Form 40p Instructions - Oregon Department Of Revenue

ADVERTISEMENT

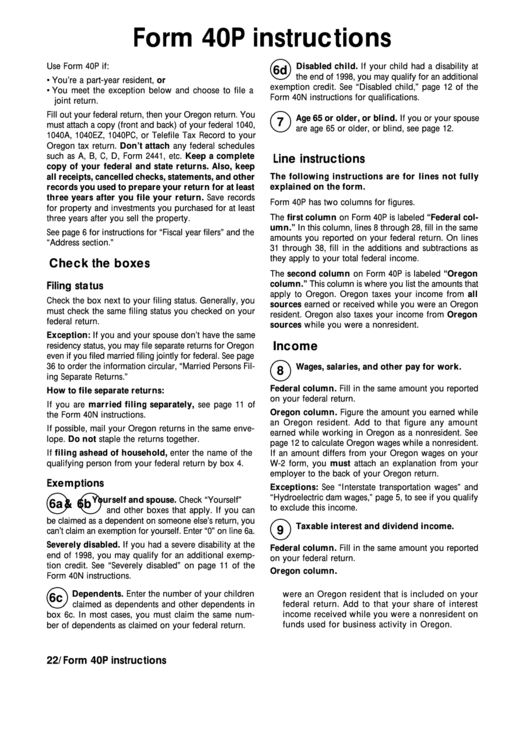

Form 40P instructions

Use Form 40P if:

Disabled child. If your child had a disability at

6d

the end of 1998, you may qualify for an additional

• You’re a part-year resident, or

exemption credit. See “Disabled child,” page 12 of the

• You meet the exception below and choose to file a

Form 40N instructions for qualifications.

joint return.

Fill out your federal return, then your Oregon return. You

Age 65 or older, or blind. If you or your spouse

7

must attach a copy (front and back) of your federal 1040,

are age 65 or older, or blind, see page 12.

1040A, 1040EZ, 1040PC, or Telefile Tax Record to your

Oregon tax return. Don’t attach any federal schedules

such as A, B, C, D, Form 2441, etc. Keep a complete

Line instructions

copy of your federal and state returns. Also, keep

all receipts, cancelled checks, statements, and other

The following instructions are for lines not fully

explained on the form.

records you used to prepare your return for at least

three years after you file your return. Save records

Form 40P has two columns for figures.

for property and investments you purchased for at least

The first column on Form 40P is labeled “Federal col-

three years after you sell the property.

umn.” In this column, lines 8 through 28, fill in the same

See page 6 for instructions for “Fiscal year filers” and the

amounts you reported on your federal return. On lines

“Address section.”

31 through 38, fill in the additions and subtractions as

they apply to your total federal income.

Check the boxes

The second column on Form 40P is labeled “Oregon

column.” This column is where you list the amounts that

Filing status

apply to Oregon. Oregon taxes your income from all

Check the box next to your filing status. Generally, you

sources earned or received while you were an Oregon

must check the same filing status you checked on your

resident. Oregon also taxes your income from Oregon

federal return.

sources while you were a nonresident.

Exception: If you and your spouse don’t have the same

Income

residency status, you may file separate returns for Oregon

even if you filed married filing jointly for federal. See page

36 to order the information circular, “Married Persons Fil-

Wages, salaries, and other pay for work.

8

ing Separate Returns.”

Federal column. Fill in the same amount you reported

How to file separate returns:

on your federal return.

If you are married filing separately, see page 11 of

Oregon column. Figure the amount you earned while

the Form 40N instructions.

an Oregon resident. Add to that figure any amount

If possible, mail your Oregon returns in the same enve-

earned while working in Oregon as a nonresident. See

lope. Do not staple the returns together.

page 12 to calculate Oregon wages while a nonresident.

If filing as head of household, enter the name of the

If an amount differs from your Oregon wages on your

qualifying person from your federal return by box 4.

W-2 form, you must attach an explanation from your

employer to the back of your Oregon return.

Exemptions

Exceptions: See “Interstate transportation wages” and

“Hydroelectric dam wages,” page 5, to see if you qualify

Yourself and spouse. Check “Yourself”

6a & 6b

to exclude this income.

and other boxes that apply. If you can

be claimed as a dependent on someone else’s return, you

Taxable interest and dividend income.

9

can’t claim an exemption for yourself. Enter “0” on line 6a.

Severely disabled. If you had a severe disability at the

Federal column. Fill in the same amount you reported

end of 1998, you may qualify for an additional exemp-

on your federal return.

tion credit. See “Severely disabled” on page 11 of the

Oregon column.

Form 40N instructions.

9a. Figure the total interest you received while you

Dependents. Enter the number of your children

were an Oregon resident that is included on your

6c

federal return. Add to that your share of interest

claimed as dependents and other dependents in

income received while you were a nonresident on

box 6c. In most cases, you must claim the same num-

funds used for business activity in Oregon.

ber of dependents as claimed on your federal return.

22/Form 40P instructions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10