Instructions For Form Ph-1040es

ADVERTISEMENT

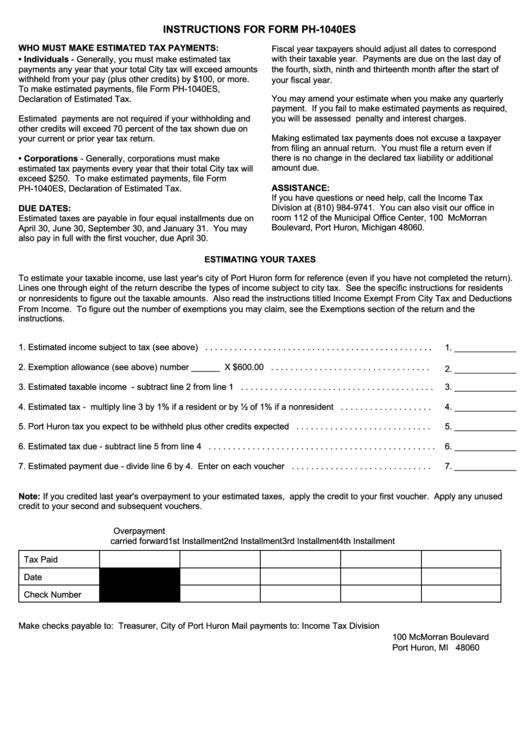

INSTRUCTIONS FOR FORM PH-1040ES

WHO MUST MAKE ESTIMATED TAX PAYMENTS:

Fiscal year taxpayers should adjust all dates to correspond

with their taxable year. Payments are due on the last day of

• Individuals - Generally, you must make estimated tax

payments any year that your total City tax will exceed amounts

the fourth, sixth, ninth and thirteenth month after the start of

withheld from your pay (plus other credits) by $100, or more.

your fiscal year.

To make estimated payments, file Form PH-1040ES,

You may amend your estimate when you make any quarterly

Declaration of Estimated Tax.

payment. If you fail to make estimated payments as required,

you will be assessed penalty and interest charges.

Estimated payments are not required if your withholding and

other credits will exceed 70 percent of the tax shown due on

Making estimated tax payments does not excuse a taxpayer

your current or prior year tax return.

from filing an annual return. You must file a return even if

there is no change in the declared tax liability or additional

• Corporations - Generally, corporations must make

amount due.

estimated tax payments every year that their total City tax will

exceed $250. To make estimated payments, file Form

ASSISTANCE:

PH-1040ES, Declaration of Estimated Tax.

If you have questions or need help, call the Income Tax

Division at (810) 984-9741. You can also visit our office in

DUE DATES:

room 112 of the Municipal Office Center, 100 McMorran

Estimated taxes are payable in four equal installments due on

Boulevard, Port Huron, Michigan 48060.

April 30, June 30, September 30, and January 31. You may

also pay in full with the first voucher, due April 30.

ESTIMATING YOUR TAXES

To estimate your taxable income, use last year's city of Port Huron form for reference (even if you have not completed the return).

Lines one through eight of the return describe the types of income subject to city tax. See the specific instructions for residents

or nonresidents to figure out the taxable amounts. Also read the instructions titled Income Exempt From City Tax and Deductions

From Income. To figure out the number of exemptions you may claim, see the Exemptions section of the return and the

instructions.

1. Estimated income subject to tax (see above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1. _____________

2. Exemption allowance (see above) number ______ X $600.00 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. _____________

3. Estimated taxable income - subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. _____________

4. Estimated tax - multiply line 3 by 1% if a resident or by ½ of 1% if a nonresident . . . . . . . . . . . . . . . . . . .

4. _____________

5. Port Huron tax you expect to be withheld plus other credits expected . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. _____________

6. Estimated tax due - subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. _____________

7. Estimated payment due - divide line 6 by 4. Enter on each voucher . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. _____________

Note: If you credited last year's overpayment to your estimated taxes, apply the credit to your first voucher. Apply any unused

credit to your second and subsequent vouchers.

Overpayment

carried forward

1st Installment

2nd Installment

3rd Installment

4th Installment

Tax Paid

Date

Check Number

Make checks payable to: Treasurer, City of Port Huron

Mail payments to:

Income Tax Division

100 McMorran Boulevard

Port Huron, MI 48060

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1