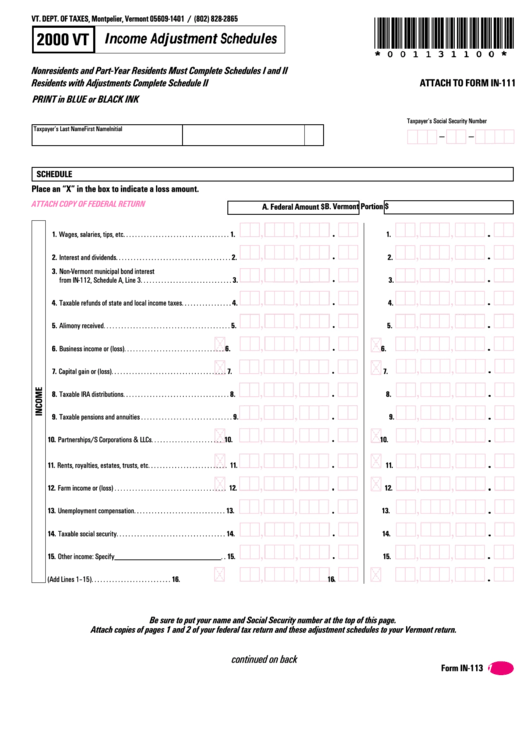

Form In-113 - Income Adjustment Schedules - 2000

ADVERTISEMENT

VT. DEPT. OF TAXES, Montpelier, Vermont 05609-1401 / (802) 828-2865

2000 VT

Income Adjustment Schedules

Nonresidents and Part-Year Residents Must Complete Schedules I and II

Residents with Adjustments Complete Schedule II

ATTACH TO FORM IN-111

PRINT in BLUE or BLACK INK

Taxpayer’s Social Security Number

Taxpayer’s Last Name

First Name

Initial

SCHEDULE I. Enter figures as they appear on your federal return in Column A and list the Vermont portion in Column B. See instructions.

Place an “X” in the box to indicate a loss amount.

ATTACH COPY OF FEDERAL RETURN

B. Vermont Portion $

A. Federal Amount $

1. Wages, salaries, tips, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

1.

2. Interest and dividends. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

2.

3. Non-Vermont municipal bond interest

from IN-112, Schedule A, Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

3.

4. Taxable refunds of state and local income taxes . . . . . . . . . . . . . . . . . 4.

4.

5. Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

5.

6. Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

6.

7. Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

7.

8. Taxable IRA distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

8.

9. Taxable pensions and annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

9.

10. Partnerships/S Corporations & LLCs . . . . . . . . . . . . . . . . . . . . . . . . 10.

10.

11. Rents, royalties, estates, trusts, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

11.

12. Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

12.

13. Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

13.

14. Taxable social security . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

14.

15. Other income: Specify___________________________ . . 15.

15.

16. TOTAL INCOME (Add Lines 1–15). . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

16.

Be sure to put your name and Social Security number at the top of this page.

Attach copies of pages 1 and 2 of your federal tax return and these adjustment schedules to your Vermont return.

continued on back

Form IN-113

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2