Montana Schedule K-1 (Clt-4s And Pr-1) Draft - Partner'S/shareholder'S Share Of Income (Loss), Deductions, Credits, Etc.

ADVERTISEMENT

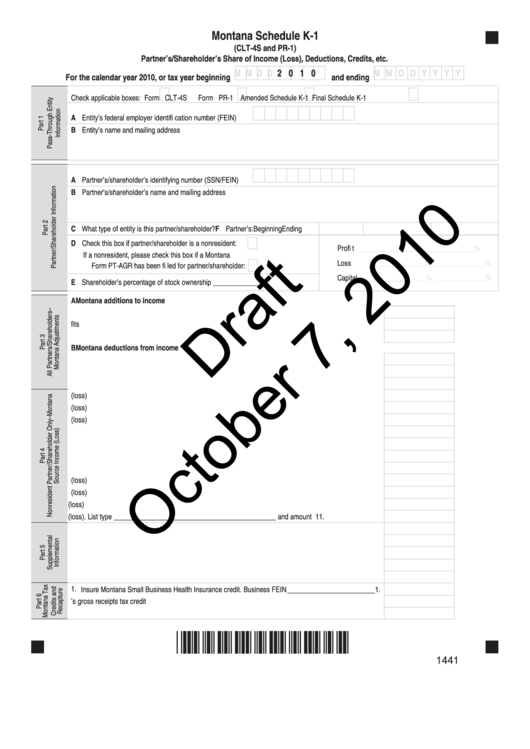

Montana Schedule K-1

(CLT-4S and PR-1)

Partner’s/Shareholder’s Share of Income (Loss), Deductions, Credits, etc.

M M D D

2 0 1 0

M M D D Y Y Y Y

For the calendar year 2010, or tax year beginning

and ending

Check applicable boxes:

Form CLT-4S

Form PR-1

Amended Schedule K-1

Final Schedule K-1

A Entity’s federal employer identifi cation number (FEIN)

B Entity’s name and mailing address

A Partner’s/shareholder’s identifying number (SSN/FEIN)

B Partner’s/shareholder’s name and mailing address

C What type of entity is this partner/shareholder?

F Partner’s:

Beginning

Ending

D Check this box if partner/shareholder is a nonresident:

Profi t

________________ % _______________ %

If a nonresident, please check this box if a Montana

Loss

________________ % _______________ %

Form PT-AGR has been fi led for partner/shareholder:

Capital

________________ % _______________ %

E Shareholder’s percentage of stock ownership _____________%

A Montana additions to income

1. Federal tax-exempt interest ...................................................................................................................... A1.

2. Taxes based on income or profi ts ............................................................................................................. A2.

3. Other additions. List type __________________________________________________ and amount A3.

B Montana deductions from income

1. Interest from U.S. Treasury obligations .................................................................................................... B1.

2. Deduction for purchasing recycle material ............................................................................................... B2.

3. Other deductions. List type ________________________________________________ and amount B3.

1. Ordinary business income (loss) .................................................................................................................1.

2. Net rental real estate income (loss) .............................................................................................................2.

3. Other net rental income (loss) .....................................................................................................................3.

4. Guaranteed payments .................................................................................................................................4.

5. Interest income ............................................................................................................................................5.

6. Ordinary dividends .......................................................................................................................................6.

7. Royalties ......................................................................................................................................................7.

8. Net short-term capital gain (loss) .................................................................................................................8.

9. Net long-term capital gain (loss) ..................................................................................................................9.

10. Net section 1231 gain (loss) ......................................................................................................................10.

11. Other income (loss). List type ______________________________________________ and amount 11.

1. Montana composite income tax paid on behalf of partner/shareholder .......................................................1.

2. Montana income tax withheld on behalf of partner/shareholder ..................................................................2.

3. Premiums for Insure Montana Small Business Health Insurance credit expenses .....................................3.

4. Montana mineral royalty tax withheld ..........................................................................................................4.

5. Other information. List type _________________________________________________ and amount 5.

____________________

1. Insure Montana Small Business Health Insurance credit. Business FEIN

1.

2. Contractor’s gross receipts tax credit ..........................................................................................................2.

3. Other credit/recapture information. List type ____________________________________ and amount 3.

*14410101*

1441

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2