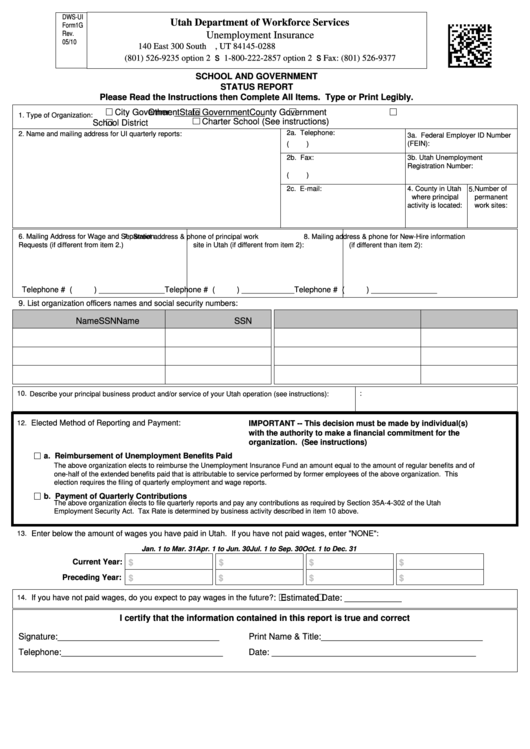

Form1g - School And Government Status Report 2010

ADVERTISEMENT

DWS-UI

Utah Department of Workforce Services

Form1G

Unemployment Insurance

Rev.

05/10

140 East 300 South P.O. Box 45288 Salt Lake City, UT 84145-0288

(801) 526-9235 option 2

1-800-222-2857 option 2

Fax: (801) 526-9377

s

s

SCHOOL AND GOVERNMENT

STATUS REPORT

Please Read the Instructions then Complete All Items. Type or Print Legibly.

City Government

County Government

State Government

Other: ___________________

1. Type of Organization:

Charter School (See instructions)

School District

2a. Telephone:

2. Name and mailing address for UI quarterly reports:

3a. Federal Employer ID Number

(

)

(FEIN):

2b. Fax:

3b. Utah Unemployment

Registration Number:

(

)

2c. E-mail:

4. County in Utah

Number of

5.

where principal

permanent

activity is located:

work sites:

6. Mailing Address for Wage and Separation

7. Street address & phone of principal work

8. Mailing address & phone for New-Hire information

Requests (if different from item 2.)

site in Utah (if different from item 2):

(if different than item 2):

Telephone # (

) _______________

Telephone # (

) ____________

Telephone # (

) _______________

9. List organization officers names and social security numbers:

Name

SSN

Name

SSN

10.

11.Date Organization began operation:

Describe your principal business product and/or service of your Utah operation (see instructions):

Elected Method of Reporting and Payment:

12.

IMPORTANT -- This decision must be made by individual(s)

with the authority to make a financial commitment for the

organization. (See instructions)

a. Reimbursement of Unemployment Benefits Paid

The above organization elects to reimburse the Unemployment Insurance Fund an amount equal to the amount of regular benefits and of

one-half of the extended benefits paid that is attributable to service performed by former employees of the above organization. This

election requires the filing of quarterly employment and wage reports.

b. Payment of Quarterly Contributions

The above organization elects to file quarterly reports and pay any contributions as required by Section 35A-4-302 of the Utah

Employment Security Act. Tax Rate is determined by business activity described in item 10 above.

Enter below the amount of wages you have paid in Utah. If you have not paid wages, enter "NONE":

13.

Jan. 1 to Mar. 31

Apr. 1 to Jun. 30

Jul. 1 to Sep. 30

Oct. 1 to Dec. 31

Current Year:

$

$

$

$

Preceding Year:

$

$

$

$

NO.

YES: Estimated Date: ____________

14.

If you have not paid wages, do you expect to pay wages in the future?

I certify that the information contained in this report is true and correct

Signature:__________________________________

Print Name & Title:__________________________________

Telephone:__________________________________

Date: ___________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2