Clear This Page

17531501010000

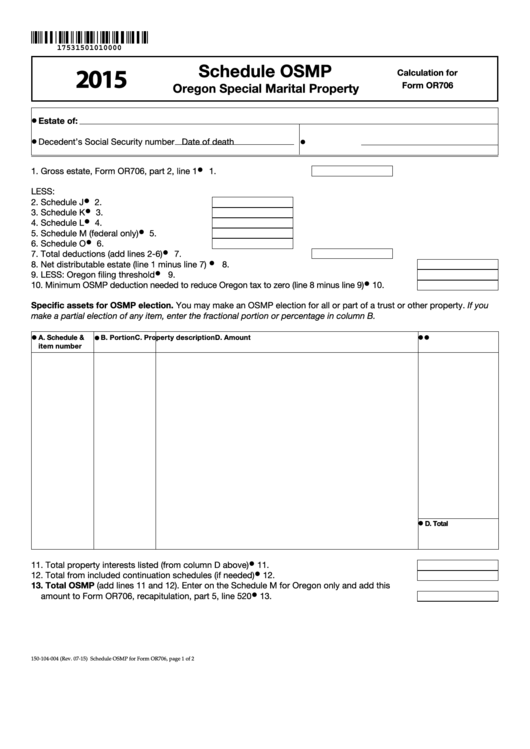

Schedule OSMP

2015

Calculation for

Form OR706

Oregon Special Marital Property

•

Estate of:

•

•

Decedent’s Social Security number

Date of death

•

1. Gross estate, Form OR706, part 2, line 1 .....................................

1.

LESS:

•

2. Schedule J ............................................

2.

•

3. Schedule K ...........................................

3.

•

4. Schedule L ...........................................

4.

•

5. Schedule M (federal only) .....................

5.

•

6. Schedule O ...........................................

6.

•

7. Total deductions (add lines 2-6) ...................................................

7.

•

8. Net distributable estate (line 1 minus line 7).............................................................................

8.

•

9. LESS: Oregon filing threshold ..................................................................................................

9.

•

10. Minimum OSMP deduction needed to reduce Oregon tax to zero (line 8 minus line 9) ...........

10.

Specific assets for OSMP election. You may make an OSMP election for all or part of a trust or other property. If you

make a partial election of any item, enter the fractional portion or percentage in column B.

•

•

•

•

A. Schedule &

B. Portion

C. Property description

D. Amount

item number

•

D. Total

•

11. Total property interests listed (from column D above) ............................................................

11.

•

12. Total from included continuation schedules (if needed) .........................................................

12.

13. Total OSMP (add lines 11 and 12). Enter on the Schedule M for Oregon only and add this

•

amount to Form OR706, recapitulation, part 5, line 520 ...........................................................

13.

150-104-004 (Rev. 07-15)

Schedule OSMP for Form OR706, page 1 of 2

1

1 2

2