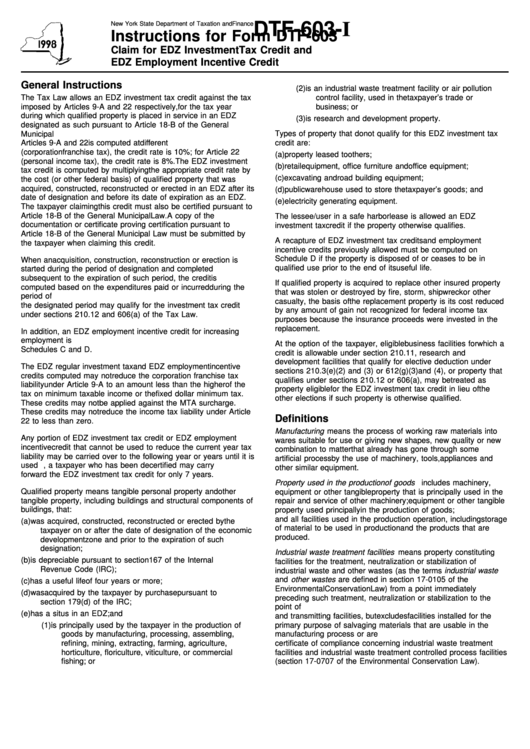

Form Dtf-603-I - Instructions For Form Dtf-603 - Claim For Edz Investment Tax Credit And Edz Employment Incentive Credit - 1998

ADVERTISEMENT

DTF-603-I

New York State Department of Taxation and Finance

Instructions for Form DTF-603

Claim for EDZ Investment Tax Credit and

EDZ Employment Incentive Credit

General Instructions

(2)

is an industrial waste treatment facility or air pollution

The Tax Law allows an EDZ investment tax credit against the tax

control facility, used in the taxpayer’s trade or

imposed by Articles 9-A and 22 respectively, for the tax year

business; or

during which qualified property is placed in service in an EDZ

(3)

is research and development property.

designated as such pursuant to Article 18-B of the General

Types of property that do not qualify for this EDZ investment tax

Municipal Law. The EDZ investment tax credit allowed under

credit are:

Articles 9-A and 22 is computed at different rates. For Article 9-A

(corporation franchise tax), the credit rate is 10%; for Article 22

(a)

property leased to others;

(personal income tax), the credit rate is 8%. The EDZ investment

(b)

retail equipment, office furniture and office equipment;

tax credit is computed by multiplying the appropriate credit rate by

(c)

excavating and road building equipment;

the cost (or other federal basis) of qualified property that was

acquired, constructed, reconstructed or erected in an EDZ after its

(d)

public warehouse used to store the taxpayer’s goods; and

date of designation and before its date of expiration as an EDZ.

(e)

electricity generating equipment.

The taxpayer claiming this credit must also be certified pursuant to

Article 18-B of the General Municipal Law. A copy of the

The lessee/user in a safe harbor lease is allowed an EDZ

documentation or certificate proving certification pursuant to

investment tax credit if the property otherwise qualifies.

Article 18-B of the General Municipal Law must be submitted by

A recapture of EDZ investment tax credits and employment

the taxpayer when claiming this credit.

incentive credits previously allowed must be computed on

Schedule D if the property is disposed of or ceases to be in

When an acquisition, construction, reconstruction or erection is

qualified use prior to the end of its useful life.

started during the period of designation and completed

subsequent to the expiration of such period, the credit is

If qualified property is acquired to replace other insured property

computed based on the expenditures paid or incurred during the

that was stolen or destroyed by fire, storm, shipwreck or other

period of designation. Expenditures paid or incurred subsequent to

casualty, the basis of the replacement property is its cost reduced

the designated period may qualify for the investment tax credit

by any amount of gain not recognized for federal income tax

under sections 210.12 and 606(a) of the Tax Law.

purposes because the insurance proceeds were invested in the

replacement.

In addition, an EDZ employment incentive credit for increasing

employment is allowed. See the instructions for completing

At the option of the taxpayer, eligible business facilities for which a

Schedules C and D.

credit is allowable under section 210.11, research and

development facilities that qualify for elective deduction under

The EDZ regular investment tax and EDZ employment incentive

sections 210.3(e)(2) and (3) or 612(g)(3) and (4), or property that

credits computed may not reduce the corporation franchise tax

qualifies under sections 210.12 or 606(a), may be treated as

liability under Article 9-A to an amount less than the higher of the

property eligible for the EDZ investment tax credit in lieu of the

tax on minimum taxable income or the fixed dollar minimum tax.

other elections if such property is otherwise qualified.

These credits may not be applied against the MTA surcharge.

These credits may not reduce the income tax liability under Article

Definitions

22 to less than zero.

Manufacturing means the process of working raw materials into

Any portion of EDZ investment tax credit or EDZ employment

wares suitable for use or giving new shapes, new quality or new

incentive credit that cannot be used to reduce the current year tax

combination to matter that already has gone through some

liability may be carried over to the following year or years until it is

artificial process by the use of machinery, tools, appliances and

used up. However, a taxpayer who has been decertified may carry

other similar equipment.

forward the EDZ investment tax credit for only 7 years.

Property used in the production of goods includes machinery,

Qualified property means tangible personal property and other

equipment or other tangible property that is principally used in the

tangible property, including buildings and structural components of

repair and service of other machinery; equipment or other tangible

buildings, that:

property used principally in the production of goods;

and all facilities used in the production operation, including storage

(a)

was acquired, constructed, reconstructed or erected by the

of material to be used in production and the products that are

taxpayer on or after the date of designation of the economic

produced.

development zone and prior to the expiration of such

designation;

Industrial waste treatment facilities means property constituting

(b)

is depreciable pursuant to section 167 of the Internal

facilities for the treatment, neutralization or stabilization of

Revenue Code (IRC);

industrial waste and other wastes (as the terms industrial waste

and other wastes are defined in section 17-0105 of the

(c)

has a useful life of four years or more;

Environmental Conservation Law) from a point immediately

(d)

was acquired by the taxpayer by purchase pursuant to

preceding such treatment, neutralization or stabilization to the

section 179(d) of the IRC;

point of disposal. Such property includes the necessary pumping

(e)

has a situs in an EDZ; and

and transmitting facilities, but excludes facilities installed for the

(1)

is principally used by the taxpayer in the production of

primary purpose of salvaging materials that are usable in the

goods by manufacturing, processing, assembling,

manufacturing process or are otherwise marketable. Attach the

refining, mining, extracting, farming, agriculture,

certificate of compliance concerning industrial waste treatment

horticulture, floriculture, viticulture, or commercial

facilities and industrial waste treatment controlled process facilities

fishing; or

(section 17-0707 of the Environmental Conservation Law).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4