Performance And Accountability Report - Fiscal Year 2013 - Federal Aviation Administration - U.s. Department Of Transportation Page 32

ADVERTISEMENT

1

1  2

2  3

3  4

4  5

5  6

6  7

7  8

8  9

9  10

10  11

11  12

12  13

13  14

14  15

15  16

16  17

17  18

18  19

19  20

20  21

21  22

22  23

23  24

24  25

25  26

26  27

27  28

28  29

29  30

30  31

31  32

32  33

33  34

34  35

35  36

36  37

37  38

38  39

39  40

40  41

41  42

42  43

43  44

44  45

45  46

46  47

47  48

48  49

49  50

50  51

51  52

52  53

53  54

54  55

55  56

56  57

57  58

58  59

59  60

60  61

61  62

62  63

63  64

64  65

65  66

66  67

67  68

68  69

69  70

70  71

71  72

72  73

73  74

74  75

75  76

76  77

77  78

78  79

79  80

80  81

81  82

82  83

83  84

84  85

85  86

86  87

87  88

88  89

89  90

90  91

91  92

92  93

93  94

94  95

95  96

96  97

97  98

98  99

99  100

100  101

101  102

102  103

103  104

104  105

105  106

106  107

107  108

108  109

109  110

110  111

111  112

112  113

113  114

114  115

115  116

116  117

117  118

118  119

119  120

120  121

121  122

122  123

123  124

124  125

125  126

126  127

127  128

128  129

129  130

130  131

131  132

132  133

133  134

134  135

135  136

136  137

137  138

138  139

139  140

140  141

141  142

142  143

143  144

144  145

145  146

146  147

147  148

148  149

149  150

150 FINANCIAL HIGHLIGHTS

DISCUSSION AND ANALYSIS OF THE

monitor the implementation of audit recommendations. The

committee is chaired by the Director of the Office of Financial

FINANCIAL STATEMENTS

Management and includes representatives from the OIG; DOT’s

FAA prepares annual financial statements in conformity with

Office of Financial Management; FAA’s Assistant Administrator

accounting principles generally accepted in the United States.

for Regions and Center Operations; and ATO’s Chief Operating

The financial statements are subject to an independent audit to

Officer. In 2006, committee participation was expanded to include

ensure that they are free from material misstatement and that

representatives from the Chief Counsel’s Office, the Assistant

they can be used to assess FAA performance.

Administrator for Human Resources Management, Information

Services, and Airports.

FY 2013 Financial Statement Audit

KPMG LLP has rendered an unmodified opinion on FAA’s FY 2013

The Chief Financial Officers Act of 1990 (Public Law 101–576),

financial statements.

as amended by the Government Management Reform Act

of 1994, requires that financial statements be prepared by

Understanding the Financial Statements

certain agencies and commercial-like activities of the federal

FAA’s Consolidated Balance Sheets, Statements of Net Cost,

government and that the statements be audited in accordance

Changes in Net Position, and Combined Statements of Budgetary

with government auditing standards. FAA is required to prepare

Resources, have been prepared to report the financial position

its own financial statements under OMB Bulletin No. 14–02,

and results of operations of FAA, pursuant to the requirements

Audit Requirements for Federal Financial Statements. DOT’s

of the Chief Financial Officers Act of 1990 and the Government

Office of Inspector General (OIG) is statutorily responsible for

Management Reform Act of 1994. The following section provides

the manner in which the audit of FAA’s financial statements

a brief description of (a) the nature of each financial statement

is conducted. The OIG selected KPMG LLP, an independent

and its relevance to FAA, (b) significant fluctuations from FY 2012

certified public accounting firm, to audit FAA’s FY 2013 financial

to FY 2013, and (c) certain significant balances, where necessary,

statements.

to help clarify their link to FAA operations.

In 2002, DOT’s OIG and Chief Financial Officer, along with

FAA’s Chief Financial Officer, established an Audit Coordination

Balance Sheet

Committee to promote and encourage open communication

The balance sheet presents the amounts available for use by FAA

among the OIG, FAA management, and the independent

(assets) against the amounts owed (liabilities) and amounts that

auditors to resolve issues that arise during the audit and to

comprise the difference (net position).

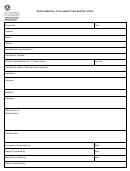

Composition of Assets

Assets Comparison

as of September 30, 2013

(Dollars in Thousands)

Fund balance

10%

with Treasury

Investments

43%

44%

Property, plant

and equipment

3%

Other

0

3,000,000

6,000,000

9,000,000 12,000,000 15,000,000

$ THOUSANDS

Fund Balance with Treasury

Other

n

n

Investments

Property, plant and equipment

n

n

2013

2012

n

n

30

|

|

Federal Aviation Administration

Fiscal Year 2013

Performance and Accountability Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business