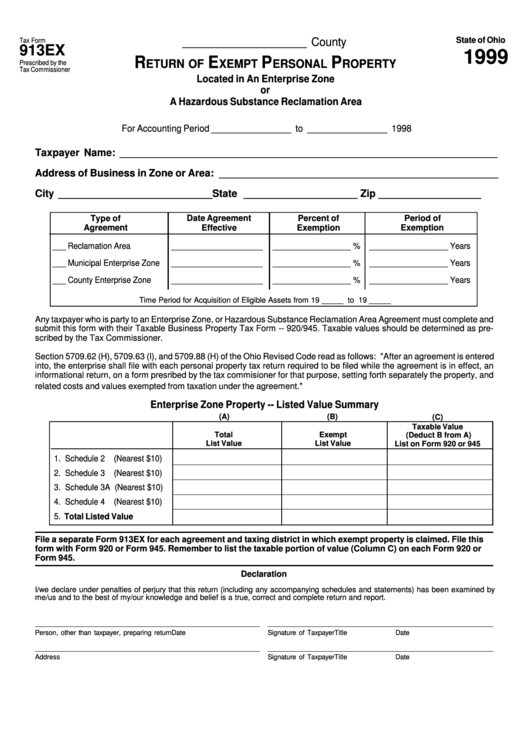

State of Ohio

Tax Form

____________________ County

913EX

1999

R

E

P

P

ETURN OF

XEMPT

ERSONAL

ROPERTY

Prescribed by the

Tax Commissioner

Located in An Enterprise Zone

or

A Hazardous Substance Reclamation Area

For Accounting Period ________________ to ________________ 1998

Taxpayer Name: __________________________________________________________________

Address of Business in Zone or Area: _________________________________________________

City ___________________________ State ____________________

Zip __________________

Type of

Date Agreement

Percent of

Period of

Agreement

Effective

Exemption

Exemption

___ Reclamation Area

_____________________

__________________ %

__________________ Years

___ Municipal Enterprise Zone

_____________________

__________________ %

__________________ Years

___ County Enterprise Zone

_____________________

__________________ %

__________________ Years

Time Period for Acquisition of Eligible Assets from 19 _____ to 19 _____

Any taxpayer who is party to an Enterprise Zone, or Hazardous Substance Reclamation Area Agreement must complete and

submit this form with their Taxable Business Property Tax Form -- 920/945. Taxable values should be determined as pre-

scribed by the Tax Commissioner.

Section 5709.62 (H), 5709.63 (I), and 5709.88 (H) of the Ohio Revised Code read as follows: "After an agreement is entered

into, the enterprise shall file with each personal property tax return required to be filed while the agreement is in effect, an

informational return, on a form presribed by the tax commisioner for that purpose, setting forth separately the property, and

related costs and values exempted from taxation under the agreement."

Enterprise Zone Property -- Listed Value Summary

(A)

(B)

(C)

Taxable Value

Total

Exempt

(Deduct B from A)

List Value

List Value

List on Form 920 or 945

1. Schedule 2 (Nearest $10)

2. Schedule 3 (Nearest $10)

3. Schedule 3A (Nearest $10)

4. Schedule 4 (Nearest $10)

5. Total Listed Value

File a separate Form 913EX for each agreement and taxing district in which exempt property is claimed. File this

form with Form 920 or Form 945. Remember to list the taxable portion of value (Column C) on each Form 920 or

Form 945.

Declaration

I/we declare under penalties of perjury that this return (including any accompanying schedules and statements) has been examined by

me/us and to the best of my/our knowledge and belief is a true, correct and complete return and report.

Person, other than taxpayer, preparing return

Date

Signature of Taxpayer

Title

Date

Address

Signature of Taxpayer

Title

Date

1

1 2

2 3

3