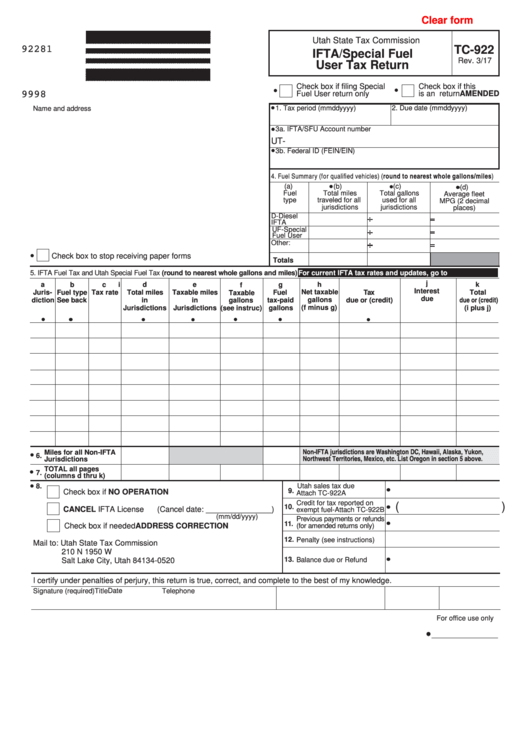

Clear form

Utah State Tax Commission

92281

TC-922

IFTA/Special Fuel

Rev. 3/17

User Tax Return

Check box if filing Special

Check box if this

9998

is an

AMENDED

return

Fuel User return only

2. Due date (mmddyyyy)

1. Tax period (mmddyyyy)

Name and address

3a. IFTA/SFU Account number

UT-

3b. Federal ID (FEIN/EIN)

4. Fuel Summary (for qualified vehicles) (round to nearest whole gallons/miles)

(a)

(b)

(c)

(d)

Fuel

Total miles

Total gallons

Average fleet

type

traveled for all

used for all

MPG (2 decimal

jurisdictions

jurisdictions

places)

D-Diesel

IFTA

UF-Special

Fuel User

Other:

Check box to stop receiving paper forms

Totals

5. IFTA Fuel Tax and Utah Special Fuel Tax (round to nearest whole gallons and miles)

For current IFTA tax rates and updates, go to

j

a

b

c

d

e

g

h

i

k

f

Interest

Juris-

Total miles

Taxable miles

Net taxable

Total

Fuel type

Tax rate

Taxable

Fuel

Tax

due

due or (credit)

diction

in

in

gallons

See back

gallons

tax-paid

due or (credit)

Jurisdictions

(f minus g)

Jurisdictions

(see instruc)

gallons

(i plus j)

Non-IFTA jurisdictions are Washington DC, Hawaii, Alaska, Yukon,

Miles for all Non-IFTA

6.

Northwest Territories, Mexico, etc. List Oregon in section 5 above.

Jurisdictions

TOTAL all pages

7.

(columns d thru k)

Utah sales tax due

8.

9.

Check box if NO OPERATION

Attach TC-922A

Credit for tax reported on

(

)

10.

CANCEL IFTA License

(Cancel date: _______________)

exempt fuel-Attach TC-922B

(mm/dd/yyyy)

Previous payments or refunds

11.

Check box if

ADDRESS CORRECTION

needed

(for amended returns only)

12.

Penalty (see instructions)

Mail to: Utah State Tax Commission

210 N 1950 W

13.

Balance due or Refund

Salt Lake City, Utah 84134-0520

I certify under penalties of perjury, this return is true, correct, and complete to the best of my knowledge.

Signature (required)

Title

Date

Telephone

For office use only

_________________

1

1 2

2