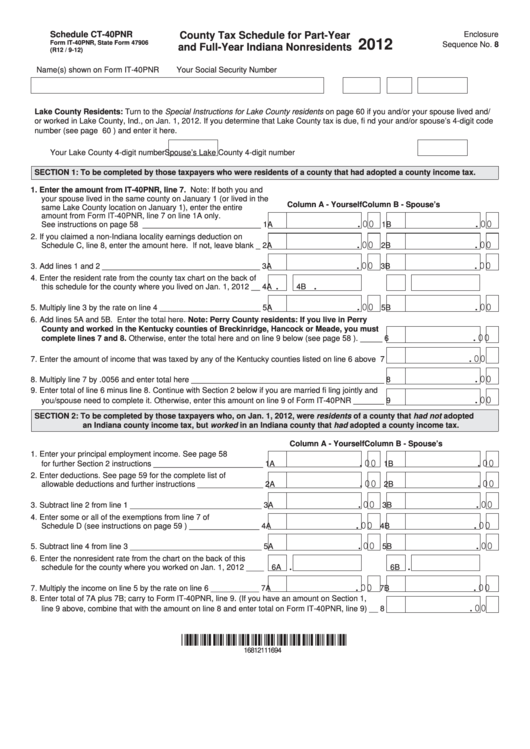

Schedule CT-40PNR

County Tax Schedule for Part-Year

Enclosure

2012

Form IT-40PNR, State Form 47906

Sequence No. 8

and Full-Year Indiana Nonresidents

(R12 / 9-12)

Name(s) shown on Form IT-40PNR

Your Social Security Number

Lake County Residents: Turn to the Special Instructions for Lake County residents on page 60 if you and/or your spouse lived and/

or worked in Lake County, Ind., on Jan. 1, 2012. If you determine that Lake County tax is due, fi nd your and/or spouse’s 4-digit code

number (see page 60 ) and enter it here.

Your Lake County 4-digit number

Spouse’s Lake County 4-digit number

SECTION 1: To be completed by those taxpayers who were residents of a county that had adopted a county income tax.

1. Enter the amount from IT-40PNR, line 7. Note: If both you and

your spouse lived in the same county on January 1 (or lived in the

Column A - Yourself

Column B - Spouse’s

same Lake County location on January 1), enter the entire

amount from Form IT-40PNR, line 7 on line 1A only.

.00

.00

See instructions on page 58 ___________________________

1A

1B

2. If you claimed a non-Indiana locality earnings deduction on

.00

.00

Schedule C, line 8, enter the amount here. If not, leave blank _

2A

2B

.00

.00

3. Add lines 1 and 2 ____________________________________

3A

3B

4. Enter the resident rate from the county tax chart on the back of

.

.

this schedule for the county where you lived on Jan. 1, 2012 __

4A

4B

.00

.00

5. Multiply line 3 by the rate on line 4 _______________________

5A

5B

6. Add lines 5A and 5B. Enter the total here. Note: Perry County residents: If you live in Perry

County and worked in the Kentucky counties of Breckinridge, Hancock or Meade, you must

.00

complete lines 7 and 8. Otherwise, enter the total here and on line 9 below (see page 58 ). _____

6

.00

7. Enter the amount of income that was taxed by any of the Kentucky counties listed on line 6 above

7

.00

8. Multiply line 7 by .0056 and enter total here ____________________________________________

8

9. Enter total of line 6 minus line 8. Continue with Section 2 below if you are married fi ling jointly and

.00

you/spouse need to complete it. Otherwise, enter this amount on line 9 of Form IT-40PNR _______

9

SECTION 2: To be completed by those taxpayers who, on Jan. 1, 2012, were residents of a county that had not adopted

an Indiana county income tax, but worked in an Indiana county that had adopted a county income tax.

Column A - Yourself

Column B - Spouse’s

1. Enter your principal employment income. See page 58

.00

.00

for further Section 2 instructions _________________________

1A

1B

2. Enter deductions. See page 59 for the complete list of

.00

.00

allowable deductions and further instructions _______________

2A

2B

.00

.00

3. Subtract line 2 from line 1 ______________________________

3A

3B

4. Enter some or all of the exemptions from line 7 of

.00

.00

Schedule D (see instructions on page 59 ) ________________

4A

4B

.00

.00

5. Subtract line 4 from line 3 ______________________________

5A

5B

6. Enter the nonresident rate from the chart on the back of this

.

.

schedule for the county where you worked on Jan. 1, 2012 ____

6A

6B

.00

.00

7. Multiply the income on line 5 by the rate on line 6 ___________

7A

7B

8. Enter total of 7A plus 7B; carry to Form IT-40PNR, line 9. (If you have an amount on Section 1,

.00

line 9 above, combine that with the amount on line 8 and enter total on Form IT-40PNR, line 9) __

8

16812111694

1

1