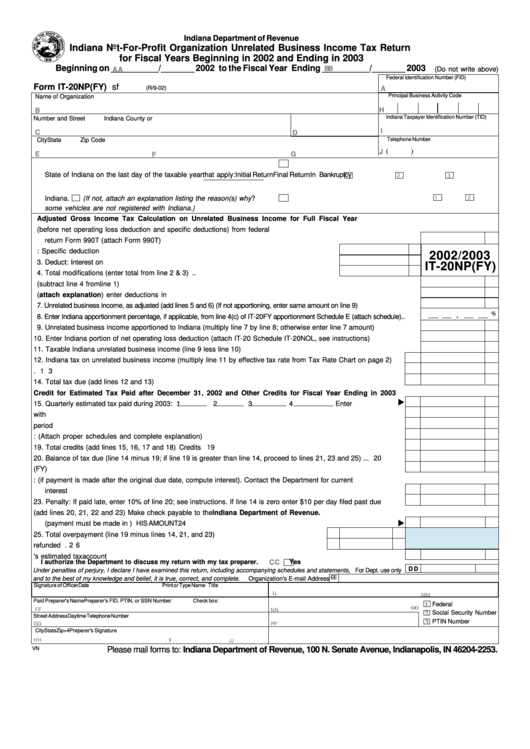

Form It-20np(Fy) - Indiana Not-For-Profit Organization Unrelated Business Income Tax Return For Fiscal Years Beginning In 2002 And Ending In 2003

ADVERTISEMENT

Indiana Department of Revenue

Indiana Not-For-Profit Organization Unrelated Business Income Tax Return

for Fiscal Years Beginning in 2002 and Ending in 2003

Beginning on __________/_______ 2002 to the Fiscal Year Ending __________/_______ 2003

BB

(Do not write above)

AA

Federal Identification Number (FID)

Form IT-20NP(FY) sf

(R/9-02)

A

Principal Business Activity Code

Name of Organization

H

B

Indiana Taxpayer Identification Number (TID)

Number and Street

Indiana County or O.O.S.

I

C

D

Telephone Number

City

State

Zip Code

(

)

J

E

G

F

K. Enter the number of motor vehicles operated by the organization in the

M. Check all boxes

State of Indiana on the last day of the taxable year

that apply:

Initial Return

Final Return

In Bankruptcy

1

2

3

L. Check box if all these vehicles are registered in the State of

Indiana.

(If not, attach an explanation listing the reason(s) why

N. Is an extension of time to file attached? ........

1

Yes

2

No

some vehicles are not registered with Indiana.)

Adjusted Gross Income Tax Calculation on Unrelated Business Income for Full Fiscal Year

1. Unrelated business taxable income (before net operating loss deduction and specific deductions) from federal

return Form 990T (attach Form 990T) .......................................................................................................................................

2. Deduct: Specific deduction .............................................................................................................

2002/2003

3. Deduct: Interest on U.S. Government obligations on the federal return less related expenses ......

IT-20NP(FY)

4. Total modifications (enter total from line 2 & 3) ..............................................................................

5. Subtotal for unrelated business income (subtract line 4 from line 1) .......................................................................................

6. Add other adjustments and special procedure adjustment (attach explanation) enter deductions in <brackets> .............

7. Unrelated business income, as adjusted (add lines 5 and 6) (If not apportioning, enter same amount on line 9) ................................

.

%

8. Enter Indiana apportionment percentage, if applicable, from line 4(c) of IT-20FY apportionment Schedule E (attach schedule) .........

9. Unrelated business income apportioned to Indiana (multiply line 7 by line 8; otherwise enter line 7 amount) ........................

10. Enter Indiana portion of net operating loss deduction (attach IT-20 Schedule IT-20NOL, see instructions) ..........................

11. Taxable Indiana unrelated business income (line 9 less line 10) ..............................................................................................

12. Indiana tax on unrelated business income (multiply line 11 by effective tax rate from Tax Rate Chart on page 2) ...... 12

13. Sales/use tax on purchases subject to use tax from Sales/Use Tax Worksheet on page 2 ......................................... 13

14. Total tax due (add lines 12 and 13) .................................................................................................................. Total Tax 14

Credit for Estimated Tax Paid after December 31, 2002 and Other Credits for Fiscal Year Ending in 2003

15. Quarterly estimated tax paid during 2003: 1

2

3

4

Enter total ..............

15

16. Amount paid with extension ............................................................................................................................................. 16

17. Amount of overpayment credit from prior period ............................................................................................................. 17

18. Other credits that offset income tax: (Attach proper schedules and complete explanation) ........................................ 18

19. Total credits (add lines 15, 16, 17 and 18) ................................................................................................. Total Credits 19

20. Balance of tax due (line 14 minus 19; if line 19 is greater than line 14, proceed to lines 21, 23 and 25) ...................... 20

21. Penalty for the underpayment of income tax. Attach Schedule IT-2220(FY) ................................................................. 21

22. Interest: (if payment is made after the original due date, compute interest). Contact the Department for current

interest rate ....................................................................................................................................................................... 22

23. Penalty: If paid late, enter 10% of line 20; see instructions. If line 14 is zero enter $10 per day filed past due date ... 23

24. Total payment due (add lines 20, 21, 22 and 23) Make check payable to the Indiana Department of Revenue.

(payment must be made in U.S. funds) ...................................................................................... PAY THIS AMOUNT

24

25. Total overpayment (line 19 minus lines 14, 21, and 23) ........................................................... 25

26. Amount of line 25 to be refunded ............................................................................................. 26

27. Amount of line 25 to be applied to the following year's estimated tax account .............................................................. 27

I authorize the Department to discuss my return with my tax preparer.

CC

Yes

D D

Under penalties of perjury, I declare I have examined this return, including accompanying schedules and statements, For Dept. use only

EE

and to the best of my knowledge and belief, it is true, correct, and complete.

Organization's E-mail Address

Signature of Officer

Date

Print or Type Name

Title

LL

MM

Paid Preparer's Name

Preparer's FID, PTIN, or SSN Number

Check box:

Federal I.D. Number

1

OO

FF

NN

2

Social Security Number

Street Address

Daytime Telephone Number

PTIN Number

3

GG

PP

City

State

Zip+4

Preparer's Signature

HH

II

JJ

VN

Please mail forms to: Indiana Department of Revenue, 100 N. Senate Avenue, Indianapolis, IN 46204-2253.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1