Performance And Accountability Report - Fiscal Year 2013 - Federal Aviation Administration - U.s. Department Of Transportation Page 34

ADVERTISEMENT

1

1  2

2  3

3  4

4  5

5  6

6  7

7  8

8  9

9  10

10  11

11  12

12  13

13  14

14  15

15  16

16  17

17  18

18  19

19  20

20  21

21  22

22  23

23  24

24  25

25  26

26  27

27  28

28  29

29  30

30  31

31  32

32  33

33  34

34  35

35  36

36  37

37  38

38  39

39  40

40  41

41  42

42  43

43  44

44  45

45  46

46  47

47  48

48  49

49  50

50  51

51  52

52  53

53  54

54  55

55  56

56  57

57  58

58  59

59  60

60  61

61  62

62  63

63  64

64  65

65  66

66  67

67  68

68  69

69  70

70  71

71  72

72  73

73  74

74  75

75  76

76  77

77  78

78  79

79  80

80  81

81  82

82  83

83  84

84  85

85  86

86  87

87  88

88  89

89  90

90  91

91  92

92  93

93  94

94  95

95  96

96  97

97  98

98  99

99  100

100  101

101  102

102  103

103  104

104  105

105  106

106  107

107  108

108  109

109  110

110  111

111  112

112  113

113  114

114  115

115  116

116  117

117  118

118  119

119  120

120  121

121  122

122  123

123  124

124  125

125  126

126  127

127  128

128  129

129  130

130  131

131  132

132  133

133  134

134  135

135  136

136  137

137  138

138  139

139  140

140  141

141  142

142  143

143  144

144  145

145  146

146  147

147  148

148  149

149  150

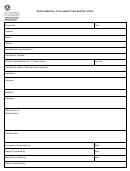

150 Composition of Net Cost

Net Cost Comparison

as of September 30, 2013

(Dollars in Thousands)

Air Traffic

2%

Organization

Airports

67%

22%

Aviation Safety

9%

Regions and Center

Operations & All Other

Air Traffic Organization

Airports

n

n

0

$ THOUSANDS

2,000,000 4,000,000 6,000,000 8,000,000 10,000,000 12,000,000

Aviation Safety

Regions and Center

n

n

2013

2012

n

n

Operations & All Other

preceding four years. This liability is updated on an annual basis

net costs. The Air Traffic Organization’s net costs decreased by

at year end.

$292.2 million, on a comparative basis, primarily from decreases

in contractor services, labor costs, and travel expenses offset by

Environmental liabilities represent 17 percent of FAA’s total

increases in property related activities, telecommunications and

liabilities and were $751.7 million as of September 30, 2013,

utilities costs.

compared with $810.4 million a year earlier. Environmental

liabilities include a component for remediation of known

The FAA’s second largest line of business is Airports with a net

contaminated sites and the estimated environmental cost to

cost of $3.6 billion as of September 30, 2013, which is 22 percent

decommission assets presently in service.

of the FAA’s total net costs. Net costs increased by $463.3 million

from the prior year primarily due to an increase in the Airport

The FAA’s Grants payable are estimated amounts incurred but

Improvement Program grant disbursements and accruals on a

not yet claimed by Airport Improvement Program (AIP) grant

comparative basis.

recipients and represent 18 percent of liabilities. Grants payable

increased by $132.2 million. Accounts payable decreased $57.8

The net cost of Aviation Safety represents 9 percent of the FAA’s

million and are amounts the FAA owes to other entities for

total net costs, while Regions and Center Operations and All

unpaid goods and services.

Other comprise 2 percent of total net costs.

Statement of Net Cost

Statement of Changes in Net Position

The Statement of Net Cost presents the cost of operating the

The Statement of Changes in Net Position presents those

FAA programs. The gross expense less any earned revenue for

accounting items that caused the net position section of the

each FAA program represents the net cost of specific program

balance sheet to change from the beginning to the end of the

operations. The FAA has used its cost accounting system to

reporting period. Various financing sources increase net position.

prepare the annual Statement of Net Cost since FY 1999.

These financing sources include appropriations received and non-

exchange revenue, such as excise taxes and imputed financing

As of September 30, 2013, and September 30, 2012 FAA’s net

from costs absorbed on the FAA’s behalf by other federal

costs were $16.2 billion and $16.1 billion, respectively. The

agencies. The agency’s net cost of operations and net transfers

Composition of Net Cost chart illustrates the distribution of costs

to other federal agencies serve to reduce net position.

among the FAA’s lines of business.

The FAA’s Cumulative Results of Operations for the period ending

The Net Cost Comparison chart compares September 30, 2012,

September 30, 2013, increased by $1.8 billion due primarily

and September 30, 2013 net costs.

to a combination of financing sources of $4.4 billion from

With a net cost of $10.9 billion, the Air Traffic Organization is

appropriations used, non-exchange revenue of $13.1 billion,

FAA’s largest line of business, comprising 67 percent of total

imputed financing of $571.0 million, and donations of property

32

|

|

Federal Aviation Administration

Fiscal Year 2013

Performance and Accountability Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business