Performance And Accountability Report - Fiscal Year 2013 - Federal Aviation Administration - U.s. Department Of Transportation Page 102

ADVERTISEMENT

1

1  2

2  3

3  4

4  5

5  6

6  7

7  8

8  9

9  10

10  11

11  12

12  13

13  14

14  15

15  16

16  17

17  18

18  19

19  20

20  21

21  22

22  23

23  24

24  25

25  26

26  27

27  28

28  29

29  30

30  31

31  32

32  33

33  34

34  35

35  36

36  37

37  38

38  39

39  40

40  41

41  42

42  43

43  44

44  45

45  46

46  47

47  48

48  49

49  50

50  51

51  52

52  53

53  54

54  55

55  56

56  57

57  58

58  59

59  60

60  61

61  62

62  63

63  64

64  65

65  66

66  67

67  68

68  69

69  70

70  71

71  72

72  73

73  74

74  75

75  76

76  77

77  78

78  79

79  80

80  81

81  82

82  83

83  84

84  85

85  86

86  87

87  88

88  89

89  90

90  91

91  92

92  93

93  94

94  95

95  96

96  97

97  98

98  99

99  100

100  101

101  102

102  103

103  104

104  105

105  106

106  107

107  108

108  109

109  110

110  111

111  112

112  113

113  114

114  115

115  116

116  117

117  118

118  119

119  120

120  121

121  122

122  123

123  124

124  125

125  126

126  127

127  128

128  129

129  130

130  131

131  132

132  133

133  134

134  135

135  136

136  137

137  138

138  139

139  140

140  141

141  142

142  143

143  144

144  145

145  146

146  147

147  148

148  149

149  150

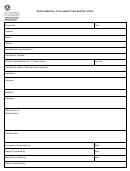

150 2012

Non-current

Current

liabilities

liabilities

Total

Intragovernmental

Advances received

$

—

$

53,654

$

53,654

Accrued payroll & benefits payable to other agencies

—

90,156

90,156

Liabilities covered by budgetary resources

—

143,810

143,810

Federal Employees' Compensation Act payable

115,495

90,623

206,118

Other

—

75,372

75,372

Liabilities not covered by budgetary resources

115,495

165,995

281,490

Intragovernmental total

115,495

309,805

425,300

With the public

Advances received and other

—

108,444

108,444

Accrued payroll & benefits payable to employees

—

344,809

344,809

Liabilities covered by budgetary resources

—

453,253

453,253

Accrued unfunded annual & other leave & assoc. benefits

—

404,714

404,714

Sick leave compensation benefits for eligible employees

65,264

61,439

126,703

Capital leases (Notes 9 and 15)

73,452

8,852

82,304

Legal claims

—

34,300

34,300

Other accrued liabilities

—

20,524

20,524

Liabilities not covered by budgetary resources

138,716

529,829

668,545

Public total

138,716

983,082

1,121,798

Total employee related and other liabilities

$

254,211

$ $1,292,887

$

1,547,098

Accrued payroll and benefits payable to other agencies consist of

The estimated liability for accrued unfunded leave and

FAA contributions payable to other federal agencies for employee

associated benefits includes annual and other types of vested

benefits. These include FAA contributions payable toward

leave. Additionally, under the terms of various bargaining unit

life, health, retirement benefits, Social Security, and matching

agreements, employees who are in FERS, have the option to

contributions to the Thrift Savings Plan.

receive a lump sum payment for 40 percent of their accumulated

sick leave as of their effective retirement date. Based on sick

An unfunded liability is recorded for the actual cost of workers’

leave balances, this estimated liability was $119.0 million and

compensation benefits to be reimbursed to the DOL, pursuant to

$126.7 million as of September 30, 2013 and 2012, respectively.

the FECA. Because the DOL bills the FAA two years after it pays

such claims, the FAA’s accrued liability as of September 30, 2013,

The FAA estimated that 100 percent of its $2.7 million and

includes workers’ compensation benefits paid by DOL during

$34.3 million legal claims liabilities as of September 30, 2013

the periods July 1, 2011, through June 30, 2013, and accrued

and 2012, respectively, would be paid from the permanent

liabilities for the quarter July 1, 2013, through September 30,

appropriation for judgments, awards, and compromise

2013. The FAA’s liability accrued as of September 30, 2012,

settlements (Judgment Fund) administered by the Department of

included workers’ compensation benefits paid by the DOL during

Treasury.

the period July 1, 2010, through June 30, 2012, and accrued

Other Accrued Liabilities with the Public is composed primarily

liabilities for the quarter July 1, 2012, through September 30,

of accruals for utilities, leases, and travel. Total liabilities not

2012.

covered by budgetary resources are presented in Note 15.

100

|

|

Federal Aviation Administration

Fiscal Year 2013

Performance and Accountability Report

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business