Clear form

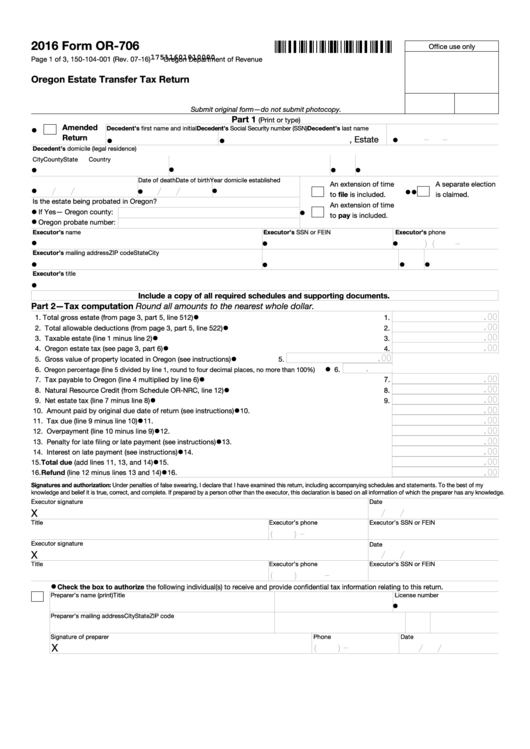

2016 Form OR-706

Office use only

17511601010000

Page 1 of 3, 150-104-001 (Rev. 07-16)

Oregon Department of Revenue

Oregon Estate Transfer Tax Return

Submit original form—do not submit photocopy.

Part 1

(Print or type)

Amended

•

Decedent’s first name and initial

Decedent’s last name

Decedent’s Social Security number (SSN)

–

–

Return

•

•

•

, Estate

Decedent’s domicile (legal residence)

City

County

State

Country

•

•

•

•

Date of birth

Date of death

Year domicile established

An extension of time

A separate election

•

•

/

/

•

/

/

•

•

to file is included.

is claimed.

Is the estate being probated in Oregon?

An extension of time

•

•

If Yes— Oregon county:

to pay is included.

•

Oregon probate number:

Executor’s name

Executor’s SSN or FEIN

Executor’s phone

•

•

(

)

–

•

Executor’s mailing address

City

State

ZIP code

•

•

•

•

Executor’s title

•

Include a copy of all required schedules and supporting documents.

Part 2—Tax computation

Round all amounts to the nearest whole dollar.

.00

•

1. Total gross estate (from page 3, part 5, line 512) ..............................................................................................

1.

.00

•

2. Total allowable deductions (from page 3, part 5, line 522) ................................................................................

2.

.00

•

3. Taxable estate (line 1 minus line 2) ....................................................................................................................

3.

.00

•

4. Oregon estate tax (see page 3, part 6) ..............................................................................................................

4.

.00

•

5. Gross value of property located in Oregon (see instructions) ....................

5.

.0000

•

6.

6.

Oregon percentage (line 5 divided by line 1, round to four decimal places, no more than 100%) ....

.00

•

7.

7. Tax payable to Oregon (line 4 multiplied by line 6) ...........................................................................................

.00

•

8. Natural Resource Credit (from Schedule OR-NRC, line 12) ..............................................................................

8.

.00

•

9. Net estate tax (line 7 minus line 8) .....................................................................................................................

9.

.00

•

10. Amount paid by original due date of return (see instructions) ...........................................................................

10.

.00

•

11. Tax due (line 9 minus line 10) .............................................................................................................................

11.

.00

•

12. Overpayment (line 10 minus line 9) ....................................................................................................................

12.

.00

•

13. Penalty for late filing or late payment (see instructions) ....................................................................................

13.

.00

•

14. Interest on late payment (see instructions) ........................................................................................................

14.

.00

•

15. Total due (add lines 11, 13, and 14) ..................................................................................................................

15.

.00

•

16. Refund (line 12 minus lines 13 and 14) .............................................................................................................

16.

Signatures and authorization: Under penalties of false swearing, I declare that I have examined this return, including accompanying schedules and statements. To the best of my

knowledge and belief it is true, correct, and complete. If prepared by a person other than the executor, this declaration is based on all information of which the preparer has any knowledge.

Executor signature

Date

/

/

X

Title

Executor’s phone

Executor’s SSN or FEIN

(

)

–

Executor signature

Date

/

/

X

Title

Executor’s phone

Executor’s SSN or FEIN

(

)

–

•

Check the box to authorize the following individual(s) to receive and provide confidential tax information relating to this return.

Preparer’s name (print)

Title

License number

•

Preparer’s mailing address

City

State

ZIP code

Signature of preparer

Phone

Date

(

)

–

/

/

X

1

1 2

2 3

3