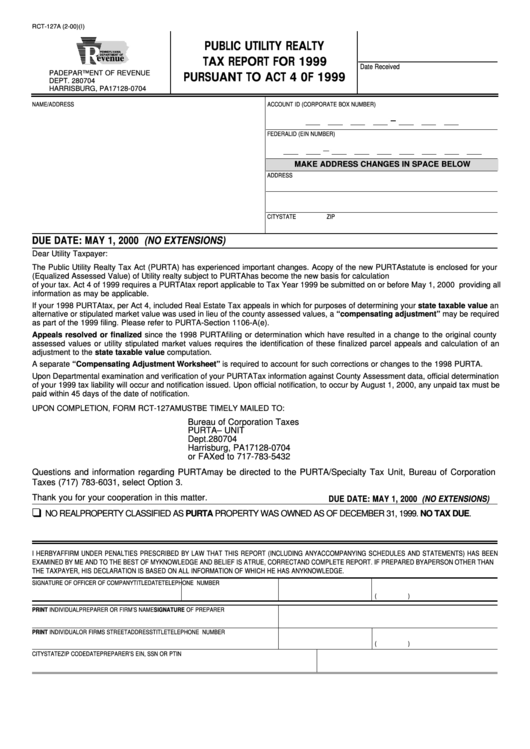

Form Rct-127a - Public Utility Realty Tax Report For 1999 Pursuant To Act 4 0f 1999

ADVERTISEMENT

RCT-127A (2-00)(I)

PUBLIC UTILITY REALTY

PENNSYLVANIA

DEPARTMENT OF

evenue

TAX REPORT FOR 1999

Date Received

PA DEPARTMENT OF REVENUE

PURSUANT TO ACT 4 0F 1999

DEPT. 280704

HARRISBURG, PA 17128-0704

NAME/ADDRESS

ACCOUNT ID (CORPORATE BOX NUMBER)

FEDERAL ID (EIN NUMBER)

MAKE ADDRESS CHANGES IN SPACE BELOW

ADDRESS

CITY

STATE

ZIP

DUE DATE: MAY 1, 2000 (NO EXTENSIONS)

Dear Utility Taxpayer:

The Public Utility Realty Tax Act (PURTA) has experienced important changes. A copy of the new PURTA statute is enclosed for your

convenience.The Market Value (Equalized Assessed Value) of Utility realty subject to PURTA has become the new basis for calculation

of your tax. Act 4 of 1999 requires a PURTA tax report applicable to Tax Year 1999 be submitted on or before May 1, 2000 providing all

information as may be applicable.

If your 1998 PURTA tax, per Act 4, included Real Estate Tax appeals in which for purposes of determining your state taxable value an

alternative or stipulated market value was used in lieu of the county assessed values, a “compensating adjustment” may be required

as part of the 1999 filing. Please refer to PURTA-Section 1106-A (e).

Appeals resolved or finalized since the 1998 PURTA filing or determination which have resulted in a change to the original county

assessed values or utility stipulated market values requires the identification of these finalized parcel appeals and calculation of an

adjustment to the state taxable value computation.

A separate “Compensating Adjustment Worksheet” is required to account for such corrections or changes to the 1998 PURTA.

Upon Departmental examination and verification of your PURTA Tax information against County Assessment data, official determination

of your 1999 tax liability will occur and notification issued. Upon official notification, to occur by August 1, 2000, any unpaid tax must be

paid within 45 days of the date of notification.

UPON COMPLETION, FORM RCT-127A MUST BE TIMELY MAILED TO:

Bureau of Corporation Taxes

PURTA – UNIT

Dept.280704

Harrisburg, PA 17128-0704

or FAXed to 717-783-5432

Questions and information regarding PURTA may be directed to the PURTA/Specialty Tax Unit, Bureau of Corporation

Taxes (717) 783-6031, select Option 3.

Thank you for your cooperation in this matter.

DUE DATE: MAY 1, 2000 (NO EXTENSIONS)

NO REAL PROPERTY CLASSIFIED AS PURTA PROPERTY WAS OWNED AS OF DECEMBER 31, 1999. NO TAX DUE.

I HERBY AFFIRM UNDER PENALTIES PRESCRIBED BY LAW THAT THIS REPORT (INCLUDING ANY ACCOMPANYING SCHEDULES AND STATEMENTS) HAS BEEN

EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IS A TRUE, CORRECT AND COMPLETE REPORT. IF PREPARED BY A PERSON OTHER THAN

THE TAXPAYER, HIS DECLARATION IS BASED ON ALL INFORMATION OF WHICH HE HAS ANY KNOWLEDGE.

SIGNATURE OF OFFICER OF COMPANY

TITLE

DATE

TELEPHONE NUMBER

(

)

PRINT INDIVIDUAL PREPARER OR FIRM’S NAME

SIGNATURE OF PREPARER

PRINT INDIVIDUAL OR FIRMS STREET ADDRESS

TITLE

TELEPHONE NUMBER

(

)

CITY

STATE

ZIP CODE

DATE

PREPARER’S EIN, SSN OR PTIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8