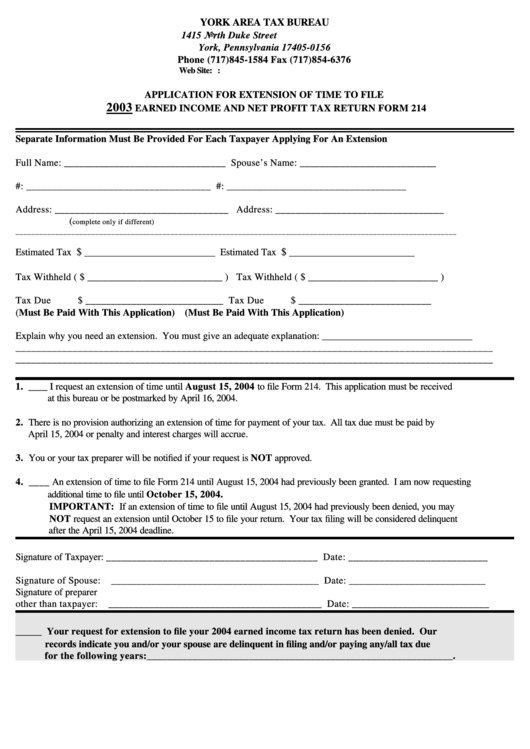

Form 214 - Application For Extension Of Time To File - Earned Income And Net Profit Tax Return - 2003

ADVERTISEMENT

YORK AREA TAX BUREAU

1415 North Duke Street P.O. Box 15627

York, Pennsylvania 17405-0156

Phone (717)845-1584 Fax (717)854-6376

Web Site: Email:

APPLICATION FOR EXTENSION OF TIME TO FILE

2003

EARNED INCOME AND NET PROFIT TAX RETURN FORM 214

Separate Information Must Be Provided For Each Taxpayer Applying For An Extension

Full Name: ________________________________

Spouse’s Name: ___________________________

S.S.#: ____________________________________

S.S.#: ___________________________________

Address: __________________________________

Address: _________________________________

(

complete only if different)

________________________________________________________

_______________________________________________________

$ _________________________

$ ________________________

Estimated Tax

Estimated Tax

Tax Withheld ( $ ___________________________ )

Tax Withheld ( $ __________________________ )

Tax Due

$ ___________________________

Tax Due

$ __________________________

(Must Be Paid With This Application)

(Must Be Paid With This Application)

Explain why you need an extension. You must give an adequate explanation: _______________________________

____________________________________________________________________________________________

____________________________________________________________________________________________

1. ____ I request an extension of time until August 15, 2004 to file Form 214. This application must be received

at this bureau or be postmarked by April 16, 2004.

2. There is no provision authorizing an extension of time for payment of your tax. All tax due must be paid by

April 15, 2004 or penalty and interest charges will accrue.

3. You or your tax preparer will be notified if your request is NOT approved.

4. ____ An extension of time to file Form 214 until August 15, 2004 had previously been granted. I am now requesting

additional time to file until October 15, 2004.

IMPORTANT: If an extension of time to file until August 15, 2004 had previously been denied, you may

NOT request an extension until October 15 to file your return. Your tax filing will be considered delinquent

after the April 15, 2004 deadline.

Signature of Taxpayer: _________________________________________ Date: ___________________________

Signature of Spouse:

_________________________________________ Date: ___________________________

Signature of preparer

other than taxpayer:

__________________________________________ Date: ___________________________

_____

Your request for extension to file your 2004 earned income tax return has been denied. Our

records indicate you and/or your spouse are delinquent in filing and/or paying any/all tax due

for the following years:____________________________________________________________.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1