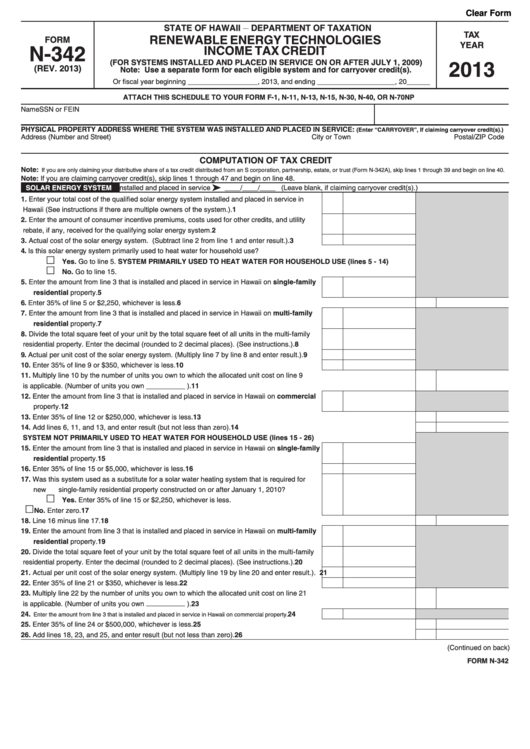

Clear Form

STATE OF HAWAII

DEPARTMENT OF TAXATION

__

TAX

RENEWABLE ENERGY TECHNOLOGIES

FORM

YEAR

N-342

INCOME TAX CREDIT

2013

(FOR SYSTEMS INSTALLED AND PLACED IN SERVICE ON OR AFTER JULY 1, 2009)

(REV. 2013)

Note: Use a separate form for each eligible system and for carryover credit(s).

Or fiscal year beginning __________________, 2013, and ending ____________________, 20______

ATTACH THIS SCHEDULE TO YOUR FORM F-1, N-11, N-13, N-15, N-30, N-40, OR N-70NP

Name

SSN or FEIN

PHYSICAL PROPERTY ADDRESS WHERE THE SYSTEM WAS INSTALLED AND PLACED IN SERVICE: (Enter “CARRYOVER”, If claiming carryover credit(s).)

Address (Number and Street)

City or Town

Postal/ZIP Code

COMPUTATION OF TAX CREDIT

Note: If you are only claiming your distributive share of a tax credit distributed from an S corporation, partnership, estate, or trust (Form N-342A), skip lines 1 through 39 and begin on line 40.

Note: If you are claiming carryover credit(s), skip lines 1 through 47 and begin on line 48.

SOLAR ENERGY SYSTEM

Enter date system was installed and placed in service

____/____/____ (Leave blank, if claiming carryover credit(s).)

1. Enter your total cost of the qualified solar energy system installed and placed in service in

Hawaii (See instructions if there are multiple owners of the system.). ......................................

1

2. Enter the amount of consumer incentive premiums, costs used for other credits, and utility

rebate, if any, received for the qualifying solar energy system. .................................................

2

3. Actual cost of the solar energy system. (Subtract line 2 from line 1 and enter result.). ............

3

4. Is this solar energy system primarily used to heat water for household use?

Yes. Go to line 5. SYSTEM PRIMARILY USED TO HEAT WATER FOR HOUSEHOLD USE (lines 5 - 14)

No. Go to line 15.

5. Enter the amount from line 3 that is installed and placed in service in Hawaii on single-family

residential property. .................................................................................................................

5

6. Enter 35% of line 5 or $2,250, whichever is less. .......................................................................................................................

6

7. Enter the amount from line 3 that is installed and placed in service in Hawaii on multi-family

residential property. .................................................................................................................

7

8. Divide the total square feet of your unit by the total square feet of all units in the multi-family

residential property. Enter the decimal (rounded to 2 decimal places). (See instructions.). ......

8

9. Actual per unit cost of the solar energy system. (Multiply line 7 by line 8 and enter result.). ....

9

10. Enter 35% of line 9 or $350, whichever is less. .........................................................................

10

11. Multiply line 10 by the number of units you own to which the allocated unit cost on line 9

is applicable. (Number of units you own __________ ). .............................................................................................................

11

12. Enter the amount from line 3 that is installed and placed in service in Hawaii on commercial

property. ....................................................................................................................................

12

13. Enter 35% of line 12 or $250,000, whichever is less. .................................................................................................................

13

14. Add lines 6, 11, and 13, and enter result (but not less than zero). .............................................................................................

14

SYSTEM NOT PRIMARILY USED TO HEAT WATER FOR HOUSEHOLD USE (lines 15 - 26)

15. Enter the amount from line 3 that is installed and placed in service in Hawaii on single-family

residential property. .................................................................................................................

15

16. Enter 35% of line 15 or $5,000, whichever is less. ....................................................................

16

17. Was this system used as a substitute for a solar water heating system that is required for

new single-family residential property constructed on or after January 1, 2010?

Yes. Enter 35% of line 15 or $2,250, whichever is less.

No. Enter zero. ..............................................................................................................

17

18. Line 16 minus line 17. ................................................................................................................................................................

18

19. Enter the amount from line 3 that is installed and placed in service in Hawaii on multi-family

residential property. .................................................................................................................

19

20. Divide the total square feet of your unit by the total square feet of all units in the multi-family

residential property. Enter the decimal (rounded to 2 decimal places). (See instructions.). ......

20

21. Actual per unit cost of the solar energy system. (Multiply line 19 by line 20 and enter result.).

21

22. Enter 35% of line 21 or $350, whichever is less. .......................................................................

22

23. Multiply line 22 by the number of units you own to which the allocated unit cost on line 21

is applicable. (Number of units you own __________ ). .............................................................................................................

23

24. Enter the amount from line 3 that is installed and placed in service in Hawaii on commercial property. ...............

24

25. Enter 35% of line 24 or $500,000, whichever is less. .................................................................................................................

25

26. Add lines 18, 23, and 25, and enter result (but not less than zero). ...........................................................................................

26

(Continued on back)

FORM N-342

1

1 2

2