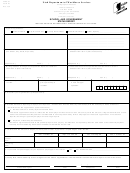

Form1g - School And Government Status Report 2010 Page 2

ADVERTISEMENT

DWS-UI

Form1G

Rev.

05/10

INSTRUCTIONS

The Utah Employment Security Act provides that the Department of Workforce Services must determine the status

under the Act of each business and each person independently established in a trade, occupation, or profession in

Utah. This report is to be completed immediately and returned to P.O. Box 45288, Salt Lake City, Utah 84145-0288.

All items must be completed. If an item does not apply to your organization, enter N/A (not applicable).

Except as indicated below, all items are self-explanatory.

Item 1.

Charter School -- Please submit a copy of your charter or 501(c)(3) exemption from I.R.S. with this form.

Item 5.

Number of permanent work sites in Utah.

Item 6.

Name and address of agent who is able to provide information concerning wages paid and reasons for

employees' separation from your employment.

Item 7.

Give street address, city, state and zip code. If you have more than one work location, give the address

where the largest number of your employees work.

Item 10. Describe in detail the specific product or service you provide. For example, do you manufacture, install, sell

wholesale or retail, or offer services? Describe the product, what is sold, or the type of services offered.

(Some examples are wholesale men's wear, construction single residential housing, or computer integrated

systems design).

Item 11. Date the organization in item 2 began operation.

Item 12a. Selection of this option will require that your organization reimburse the Unemployment Insurance Fund for

the actual amount of unemployment paid to your former employees. You will receive a detailed billing each

month showing the benefits paid to each individual for the prior month.

The initial election of "Reimbursement of Unemployment Benefits Paid" will remain in effect for a minimum

of one calendar year. If a change in election of method is desired, submit a written notice not later than

thirty (30) days prior to the beginning of the next calendar year. Subsequent elections remain in effect for a

minimum of two calendar years. Section 35A-4-309 of the Utah Employment Security Act.

Item 12b. Selection of this option will require that your organization submit a quarterly contribution (tax) report and pay

a quarterly contribution to the Unemployment Insurance Fund. The contribution (tax) is calculated by

multiplying the taxable wages paid during the quarter by the contribution rate. The rate is initially

determined by using an existing rate which prevails for employers in your general business classification.

After a fiscal year of experience (July 1 - June 30), your rate for the next calendar year will be determined by

the experience or history of benefits paid to your former employees and taxable wages from your

organization for the same benefit period.

If your organization is determined to be subject to the Utah Employment Security Act, your organization will

be required to submit a quarterly list of employees showing each individual's social security number, name

and quarterly gross earnings. This is required regardless of the election for reimbursable or contributing

coverage.

Item 13. The definition of wages is currently defined by Section 3306(b), of the Internal Revenue Code of 1986, with

modifications, subtractions, and adjustments provided in Section 35A-4-208 Subsections (2), (3), and (4), of

the Utah Employment Security Act with regard to how the wage base is determined. Wages means all

remuneration for employment including commissions, bonuses, salaries or draws to corporate officers, tips

and the cash value of all remuneration in any medium other than cash.

Earnings of elected officials, members of the judiciary, persons in advisory or policy-making positions and

persons serving on a temporary basis in case of fire, storm, snow, earthquake, flood or similar

emergencies, are not to be included on this report or any required quarterly reports.

If additional information is needed, please call 801-526-9235 option 2 or

1-800-222-2857 option 2 (instate toll free number).

Fax: 801-526-9236.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2