Virginia Consumer’s Use Tax Return for Individuals, Form CU-7

If you purchased more than $100 in merchandise during the taxable year from out-of-state mail order companies, telephone

or television shopping services, or while traveling outside the state and did not pay Virginia sales or use tax on these

items, you may be required to file a Virginia Consumer’s Use Tax Return For Individuals, Form CU-7.

What is Virginia consumer’s use tax?

Penalty and interest will apply if the return is filed after May 1. If you are filing

The Virginia consumer’s use tax is the “other half” of the Virginia Sales and Use

on a basis other than a calendar year, you must file your return by the 15th

Tax Act passed by the 1966 Virginia General Assembly. As a general rule, you

day of the 4th month after the close of your taxable year.

owe this tax if you purchased merchandise and did not pay sales tax. Typically this

happens when you purchase an item (for example, clothing, a camera or computer

If the due date falls on a Saturday, Sunday or legal holiday, you may file your

equipment) through the mail, by telephone or television shopping from a business

return on the next day that is not a Saturday, Sunday or legal holiday.

that does not add the Virginia sales and use tax to your bill. You may also owe the

Pay the balance due as computed on Form CU-7 by the due date. Payment

tax if you purchased an item (for example, furniture or art) tax-free while you were

must be attached to this return when filed. Mail Form CU-7 to: Virginia

outside Virginia. Sales or use tax does not apply to magazine or newspaper

Department of Taxation, P.O. Box 1103, Richmond, VA 23218-1103.

subscriptions.

(Do NOT file Form CU-7 in the same envelope with your individual

The consumer’s use tax is 4 ½% of what you paid for the item (“cost price”).

income tax return and do NOT file it with your local Commissioner of

“Cost price” does not include separately stated shipping or delivery charges,

the Revenue, Director of Finance or Director of Tax Administration.)

but it does include a “shipping and handling” charge when this is listed as a

Make your check or money order payable to the Virginia Department of Taxation.

single item on the bill.

Checks returned by the bank will be subject to a $25.00 returned check fee,

Effective for taxable years 1995 and after

in addition to other penalties.

If you purchased more than $100 in goods during the taxable year ($25 for taxable

Where to get help

years before 1995) from businesses that did not charge you sales tax, you must

If you have any questions, please call (804) 367-8037 or write the Department

pay the consumer’s use tax on the total amount of these purchases. If your

of Taxation, P.O. Box 1115, Richmond, Virginia 23218-1115. Assistance is

purchases of untaxed goods during the taxable year total $100 or less ($25 for

also available from the district offices of the Virginia Department of Taxation (Bristol,

taxable years before 1995), you are not required to pay the consumer’s use tax.

Danville, Norfolk, Fairfax, Springfield, Newport News, Richmond, Roanoke and

For example, if you have $200 of untaxed purchases from out-of-state mail order

Harrisonburg).

companies during 1998, consumer's use tax of $9 is due ($200.00

.045 =

$9.00).

Where to get forms

Form CU-7 is available from the Department of Taxation, Forms Request Unit,

Who should file this form?

by calling (804) 236-2760, (804) 236-2761 or 1-888-268-2829 (toll-free

If you purchased more than $100 in goods during the taxable year ($25 for taxable

outside the Richmond area). Also, if you have a computer and have

years before 1995) from out-of-state mail order companies, telephone or

access to the World Wide Web, you can obtain most Virginia tax forms by

television shopping networks or other businesses that did not charge you

connecting to

sales tax, you must file an annual consumer’s use tax return, Form CU-7.

This form is for use by individuals only. Businesses, including

Completing Form CU-7

partnerships and sole proprietorships, must report such purchases on Form

A worksheet and line by line instructions for completing Form CU-7 are on the

ST-7 or Form ST-9, whichever is appropriate.

back of this page. Complete the worksheet, transfer the information to the

form below, then see “When and where to file” above for filing information.

When and where to file

Keep the worksheet for three years from the due date of the return.

File your return as soon as possible after January 1, but not later than May 1.

Alternative To Filing Form CU-7: You can report and pay the consumer’s use tax using your income tax return instead of filing Form

CU-7. See the Contributions and Consumer's Use Tax Schedule for Form 760, Form 760S or Form 760PY.

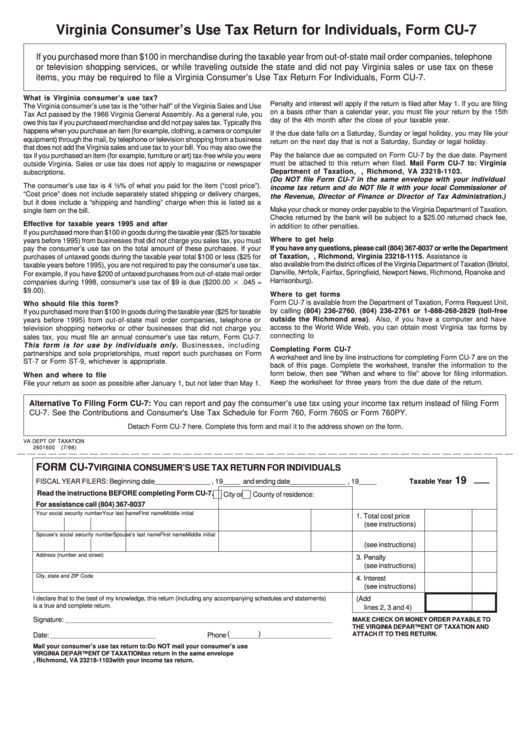

Detach Form CU-7 here. Complete this form and mail it to the address shown on the form.

VA DEPT OF TAXATION

2601600

(7/98)

FORM CU-7

VIRGINIA CONSUMER’S USE TAX RETURN FOR INDIVIDUALS

19

FISCAL YEAR FILERS: Beginning date

, 19

and ending date

, 19

Taxable Year

___________________

______

___________________

______

Read the instructions BEFORE completing Form CU-7.

City or

County of residence:

For assistance call (804) 367-8037

Your social security number

Your last name

First name

Middle initial

1. Total cost price

(see instructions)

Spouse’s social security number

Spouse’s last name

First name

Middle initial

2. Use tax

(see instructions)

Address (number and street)

3. Penalty

(see instructions)

City, state and ZIP Code

4. Interest

(see instructions)

I declare that to the best of my knowledge, this return (including any accompanying schedules and statements)

5. Total Due (Add

is a true and complete return.

lines 2, 3 and 4)

Signature:

MAKE CHECK OR MONEY ORDER PAYABLE TO

___________________________________________________________________________________________

THE VIRGINIA DEPARTMENT OF TAXATION AND

(

)

ATTACH IT TO THIS RETURN.

Date:

Phone

____________________________________

___________________________________

Mail your consumer’s use tax return to:

Do NOT mail your consumer’s use

VIRGINIA DEPARTMENT OF TAXATION

tax return in the same envelope

P.O. Box 1103, Richmond, VA 23218-1103

with your income tax return.

1

1