Performance And Accountability Report - Fiscal Year 2013 - Federal Aviation Administration - U.s. Department Of Transportation Page 81

ADVERTISEMENT

1

1  2

2  3

3  4

4  5

5  6

6  7

7  8

8  9

9  10

10  11

11  12

12  13

13  14

14  15

15  16

16  17

17  18

18  19

19  20

20  21

21  22

22  23

23  24

24  25

25  26

26  27

27  28

28  29

29  30

30  31

31  32

32  33

33  34

34  35

35  36

36  37

37  38

38  39

39  40

40  41

41  42

42  43

43  44

44  45

45  46

46  47

47  48

48  49

49  50

50  51

51  52

52  53

53  54

54  55

55  56

56  57

57  58

58  59

59  60

60  61

61  62

62  63

63  64

64  65

65  66

66  67

67  68

68  69

69  70

70  71

71  72

72  73

73  74

74  75

75  76

76  77

77  78

78  79

79  80

80  81

81  82

82  83

83  84

84  85

85  86

86  87

87  88

88  89

89  90

90  91

91  92

92  93

93  94

94  95

95  96

96  97

97  98

98  99

99  100

100  101

101  102

102  103

103  104

104  105

105  106

106  107

107  108

108  109

109  110

110  111

111  112

112  113

113  114

114  115

115  116

116  117

117  118

118  119

119  120

120  121

121  122

122  123

123  124

124  125

125  126

126  127

127  128

128  129

129  130

130  131

131  132

132  133

133  134

134  135

135  136

136  137

137  138

138  139

139  140

140  141

141  142

142  143

143  144

144  145

145  146

146  147

147  148

148  149

149  150

150 Federal Aviation Administration

Independent Auditors’ Report

Internal Control Over Financial Reporting

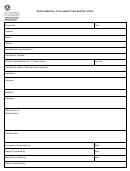

EXHIBIT I

SIGNIFICANT DEFICIENCIES

______________________________________________________________________________________

In addition, our testing of the grant accrual as of September 30, 2013 revealed the following errors in key

inputs and assumptions used in the calculation of the estimate:

•

The grant disbursement data used in the calculation of the grant accrual was incomplete, as two

months of data was erroneously excluded from the accrual calculation.

•

The grant accrual calculation erroneously did not include an accrual for costs associated with one

grant that was awarded in August 2013.

The errors above were not detected by management in the review of these accruals at year-end.

Cause/Effect

The errors above related to overflight fee revenue first occurred after personnel at the Enterprise Service

Center implemented a Dataloader tool in June 2013 to post overflight fee revenue transactions to the

general ledger. The Dataloader did not always properly capture overflight fee revenue and, as a result,

posted incorrect transactions to the general ledger. A manual review of the transactions posted by the

Dataloader tool was not consistently performed to ensure the recorded amounts were consistent with the

related source documentation and general ledger inputs.

The conditions above related to the grant accrual occurred because personnel within the Office of Financial

Reporting and Accountability did not perform procedures to validate the completeness and accuracy of key

inputs provided by other organizations within FAA for use in calculating year-end accruals. As a result,

Grants Payable and Expenses were overstated by $80 million as a result of the error related to incomplete

disbursements, and understated by $65 million as a result of the exclusion of one grant from the accrual.

The net impact was an overstatement to Grants Payable and Expenses of $15 million. The draft FY 2013

Performance and Accountability Report provided to us contained errors caused by the conditions described

above.

Failure to perform sufficient review controls over key general ledger inputs and outputs increases the risk

and the likelihood that material differences will not be detected or corrected timely.

Recommendations

We recommend that FAA design and implement policies and procedures 1) to ensure transactions are

recorded properly in the general ledger and 2) to validate the completeness and accuracy of key inputs and

assumptions that are the basis for transactions recorded to the general ledger.

79

|

|

Federal Aviation Administration

Fiscal Year 2013

Performance and Accountability Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business