Performance And Accountability Report - Fiscal Year 2013 - Federal Aviation Administration - U.s. Department Of Transportation Page 80

ADVERTISEMENT

1

1  2

2  3

3  4

4  5

5  6

6  7

7  8

8  9

9  10

10  11

11  12

12  13

13  14

14  15

15  16

16  17

17  18

18  19

19  20

20  21

21  22

22  23

23  24

24  25

25  26

26  27

27  28

28  29

29  30

30  31

31  32

32  33

33  34

34  35

35  36

36  37

37  38

38  39

39  40

40  41

41  42

42  43

43  44

44  45

45  46

46  47

47  48

48  49

49  50

50  51

51  52

52  53

53  54

54  55

55  56

56  57

57  58

58  59

59  60

60  61

61  62

62  63

63  64

64  65

65  66

66  67

67  68

68  69

69  70

70  71

71  72

72  73

73  74

74  75

75  76

76  77

77  78

78  79

79  80

80  81

81  82

82  83

83  84

84  85

85  86

86  87

87  88

88  89

89  90

90  91

91  92

92  93

93  94

94  95

95  96

96  97

97  98

98  99

99  100

100  101

101  102

102  103

103  104

104  105

105  106

106  107

107  108

108  109

109  110

110  111

111  112

112  113

113  114

114  115

115  116

116  117

117  118

118  119

119  120

120  121

121  122

122  123

123  124

124  125

125  126

126  127

127  128

128  129

129  130

130  131

131  132

132  133

133  134

134  135

135  136

136  137

137  138

138  139

139  140

140  141

141  142

142  143

143  144

144  145

145  146

146  147

147  148

148  149

149  150

150 Federal Aviation Administration

Independent Auditors’ Report

Internal Control Over Financial Reporting

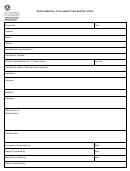

EXHIBIT I

SIGNIFICANT DEFICIENCIES

______________________________________________________________________________________

Improvements Needed in Management Review Controls

Criteria

The Government Accountability Office’s (GAO) Standard for Internal Control in the Federal Government

(the Standards) states that, “… control activities help to ensure that all transactions are completely and

accurately recorded.”

The Standards further define internal control as “an integral component of an organization’s management

that provides reasonable assurance that the following objectives are being achieved: effectiveness and

efficiency of operations, reliability of financial reporting, and compliance with applicable laws and

regulations.” Furthermore, the Standards list examples of control activities that include (1) top-level

reviews of actual performance, (2) reviews by management at the functional or activity level …

(4) controls over information processing … (6) Establishment and review of performance measures and

indicators, (7) segregation of duties, (8) proper execution of transactions and events, (9) accurate and

timely recording of transactions and events, (10) access restrictions to and accountability for resources and

records, and (11) appropriate documentation of transactions and internal control.

The Standards also state, “Internal control should generally be designed to assure that ongoing monitoring

occurs in the course of normal operations. It is performed continually and is ingrained in the agency’s

operations. It includes regular management and supervisory activities, comparisons, reconciliations, and

other actions people take in performing their duties.”

Appendix A, Section I, of the Office of Management and Budget (OMB) Circular No. A-123,

Management’s Responsibility for Internal Controls, states that “Internal control over financial reporting is

a process designed to provide reasonable assurance regarding the reliability of financial reporting.

Reliability of financial reporting means that management can reasonably make the following assertions:

•

All reported transactions actually occurred during the reporting period and all assets and liabilities

exist as of the reporting date (existence and occurrence);

•

All assets, liabilities, and transactions that should be reported have been included and no

unauthorized transactions or balances are included (completeness); and,

•

All assets and liabilities have been properly valued, and where applicable, all costs have been

properly allocated (valuation).”

Conditions

During the fiscal year (FY) 2013 audit, we noted several instances whereby the FAA did not have adequate

controls in place to ensure that all transactions were properly recorded in the general ledger, including

sufficient review controls to validate the completeness and accuracy of key inputs and assumptions of

certain estimated amounts. For example, we identified errors totaling over $100 million in three of eight

overflight fee revenue transactions tested for the period July 1, 2013 through September 30, 2013.

One error was identified and corrected by management; however, the correction was not made timely.

Two errors were identified by us.

78

|

|

Federal Aviation Administration

Fiscal Year 2013

Performance and Accountability Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business