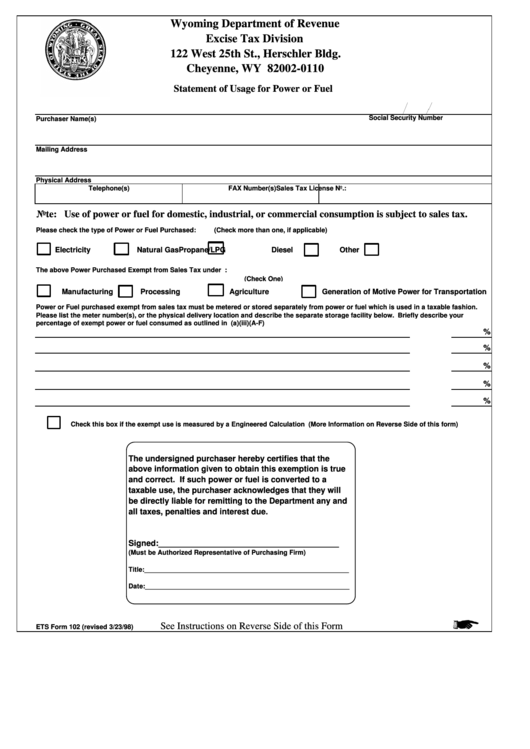

Wyoming Department of Revenue

Excise Tax Division

122 West 25th St., Herschler Bldg.

Cheyenne, WY 82002-0110

Statement of Usage for Power or Fuel

Social Security Number

Purchaser Name(s)

Mailing Address

Physical Address

Telephone(s)

FAX Number(s)

Sales Tax License No.:

Note: Use of power or fuel for domestic, industrial, or commercial consumption is subject to sales tax.

Please check the type of Power or Fuel Purchased:

(Check more than one, if applicable)

Electricity

Natural Gas

Propane/LPG

Diesel

Other

The above Power Purchased Exempt from Sales Tax under W.S. 39-15-105 for reason that the same is consumed directly in:

(Check One)

Manufacturing

Processing

Agriculture

Generation of Motive Power for Transportation

Power or Fuel purchased exempt from sales tax must be metered or stored separately from power or fuel which is used in a taxable fashion.

Please list the meter number(s), or the physical delivery location and describe the separate storage facility below. Briefly describe your

percentage of exempt power or fuel consumed as outlined in W.S. 39-15-105(a)(iii)(A-F)

%

%

%

%

%

Check this box if the exempt use is measured by a Engineered Calculation (More Information on Reverse Side of this form)

The undersigned purchaser hereby certifies that the

above information given to obtain this exemption is true

and correct. If such power or fuel is converted to a

taxable use, the purchaser acknowledges that they will

be directly liable for remitting to the Department any and

all taxes, penalties and interest due.

Signed:________________________________________

(Must be Authorized Representative of Purchasing Firm)

Title:________________________________________________________

Date:________________________________________________________

See Instructions on Reverse Side of this Form

ETS Form 102 (revised 3/23/98)

1

1