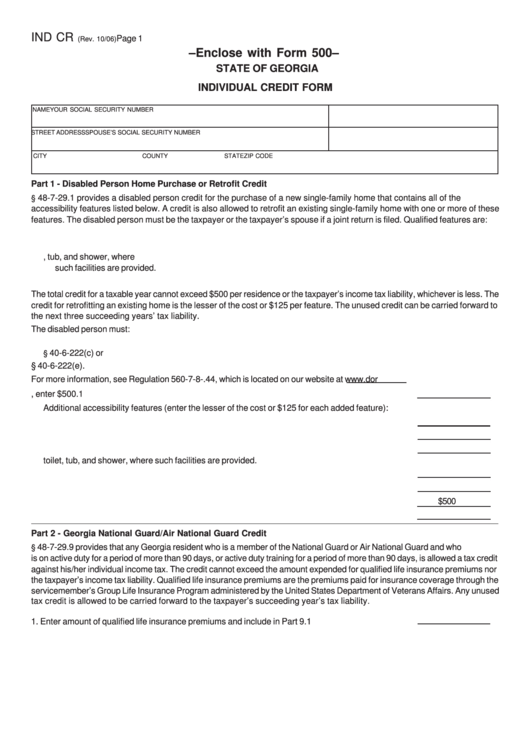

Form Ind Cr - Individual Credit Form - State Of Georgia

ADVERTISEMENT

IND CR

Page 1

(Rev. 10/06)

– Enclose with Form 500 –

STATE OF GEORGIA

INDIVIDUAL CREDIT FORM

NAME

YOUR SOCIAL SECURITY NUMBER

STREET ADDRESS

SPOUSE’S SOCIAL SECURITY NUMBER

CITY

COUNTY

STATE

ZIP CODE

Part 1 - Disabled Person Home Purchase or Retrofit Credit

O.C.G.A.

48-7-29.1 provides a disabled person credit for the purchase of a new single-family home that contains all of the

§

accessibility features listed below. A credit is also allowed to retrofit an existing single-family home with one or more of these

features. The disabled person must be the taxpayer or the taxpayer’s spouse if a joint return is filed. Qualified features are:

1. One no-step entrance allowing access into the residence.

2. Interior passage doors providing at least a 32-inch-wide opening.

3. Reinforcements in bathroom walls allowing installation of grab bars around the toilet, tub, and shower, where

such facilities are provided.

4. Light switches and outlets placed in accessible locations.

The total credit for a taxable year cannot exceed $500 per residence or the taxpayer’s income tax liability, whichever is less. The

credit for retrofitting an existing home is the lesser of the cost or $125 per feature. The unused credit can be carried forward to

the next three succeeding years’ tax liability.

The disabled person must:

1. Be permanently disabled and have been issued a permanent parking permit by the Department of Public Safety under

O.C.G.A.

40-6-222(c) or

§

2. Have been issued a special permanent parking permit by the Department of Public Safety under O.C.G.A. § 40-6-222(e).

For more information, see Regulation 560-7-8-.44, which is located on our website at

1. Purchase of a home that contains all four accessibility features, enter $500.

1

Additional accessibility features (enter the lesser of the cost or $125 for each added feature):

2. One no-step entrance allowing access into the residence.

2

3. Interior passage doors providing at least a 32-inch-wide opening.

3

4. Reinforcements in bathroom walls allowing installation of grab bars around the

4

toilet, tub, and shower, where such facilities are provided.

5. Light switches and outlets placed in accessible locations.

5

6. Sum of Lines 1 through 5.

6

$500

7. Maximum credit per residence.

7

8. Enter the lesser of Line 6 or Line 7 and include in Part 9.

8

Part 2 - Georgia National Guard/Air National Guard Credit

O.C.G.A.

48-7-29.9 provides that any Georgia resident who is a member of the National Guard or Air National Guard and who

§

is on active duty for a period of more than 90 days, or active duty training for a period of more than 90 days, is allowed a tax credit

against his/her individual income tax. The credit cannot exceed the amount expended for qualified life insurance premiums nor

the taxpayer’s income tax liability. Qualified life insurance premiums are the premiums paid for insurance coverage through the

servicemember’s Group Life Insurance Program administered by the United States Department of Veterans Affairs. Any unused

tax credit is allowed to be carried forward to the taxpayer’s succeeding year’s tax liability.

1. Enter amount of qualified life insurance premiums and include in Part 9.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4