Instructions For Form 5462 Draft - City Of Detroit Income Tax - Estates And Trusts

ADVERTISEMENT

Instr draft 02-02-17

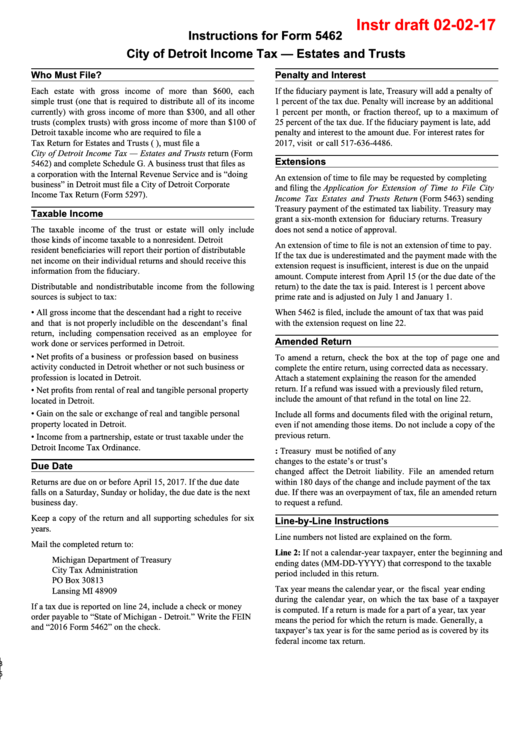

Instructions for Form 5462

City of Detroit Income Tax — Estates and Trusts

Who must File?

penalty and Interest

Each estate with gross income of more than $600, each

If the fiduciary payment is late, Treasury will add a penalty of

simple trust (one that is required to distribute all of its income

1 percent of the tax due. Penalty will increase by an additional

currently) with gross income of more than $300, and all other

1 percent per month, or fraction thereof, up to a maximum of

trusts (complex trusts) with gross income of more than $100 of

25 percent of the tax due. If the fiduciary payment is late, add

Detroit taxable income who are required to file a U.S. Income

penalty and interest to the amount due. For interest rates for

2017, visit or call 517-636-4486.

Tax Return for Estates and Trusts (U.S. Form 1041), must file a

City of Detroit Income Tax — Estates and Trusts return (Form

Extensions

5462) and complete Schedule G. A business trust that files as

a corporation with the Internal Revenue Service and is “doing

An extension of time to file may be requested by completing

business” in Detroit must file a City of Detroit Corporate

and filing the Application for Extension of Time to File City

Income Tax Return (Form 5297).

Income Tax Estates and Trusts Return (Form 5463) sending

Treasury payment of the estimated tax liability. Treasury may

Taxable Income

grant a six-month extension for fiduciary returns. Treasury

The taxable income of the trust or estate will only include

does not send a notice of approval.

those kinds of income taxable to a nonresident. Detroit

An extension of time to file is not an extension of time to pay.

resident beneficiaries will report their portion of distributable

If the tax due is underestimated and the payment made with the

net income on their individual returns and should receive this

extension request is insufficient, interest is due on the unpaid

information from the fiduciary.

amount. Compute interest from April 15 (or the due date of the

Distributable and nondistributable income from the following

return) to the date the tax is paid. Interest is 1 percent above

sources is subject to tax:

prime rate and is adjusted on July 1 and January 1.

• All gross income that the descendant had a right to receive

When 5462 is filed, include the amount of tax that was paid

and that is not properly includible on the descendant’s final

with the extension request on line 22.

return, including compensation received as an employee for

Amended Return

work done or services performed in Detroit.

• Net profits of a business or profession based on business

To amend a return, check the box at the top of page one and

activity conducted in Detroit whether or not such business or

complete the entire return, using corrected data as necessary.

profession is located in Detroit.

Attach a statement explaining the reason for the amended

return. If a refund was issued with a previously filed return,

• Net profits from rental of real and tangible personal property

include the amount of that refund in the total on line 22.

located in Detroit.

• Gain on the sale or exchange of real and tangible personal

Include all forms and documents filed with the original return,

property located in Detroit.

even if not amending those items. Do not include a copy of the

previous return.

• Income from a partnership, estate or trust taxable under the

Detroit Income Tax Ordinance.

U.S. Form 1041 changes: Treasury must be notified of any

changes to the estate’s or trust’s U.S. Form 1041 if the items

Due Date

changed affect the Detroit liability. File an amended return

Returns are due on or before April 15, 2017. If the due date

within 180 days of the change and include payment of the tax

falls on a Saturday, Sunday or holiday, the due date is the next

due. If there was an overpayment of tax, file an amended return

business day.

to request a refund.

Keep a copy of the return and all supporting schedules for six

Line-by-Line Instructions

years.

Line numbers not listed are explained on the form.

Mail the completed return to:

Line 2: If not a calendar-year taxpayer, enter the beginning and

Michigan Department of Treasury

ending dates (MM-DD-YYYY) that correspond to the taxable

City Tax Administration

period included in this return.

PO Box 30813

Tax year means the calendar year, or the fiscal year ending

Lansing MI 48909

during the calendar year, on which the tax base of a taxpayer

If a tax due is reported on line 24, include a check or money

is computed. If a return is made for a part of a year, tax year

order payable to “State of Michigan - Detroit.” Write the FEIN

means the period for which the return is made. Generally, a

and “2016 Form 5462” on the check.

taxpayer’s tax year is for the same period as is covered by its

federal income tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3