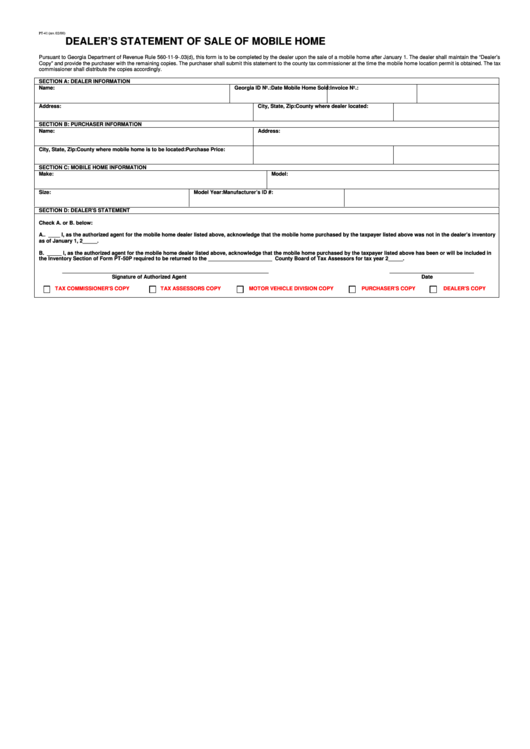

PT-41 (rev. 02/00)

DEALER’ S STATEMENT OF SALE OF MOBILE HOME

Pursuant to Georgia Department of Revenue Rule 560-11-9-.03(d), this form is to be completed by the dealer upon the sale of a mobile home after January 1. The dealer shall maintain the “ Dealer’ s

Copy” and provide the purchaser with the remaining copies. The purchaser shall submit this statement to the county tax commissioner at the time the mobile home location permit is obtained. The tax

commissioner shall distribute the copies accordingly.

SECTION A: DEALER INFORMATION

Name:

Georgia ID No.:

Date Mobile Home Sold:

Invoice No.:

Address:

City, State, Zip:

County where dealer located:

SECTION B: PURCHASER INFORMATION

Name:

Address:

City, State, Zip:

County where mobile home is to be located:

Purchase Price:

SECTION C: MOBILE HOME INFORMATION

Make:

Model:

Size:

Model Year:

Manufacturer’ s ID #:

SECTION D: DEALER’ S STATEMENT

Check A. or B. below:

A.. ____ I, as the authorized agent for the mobile home dealer listed above, acknowledge that the mobile home purchased by the taxpayer listed above was not in the dealer’ s inventory

as of January 1, 2_____.

B. _____ I, as the authorized agent for the mobile home dealer listed above, acknowledge that the mobile home purchased by the taxpayer listed above has been or will be included in

the Inventory Section of Form PT-50P required to be returned to the ______________________ County Board of Tax Assessors for tax year 2_____.

_______________________________________________________________________

_____________________________

Signature of Authorized Agent

Date

TAX COMMISSIONER’ S COPY

TAX ASSESSORS COPY

MOTOR VEHICLE DIVISION COPY

PURCHASER’ S COPY

DEALER’ S COPY

1

1